CIO’s Commentary – Sept 2020

“The future ain’t what it used to be.” ― Yogi Berra

In this commentary we cover:

- The March 2020 downturn and subsequent “V” shaped recovery

- The dichotomy of markets being up when the economy is struggling

- The action Pender took (and what we didn’t do) in response to market dynamics

- Our outlook – where we see tailwinds that are suited to Pender’s investment style

Suffering Whiplash

The S&P500 experienced its sharpest downturn in history this spring. Staring into the abyss at the bottom, few could have imagined that we were in fact on the eve of one of the strongest bull upturns in history. We certainly didn’t. Then again, this is a pattern that tends to repeat itself over and over in investing.

“The thing I find most interesting about investing is how paradoxical it is: how often the things that seem most obvious—on which everyone agrees—turn out not to be true.” – Howard Marks

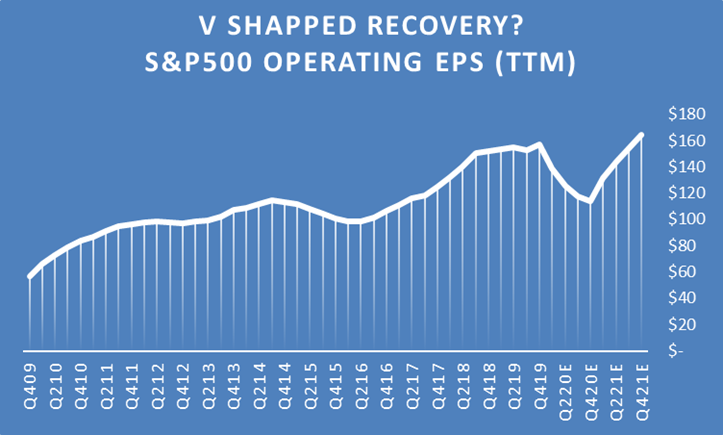

The market’s recovery has been breathtaking. The S&P500 reached a new all time high by mid August, making it the shortest bear market in history and a best case “V” shaped recovery. But market averages are misleading. Like Dickens’ classic novel A Tale of Two Cities, “It was the best of times, it was the worst of times …” There have been a handful of big winners, but many more losers. The market’s recovery has been highly uneven.

Most global economies are still reeling from lockdowns and other measures put in place to control the pandemic. COVID-19 is expected to lead to the deepest global recession in decades. Baseline forecasts[1] are projecting a 5.2% contraction in global growth this year. Ironically, the only major global economy expected to grow this year is China, the epicenter of the pandemic. Its stock market has also been one of the best performing in the world. Very few would have forecast this in January when the shocking videos of overflowing Wuhan hospitals first emerged.

Why is Wall Street up when Main Street is struggling?

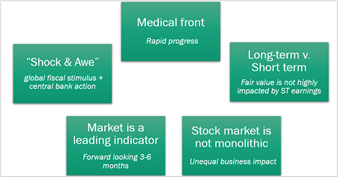

There is a lot of debate about whether the “stock market” is disconnected from the “real economy”. This makes intuitive sense. Headlines about high unemployment, bankruptcies and other pandemic related issues are alarming. But our intuition often fools us. There are several sensible interrelated reasons why markets have made a recovery, despite worrisome issues.

There is a lot of debate about whether the “stock market” is disconnected from the “real economy”. This makes intuitive sense. Headlines about high unemployment, bankruptcies and other pandemic related issues are alarming. But our intuition often fools us. There are several sensible interrelated reasons why markets have made a recovery, despite worrisome issues.

The Fed

When Fed Chairman Jerome Powell said, “We will not run out of money”, market veterans knew it was code for, “Don’t fight the Fed”. The unprecedented speed and scale of the global fiscal stimulus and central bank action broke the momentum in the market’s negative feedback loop. Beyond restoring market confidence as buyer of last resort, central bank actions have led to even lower interest rates, which usually equates to higher business values. Endless volumes of digital ink have been spilled writing about these developments. We won’t rehash them here. While there will be unintended second and third order effects, the “shock & awe” actions from central authorities bought us more time to deal with the real issue – the mortality and morbidity issues from COVID-19.

