-

![]()

Discover the powerful tax benefits of Pender Alternative Arbitrage Funds

Amar Pandya

April 18, 2023

Print PDF

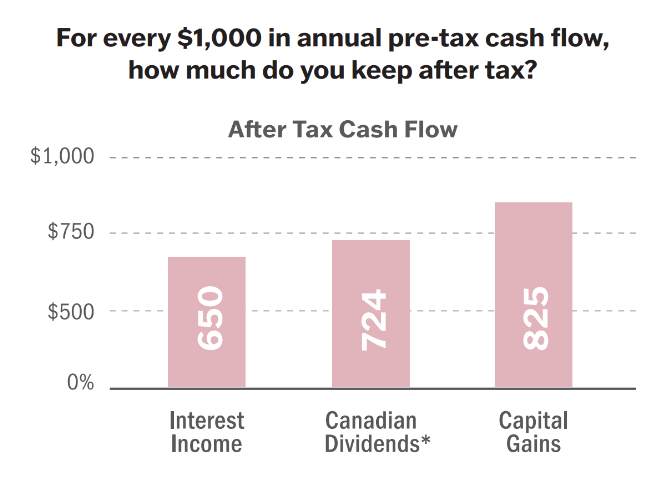

High-net-worth investors seek strategies to protect and grow wealth in a tax-efficient manner. Pender Alternative Arbitrage Fund aims to generate positive and sustainable returns with low volatility. The Fund offers superior tax efficiency because most of the returns are taxed more favourably as capital gains, not interest income or dividends.

What is a merger arbitrage strategy?

This strategy offers better tax efficiency because the majority of returns are in the form of capital gains, not interest income. Capital gains are taxed at a more favourable rate than interest income and dividends.

What are the tax benefits of this strategy?

This strategy offers better tax efficiency because the majority of returns are in the form of capital gains, not interest income. Capital gains are taxed at a more favourable rate than interest income and dividends.

For the purposes of this example, a marginal federal tax rate of 35% is used. Please note that tax rates are unique to the circumstances of each individual and this simplified view is for illustrative purposes only. In addition to the federal taxes noted in the example, provincial taxes are required to be paid. The amount of provincial taxes will vary according to the province (provincial

dividend tax credits also apply). When combined, the total of the federal and provincial taxes equals the taxes owing on taxable income. All figures are rounded to the nearest whole number. Tax rates are subject to change.

* Represents eligible Canadian dividends with a federal tax credit of 15.02%. Additional provincial dividend tax credits may be available

How tax efficient is your portfolio?

Investment income typically comes in three forms: interest income, dividends, and capital gains, in declining order of taxation. Only half of capital gains are subject to taxation compared to interest income which is fully taxed. Tax efficiency is an important strategy in maximizing after-tax investment returns.

What are additional benefits of this strategy?

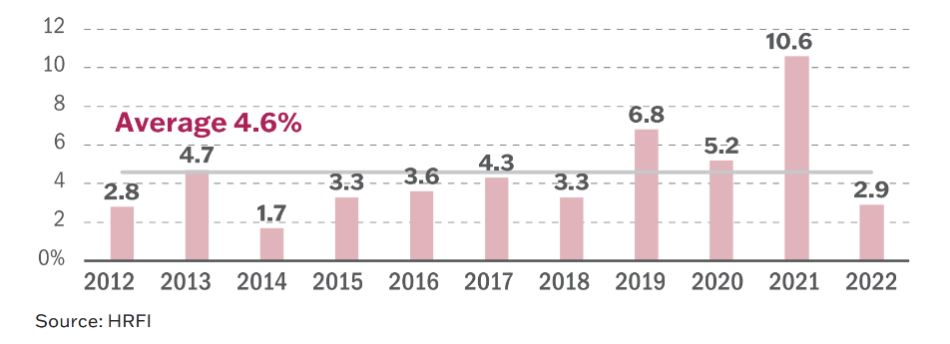

- Consistent Returns with Merger Arbitrage

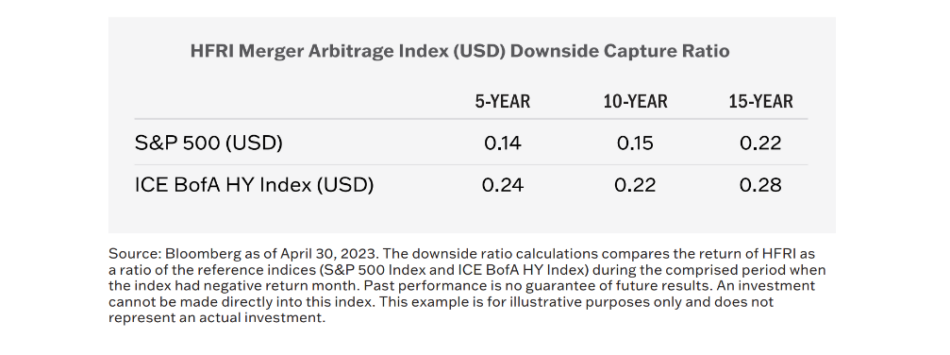

- Optimized Portfolios with Lower Volatility and Greater Diversification

Portfolio Diversification

Alternatives and portfolio risk/return & Annualized volatility and returns, 1989-2Q22

Source: Bloomberg, Burgiss, HRFI, NCREIF, Standard & Poor’s, FactSet, J.P. Morgan Asset Management. Alts include hedge funds, real estate, and private equity, with each receiving an equal weight. Portfolios are rebalanced at the start of the year. Data is based on availability as of November 30, 2022.

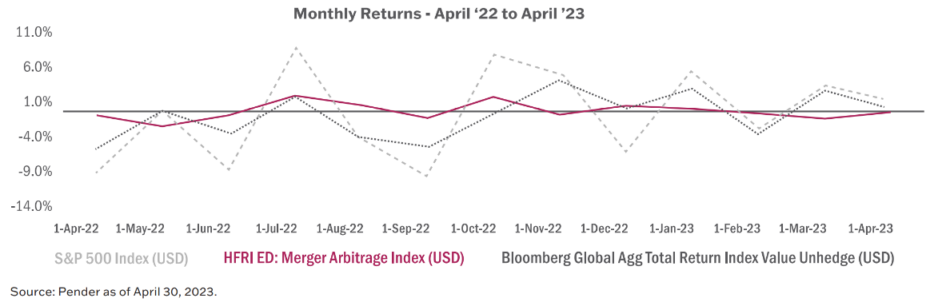

- Market Neutral Returns

- Structured to Protect Portfolios from Excess Volatility and Drawdowns

Learn how you can build a more tax efficient portfolio with Pender Alternative Arbitrage Funds: Click here

Sign Up To Our Newsletter

Stay Connected

Join our online community and receive a monthly round up of new blog posts, commentaries, podcasts, media coverage and more.