Pender Small Cap Opportunities Fund – August 2025

August recap

It feels as if we were just heading into the summer in the midst of Liberation Day drama, but somehow, we already find ourselves post Labour Day! August was marked by rising fears and uncertainty around tariffs and trade, creating a difficult backdrop for forecasting and keeping expectations subdued. That said, investment results surprised to the upside—an unexpected late-summer lift.

A key theme in August was the resurgence of small-cap and value stocks. In Canada, small caps outpaced the broader market by a wide margin: the S&P/TSX SmallCap Index advanced 9.2% versus a 4.8% gain for the S&P/TSX Composite. Strength was broad-based, with 9 of 11 sectors posting positive returns, led by Materials (+19.1%) and Health Care (+17.4%), while Utilities (–3.2%) and Technology (–2.3%) lagged. Turning to commodities, natural gas prices fell 3.5% during the month, while the price of a barrel of crude oil lost 7.6%. Gold, silver, and copper all had a positive month, gaining 5.9%, 9.5%, and 3.8%, respectively. Inflation in Canada came in at 1.7% year-over-year in July, down from the 1.9% print in June. The decline was due to gasoline prices falling on lower geopolitical tensions and increased OPEC+ output. The Canadian economy lost 41,000 jobs in July, and the nation’s unemployment rate held steady at 6.9%.

There were some concerns that the strong run in equities since late April might come to an end, especially as clouds gathered in the form of trade disputes and political pressure on the Fed. Fortunately, investors focused on the positives: robust corporate earnings and solid economic data. A rate cut for September is now the expectation as Fed Chair Powell signaled at the Jackson Hole conference at the end of August, though debate remains whether this is more political than economic. In the best case, cuts support employment; in the worst case, they risk feeding stagflation.

As we look back on our summer, investors appear to have returned from the beach in a cautiously optimistic mood. Businesses are, for now, managing higher tariff-related costs, while consumers continue to spend ahead of potential price pressures. But remember, we aren’t out of the woods yet. This environment makes for challenging circumstances. Volatility will remain, the only debate is what happens when everyone decides they have had enough and are content with their gains. It’s impossible to say when that will occur, but seasonally we believe it is usually around this time.

Markets remain resilient and momentum is building, but we’re mindful that opportunities often emerge in times of change— and as Bob Dylan said, “the times they are a-changin’.”

Fund specific updates

- Pender Small Cap Opportunities Fund performed positively and posted a gain of 0.6% in August, bringing YTD gains to 4.4%1.

- The majority of the top 10 holdings in the Fund have now reported and provided important data points. Most have delivered strong performance once again. Results this quarter reflected continued execution on operational priorities, with many portfolio companies exceeding expectations on both growth and profitability.

- Equally encouraging was the guidance and forward commentary provided. Management teams across our core positions remain confident in their outlooks for the remainder of the year, pointing to sustained growth. Despite ongoing macro uncertainties, including ongoing tariff impacts, interest rate sensitivity and shifting economic data, our companies continue to demonstrate resilience and discipline in navigating challenges.

- This stability stems from our focus on small-cap companies operating in specialized markets. Their agility, targeted business models, and leadership allow them to adapt quickly to evolving conditions and capture growth opportunities.

- We saw an increase in dispersion of returns in our universe this month as several companies that had performed well took a breather: Kneat (TSX:KSI), Tantalus Systems Holding Inc. (TSX: GRID). While other companies responded positively coming out of earnings season: 5N Plus (TSX:VNP), Sangoma (TSX:STC), Blackline Safety Corp (TSX:BLN).

Positive contributors in August: Thesis affirming quarterly results

- Earnings season provided significant data points affirming our investment thesis in many core holdings.

- 5N Plus was a strong contributor in the month. On August 4, the company released its Q2 results, delivering exceptional performance. Revenue surged 28% y/y, Adjusted EBITDA jumped 79% (a record high) and the company raised annual guidance along with announcing several significant contract wins. The stock was up 16% on the news, 21% in the month and 99% YTD.

- 5N Plus is a global leader in specialty semiconductors and performance materials. Its products are essential for industries like solar energy, space, medical imaging, and pharmaceuticals. In many cases, 5N is the only supplier outside China, making it a critical partner for countries like the US The new contracts position 5N as the main supplier of materials for US-made solar panels, which are set to grow quickly due to rising energy demand and tariffs on Chinese products.