Medical Progress

The good news is that the progress on the medical front has been astounding. So many of the world’s top scientists and researchers have collaborated urgently on this single topic. Advances in therapeutics and vaccines are taking place at a breathtaking pace. Consumer behaviour could change quickly if an effective vaccine becomes available in mass quantities. This would likely lead to a resurgence of economic activity. This pandemic, like others before it, will eventually end. The question is how long and how much damage will be caused in the meantime. Which brings us to the long-term versus the short-term perspective.

Fundamentals

In the short term, fundamentals rarely matter much to stock performance. Narratives driven by investor psychology and structural factors are much more powerful determinants of near-term price action. But fundamentals matter over the long haul. The longer you hold onto your stocks, the more your returns will reflect the economics of the underlying businesses. The truth is that earnings over the near term only have a minor impact on the economic value of a company. The sudden plunge in the stock market this spring would only have a significant impact if it impaired earnings over a multi-year time horizon, or companies were in danger of insolvency. Currently, consensus estimates are projecting a full earnings recovery by late 2021[2]. At this point, it appears the worst is behind us from an earnings perspective.

Source: S&P Dow Jones Indices

The stock market is a leading indicator which typically looks three to six months ahead. During periods of panic and distress investors sometimes forget that stocks can go higher even when the real economy is getting worse. During the last major downturn, the S&P500 bottomed on March 9, 2009, closing at 677. From there the market started to power higher, beginning its journey as the longest and biggest bull market in history, even though the “real economy” did not bottom until June 2009[3].

Timing & Magnitude

Timing is clearly one issue. But the magnitude of the change is another, where the connection between the “real economy” and the “stock market” is not as strong as commonly believed. During the 2008 Financial Crisis, stock markets around the world plummeted approximately 30-60%, but of course the real economy did not fall by a similar amount. The following bull market saw the S&P500 rise five-fold to the next peak in early 2020, which is also not reflective of real GDP growth.

Digital Giants vs the Rest of the World

Companies listed in the stock market are only one part of the real economy which is much broader than just the prospects of those companies traded on stock exchanges.

There are hundreds of thousands of small businesses that had to shut down or were severely impaired but were not publicly listed. On the flip side of the coin there is Amazon.com, already one of the world’s largest online retailers which became an even greater necessity in a lockdown. Amazon’s cloud business also has been a beneficiary of accelerated online migration. Private offline businesses around the world face hardship due to global lockdowns, while Amazon picked up their business.

In a sense, an increased share of the industry profit pools that formerly resided with small private businesses all over the globe have shifted to Amazon.com, a US listed security. At the margin, public investors in Amazon benefited while private investors in the real economy lost share. Thus, the real economy could be hit over the short term, but because the Amazon’s, Microsoft’s and Apple’s of the world are experiencing heightened demand from their customers and already account for a large portion of the S&P500, overall markets could be surprisingly resilient, or even go up. That dynamic is even more visible in the more concentrated and tech-centric NASDAQ.

The market is a collection of businesses operating in different markets, with distinct cycles and possessing unique economic prospects. Many of the most battered industries do not matter much because of the way stock indexes are structured. Some of the worst hit and highly visible industries like department stores, airlines and oil and gas equipment services are only a very small part of the S&P500. They are more than offset by the tailwinds experienced by the giant tech beneficiaries.

Don’t just do something, sit there

We are living in a period of accelerated change and need to stay flexible in our thinking. Some trends are temporary while others are more structural. More and more businesses are being disrupted by technological change as consumers dramatically adapt their behaviour and this has been further accelerated by COVID-19.

There was a lot of uncertainty and mispricing last spring. We held a number of holdings that we felt would do well in a post pandemic world, even though investors were pessimistic about their near-term outlook. As outlined this spring, we categorized our existing holdings into “the Good, the Bad and the Ugly”. Zillow (NASD:Z,ZG) and PAR Tech (NYSE:PAR) stock prices’ were indeed looking ugly this spring. Both were perceived as highly risky; however, we theorized that both had the potential to be beneficiaries of digital acceleration. Now the market appears to agree with this assessment and both stocks have more than tripled from the bottom to hit all time highs. JD.com (NASD:JD), a more obvious pandemic winner as China’s largest ecommerce retailer, also hit all-time highs in early September. These positions were not short-term trades and we expect to continue to “sit there” and hold core positions in all three companies.

