Manager’s Quarterly Commentary – Felix Narhi – Q1 2015

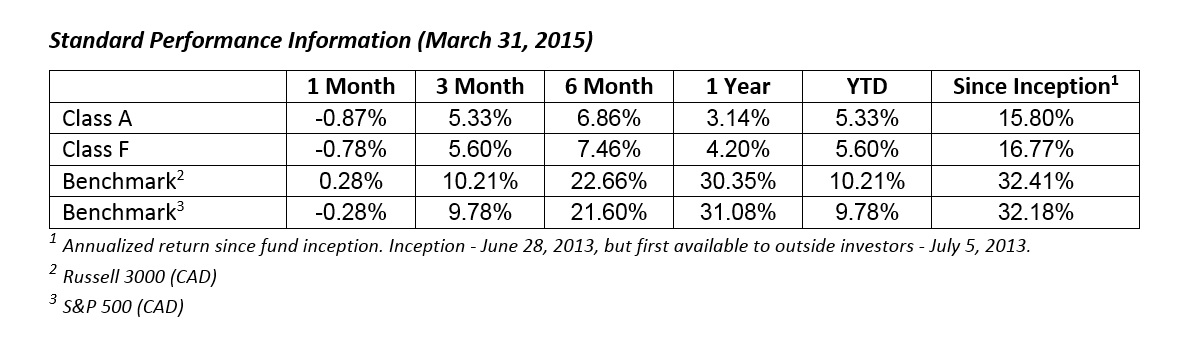

Class A units were up 5.3% during the quarter and were valued at C$12.93 at March 31, 2015. The US All Cap Equity Fund ended the quarter with 21 holdings and a cash weighting of 7.2%. Syntel, Markel and Post Holdings led the gainers for the quarter, while Altisource Portfolio Solutions, Apollo Education Group and Strayer were the biggest detractors. During the quarter we did not make any major changes, but modestly trimmed certain holdings (BAM/SYNT/SWI) and added to one position (ASPS).

Once again, the strong USD dollar provided a tailwind for Canadian-dollar denominated investors. Given the volatility of exchange rates over the last year, we have understandably fielded more questions about currency in recent months. Of course, the purchasing power of all currencies depreciate over time, but the relative rate of decline between currencies is a function of governmental action and discipline. As value-seeking long-term investors, we believe it makes sense to concentrate action at the extreme points in valuation and remain patient during the longer stretches in between. To cut to the punch line, we believe the Canadian buck is at a mid-cycle stage between the extremes and still likely to head lower. We are not inclined to hedge currency exposure at this time.

Over long periods, we believe purchase power parity (PPP) provides a reasonable basis for approximating how a currency should be valued relative to other currencies. This theory suggests that within competitive markets, identical goods tend to be priced at levels that set the “fair exchange” levels between two countries. For example, if an identical TV set sells for C$500 in Vancouver and US$400 in Seattle, then the PPP exchange rate would be $0.80 ($400/$500). According to figures tabulated by the OECD, the PPP Canadian exchange rate has fluctuated in a relatively narrow range over the last 30 years between US$0.80-0.85. Today this theory suggests the Canadian dollar is fairly valued closer to the low end of that range.

Now might be a good time to recall Yogi Berra’s quip, “In theory there is no difference between theory and practice. In practice there is.” In practice, PPP has no predictive value over the near term. The loonie has fluctuated widely around its “fair” value over cycles that typically range from five to 10 years. Yet, it appears undeniable that the gravitational pull of this “fair exchange” value is strong as the Canadian dollar tends to meander around this value over time. In between the extremes, momentum seems to carry the day. Supporting this view is an observation that exchange rates are news driven over shorter periods. They are especially sensitive to changes in economic growth and interest rates which tend to persist over the medium-term of a classic business cycle. Today, the dollar is not near the extremes of its trading ranges, so we believe the recent trends point to more weakness ahead for the Canadian dollar.

The loonie has just spent most of the last decade as overvalued relative to its PPP “fair value”, peaking in November 2007 at US$1.09 just as the commodity boom hit its apex. It subsequently fell during the financial crisis when commodity prices collapsed but recovered somewhat after economies bounced back on central bank stimulation. We agree with the widely held view that such QE-driven tailwinds have largely run their course. What’s next? Relative to the US, it is hard to see why the Canadian dollar might reverse its generally downward momentum today.

First, like many resource rich economies, there has been a relatively high correlation between commodity prices and the Canadian dollar. Strong commodity prices boost the relative value of the loonie and vice versa. China’s growth and its massive spending on infrastructure over the last few decades spurred an unprecedented appetite for virtually all commodities. The enormous demand for resources to feed China’s growth spurred higher prices which incentivized large investments to increase supply. The Canadian economy and its loonie benefited from this windfall. As China’s infrastructure-driven boom fades, who will replace that demand? We should accept that we are living in a slower growing and more leveraged world today. We believe the combination of lower demand and higher supply will cap commodity prices. This will also help keep a lid on the Canadian dollar.

Second, Canadian households are among the most heavily indebted in the world and the situation is only getting worse. The main culprit is high housing prices. Real estate has long been cyclical and the combination of high debt loads and lofty housing prices poses increased risks to the Canadian economy. Canadians can only afford to service their high debt levels as long as interest rates remain at current historically low rates. Any meaningful increase in interest rates would be catastrophic for many leveraged Canadian families. Meanwhile, Americans have been in deleveraging mode since the financial crisis and housing prices are broadly considered to be trading near fair value relative to incomes and rents. Given this contrast between the two countries, we expect American interest rates to rise ahead of Canadian rates. On a relative basis, this will support a stronger greenback.

The loonie is currently trading near its PPP “fair value” but if history is a guide, it is only passing through as it bumps along its current path downward as part of another long cycle. Eventually down the road, we will hit another extreme and our dollar will reverse course, but that is unlikely to occur for many years, in our opinion. We anticipate it will take an extended multi-year period of undervaluation of the Canadian dollar to correct the excesses of the last decade (e.g. commodity super cycle and Canadian housing boom).

Please do not hesitate to contact myself, should you have questions or comments you wish to share with us.

Felix Narhi, CFA, May 15, 2015