- Sangoma had an eventful quarter, with the share price rising 8.5%. It was a busy month for the company which announced the completion of the sale of its VoIP Supply subsidiary for 4x EBITDA, its expanded use of Amazon Web Services (AWS) and a new partnership with VTech Hospitality, a targeted vertical with growth potential. Management continues to execute on the initiatives it has laid out to simplify and enhance the go-forward business.

- On the negative side, Terravest (TSX:TVK) and Sylogist (TSX:SYZ) had negative months.

- TVK reported earnings in August that came in below expectations, largely due to one-off factors, and its share price often shows volatility around quarterly results. The company’s model is driven less by organic growth and more by replacement demand, with our investment thesis focused on M&A and disciplined capital allocation—areas in which management has an established long-term track record.

- Meanwhile, SYZ faced softer government demand this quarter due to DOGE.

- We continue to view both TVK and SYZ as high-conviction holdings and nothing in our outlook has changed.

Equity Spotlight: Coveo Solutions Inc. (TSX: CVO)

We are always looking for companies that combine innovative technology, disciplined execution, and long-term growth potential. Coveo meets these criteria and has become a key holding in the Fund.

Company profile

Coveo is a Canadian SaaS company that uses AI to power personalized search, recommendations, and generative answers across ecommerce, customer service, and workplace apps. With integrations into Salesforce, SAP, Adobe, and Shopify, Coveo has built a sticky ecosystem that keeps customers engaged. You can think of Coveo as the intelligence layer that makes websites and digital tools smarter, more useful, and more profitable.

Source: Coveo Investor Presentation – July 2025

The financial picture

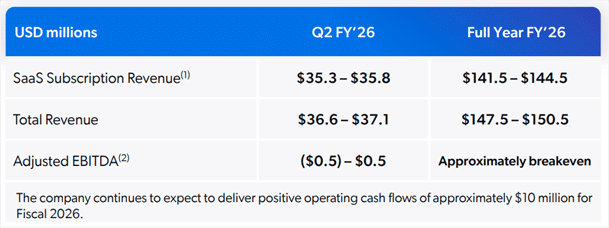

- Coveo is scaling SaaS revenue at a reasonable rate (~14–17% YoY in FY2026), improving margins, and is on track to achieve operational cash flow positivity.

- The company has recently seen bookings growth reaccelerate; it has also strengthened its leadership with the return of its founder-CEO and the elevation of its CRO to COO—ensuring continuity from seasoned founders while sharpening focus on growth, execution, and innovation.

- CVO reported FQ1 at the end of July. Results were positive reflecting the reacceleration of revenue growth (16% core platform growth vs 14% last quarter) on track to 20% by fiscal yearend. Other KPIs such as bookings and net expansion rate (108%) also remained strong.

- In Q1 GenAI drove 50% new bookings and has a net expansion rate over 150%.

- The company also renewed its NCIB.

Coveo appears to be at an inflection point for both growth and profitability.

Q2 FY’26 and Full Year Guidance; source: Coveo Investor Presentation – July 2025

We believe that Coveo represents a great opportunity to invest in a Canadian publicly traded AI company at attractive valuation.

- Generative AI momentum – Coveo’s generative answering product is already driving bookings — over 20% of new business came from AI-powered features last year.

- Global customer wins – From Shopify-based retailers like Elite Supplements in Australia to major US and European enterprises, Coveo is proving its global relevance.

- Recognition as a market leader – Industry analysts consistently rank Coveo among the leaders in enterprise search and product discovery platforms.

With a market cap of just ~$870 million (CAD), Coveo is relatively small compared to its global peers in search, AI, and personalization. As the company scales SaaS revenue, achieves cash-flow positivity, and deepens its AI moat, we see room for multiple expansion and long-term shareholder value creation.

Why we like it

- Growth: SaaS revenue expected to rise ~15% y/y in FY2026.

- Profitability path: Approaching breakeven; on track for ~$10 million positive cash flow this year.

- Exposure to key Pender theme of AI Adoption: Generative answering now accounts for 20%+ of new bookings.

Outlook

We continue to see an attractive set up for Canadian Small cap companies overall. Despite the recent move, valuations are still very attractive on a relative and absolute basis. We have positioned the portfolio in high quality businesses that are trading at reasonable prices and believe we can continue to compound value for shareholders for the foreseeable future.

David Barr, CFA, Amar Pandya, CFA and Laura Baker

September 16, 2025