Don’t just sit there, do something

We outlined some selling activity in our earlier commentary. This provided the liquidity to take advantage of an entirely new opportunity set. We were able to pick up some new promising positions at bargain prices that would not have been available prior to the pandemic. Importantly, we felt they would also be long-term beneficiaries of digital acceleration, including Square (NASD:SQ), Dye & Durham (TSX:DND), Stitch Fix (NASD:SFIX), Twitter (NASD:TWTR) and Interactive Brokers (NASD:IBKR). Many of these new holdings have performed exceptionally well so far.

Onward…

After a strong start to 2020, the drawdowns in March were gut wrenching. Since then, we are pleased with the much stronger recoveries than we could have imagined at the time. In many cases the very same names that have been performing the best of late, making all time highs today, also had the worst drawdowns. It is remarkable to see how quickly markets pivot and investors revise their opinions about companies. Much of the humility that investors gained in March 2020 has been lost once again by the summer. It is an endless cycle. Plus ça change, plus c’est la même chose[4].

We remain particularly excited about some potential upcoming catalysts which could further boost momentum. As one of many casualties early in the pandemic, M&A activity came to a virtual stand still. This has been a big headwind for Pender because part of our strategy requires normal deal-making activity (see our track record of picking small-cap takeout targets). That headwind seems to be reversing. Big time. As “animal spirits” return to the markets, and potential acquirers can conduct their due diligence once again, enthusiasm for deals is quickly ramping up again. In aggregate, we believe many of our small and microcaps represent “juicy” takeout targets because their valuations are still relatively attractive, especially compared to the larger caps that have already run up. We believe investment bankers and deal-hungry executives are scrambling to make up for lost time. This heighted buyout activity could provide a strong tailwind for us over the next few quarters.

The central bank driven liquidity injection that ignited the large cap rally is now being followed up by a small cap rally. A few of our equity mandates have recovered to the top performing quartiles of their respective categories, particularly in the small cap mandates. It is a rare event when all our funds are firing on all cylinders – today is no exception. We are not satisfied by the performance of a few our funds, but we have made adjustments as noted, and are encouraged by the early progress.

There have been very few investment strategies that have kept up with the turbo charged returns of a handful of tech megacaps of late. The five largest companies of the S&P500 are currently worth more than the entire S&P500 during the last bear market in March 2009! The collective market cap of the Giant 5[5] is +$7 trillion. They are undoubtedly great companies when measured by almost any metric. It has been a truly remarkable run, but from an investment perspective, generating say, a 10% return on $7 trillion of market value is… well…a very big number. Great companies are not always great investments. The sky does have some limits. As an alternative, we find it fascinating to study these great companies and then apply the template of those learnings within our smaller-than-megacap universe to holdings that are also that are re-platforming their industries, as noted earlier. We believe owning a handful of great companies that are still in the earlier phases of their value creation journey increases their compounding potential for becoming great investments as well.

We can’t control stock prices. However, we control our investment process. And we can and must adapt to new methods and views that better represent how the world works.

“You have to play the cards that are there. You have to deal with the world as it is, not as you want it to be, or you wish it to be, or how you think it should be. That’s also another thing to bear in mind for people is that, don’t complain about the world, figure out a way to thrive in it.” – Michael Mauboussin

Please do not hesitate to contact me, should you have questions or comments you wish to share with us.

Felix Narhi

September 22, 2020

[1] http://pubdocs.worldbank.org/en/267761588788282656/Global-Economic-Prospects-June-2020-Highlights-Chapter-1.pdf

[2] http://ca.spindices.com/documents/additional-material/sp-500-eps-est.xlsx

[3] The NBER officially announced its June 2009 recession-end determination on September 10, 2010. By the time the end of the recession was announced, the S&P500 was at 1165, up 72% from the market bottom and up a further 27% from the end of the recession. Waiting until better visibility cost investors dearly. By the time NBER sang their tune, the song was over.

[4] The more things change the more they stay the same.

[5] Apple, Microsoft, Amazon, Alphabet, Facebook