Value Fund – Outlook For 2023

HIGHLIGHTS

Pender Value Fund returned 9.7%[1] in January, following a 4.7% gain in the fourth quarter.

Technology holdings now represent the largest sector weight in the portfolio at 37.6% at the end of January, up from 29.3% at the end of June 2022. We see many high-quality tech companies trading at a discount of greater than 50% to their private market value.

We continue to focus on North American small and mid-cap businesses. Our weight in Canadian equities grew to 47.0% at the end of January, up from 36.3% at June 30, 2022. We have been adding to attractively priced companies, like Sylogist and Copperleaf.

Our Canadian exposure has increased, while reducing our exposure to international companies from 16.1% at the end of June 2022 to 8.7% as of January 31, 2023.

—

Fellow Unitholders,

Pender Value Fund returned 9.7%[2] in January, following a 4.7% gain in the fourth quarter. This compares to the Russell 2000 Index returning 7.8% and the S&P/TSX Composite Index posting a 7.4% gain in January. The Fund has begun to rebound following a challenging year in 2022. We have seen a reprieve so far in 2023 following the end of tax loss selling and a reversal in some companies that we believed were oversold at the end of the year.

Technology in particular was one of the worst-performing sectors last year, but is off to a strong start in January. The S&P/TSX Capped Info Tech sector was up 15.8% in January, after retreating 35.5% in 2022. This has been a key area of focus for the portfolio and, with the volatility, we were selectively adding to our technology holdings throughout the second half of 2022. It now represents the largest sector weight in the portfolio at 37.6% at the end of January, up from 29.3% at the end of June 2022. We see many high-quality tech companies trading at a discount of greater than 50% to their private market value, despite double-digit growth rates and an attractive long-term runway to compound growth. From a fundamental and valuation perspective, this is a strong starting point from which to generate promising five-year returns.

A portfolio holding that fits this description would be Sylogist Ltd. (TSX: SYZ). The company is an enterprise resource planning software provider and was the largest holding in the portfolio at the end of January. We added the company to the portfolio in October 2021 after beginning to see encouraging results from a new management team that joined the company in late-2020. Its strategy to refocus on the sales execution process to drive organic growth began to take hold, with organic growth trends accelerating to 6% in its most recent quarter. Its backlog also expanded 20% year-over-year and grew an impressive 40% quarter-over-quarter. Along with the broad technology sector, Sylogist’s multiple has contracted from approximately 8x revenue in late 2021 to below 3x at the end of 2022. With fundamentals improving, we believe this is a great opportunity in a high-quality, sticky business that is very cash generative and attractively priced relative to its history and our estimate of private market value.

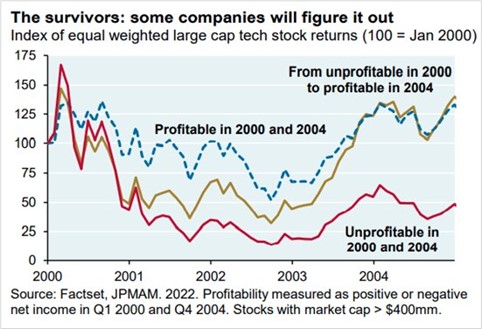

Unprofitable technology companies were another area of the market that underperformed significantly in 2022. With the macro headwinds of rising interest rates and concerns about slowing economic growth at the forefront, investors rewarded businesses that were producing cash flows. In this depressed pocket of the market, we believe there are opportunities in companies that are unprofitable today but will become profitable as they continue to scale products and services that have traction in addressable markets. The chart below compares this period to the early 2000’s, when unprofitable companies underperformed as the TMT bubble unwound. However, for the companies that were able to prove out their business model and scale to become profitable, there was significant outperformance in the ensuing years.

One company that we have been adding to and which fits this description is Copperleaf Technologies Inc. (TSX: CPLF). Although it is not profitable today, we believe it will be. Importantly, it has demonstrated profitability in the past. The company is investing heavily in sales and marketing initiatives to drive top-line growth. We believe these are sound investments and that Copperleaf has demonstrated its ability to convert these investments into revenues and profits in the past. This gives us confidence that it will again, as it has faced previous investment cycles head on and delivered positive operating cash flows in both 2018 and 2020. We think the company has been overly punished in the sell-off and can continue to compound at a healthy rate (it delivered 19% revenue growth in its most recent quarter), while seeing its valuation multiple compress from +25x market cap to revenues to ~5x today. Copperleaf is a top 10 holding and represented a 4.2% weight in the portfolio at the end of January.

“Our view is that pockets of small cap are very attractively priced relative to the business quality and will help provide valuation support.”

We continue to focus on the opportunity set for the Fund in North American small and mid-cap businesses. Our weight in Canadian equities grew to 47.0% at the end of January, up from 36.3% at June 30, 2022. We have been adding to attractively priced companies, like Sylogist and Copperleaf. Our Canadian exposure has increased, while reducing our exposure to international companies from 16.1% at the end of June 2022 to 8.7% as of January 31, 2023. Approximately 54.3% of the holdings in the portfolio were held in small and mid-cap companies.

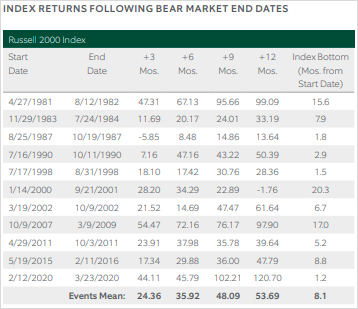

With the bear market in small caps, there are reasons to be more optimistic about the opportunity set going forward. Looking at the historical returns following a drawdown of this magnitude, returns tend to be strong as the cycle of fear and greed runs its course. The table below highlights drawdowns of greater than 20% in the Russell 2000 since the 1980’s and shows that returns for the index in the year following a bear market low averaged 53.7%. There have been 11 instances of bear markets and recoveries during this time – 10 of the recoveries following a bear market trough have been positive in the ensuing year. While bear markets and drawdowns are challenging to endure, the silver lining is that the starting point for future return prospects is much more attractive.

Another reason to be optimistic is the early sign of strategic M&A picking up pace. This aligns with our view that pockets of small-cap are very attractively priced relative to the business quality and will help provide valuation support. Our investment process targets similar characteristics to what strategic buyers are looking for – attractive unit economics, long-term growth runways and durable competitive advantages. These characteristics are abundant in the businesses we own in the portfolio and give us optimism that these companies will continue to execute in 2023 and beyond.

David Barr, CFA

February 24, 2023

[1] Class F of the Fund. Other classes are available. Fees and performance may differ in those other classes.