-

![]()

How investors can benefit from Pender’s small cap ecosystem

Small cap returns come from investing in the higher growth part of the cycle and from greater market inefficiencies

February 07, 2023

Print PDF

Pender has developed a circle of competence in understanding small-cap companies. We launched as a venture capital company investing in private and very small public companies which honed our expertise. We sat on boards and tracked management team execution of business plans. We understand the mindset and we know a lot about the potential buyers and sellers in the industry. This gives us, not only an analytical, but also a behavioral edge. Our knowledge base has been developed over many years and is one way we differentiate from the competition.

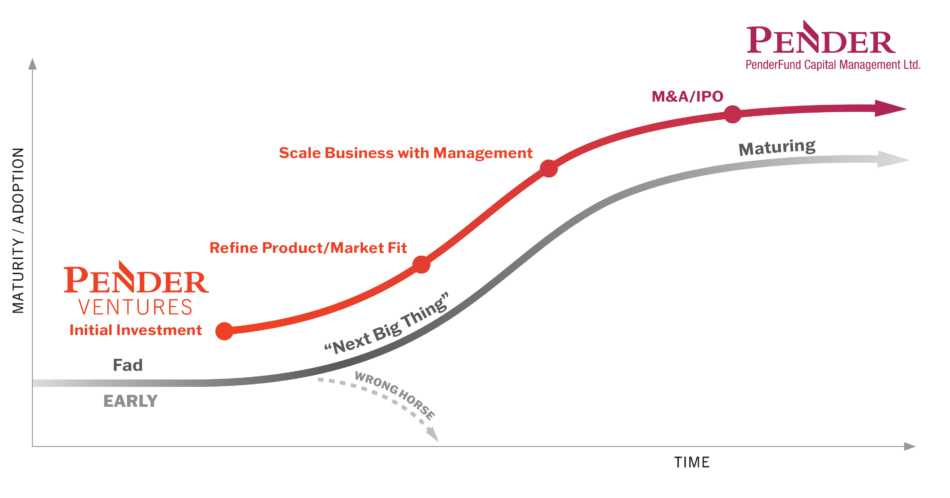

In 2009, we leveraged our expertise in venture capital as a springboard to launch mutual funds. Today, Pender Ventures, our private equity division, continues to work synergistically with PenderFund. For over a decade we have shepherded companies through their lifecycle—from their inflection point to scaling, to potentially a public offering and, at times, through to a merger and acquisition or other special situation event.

Pender’s History of Identifying Catalysts

Finding market inefficiencies in small caps can generate alpha

One of the tenets of finance is the Efficient Market Hypothesis which states that “when new information comes into the market, it is immediately reflected in stock prices…”

However, it has been our experience that some segments of the market are less efficient than others. By having a clear understanding of where those potential inefficiencies may reside, and by having a flexible mandate to pursue them, an investor can generate tax-advantaged profits.

One segment of the market where these inefficiencies may be found is among smaller public companies. These companies are often less followed by analysts and sometimes no analysts at all. Furthermore, institutional investors such as pension funds, foundations and endowments may be restricted from investing in smaller companies for various reasons, likewise many large ETF providers are also prohibited from doing so. This leaves the playing field relatively uncrowded for those who are willing to dig deep to understand these businesses, their managements, and assess their potential as sound investments.

“Small and mid-sized companies are more agile than their supersized brethren.”

Since 2009, Pender has been doing just that. A core area of our expertise is investing in small-to-mid capitalization companies through in-depth research and due diligence which has proven to be successful over the long term. By focusing on these relatively inefficient parts of the market, with a concentrated portfolio of value-based investments, the Pender Small Cap Opportunities Fund has generated a 10-year annualized return of 13.8 (to December 31, 2022) vs. the benchmark, the S&P/TSX Composite Index, return of 7.8% (to December 30, 2022).

Small and mid-sized companies are more agile than their supersized brethren. Their relative dynamism compared to large or mega cap companies presents us with a range of outcomes to generate capital gains for our clients. For example, some of our holdings were acquired by larger companies or experienced other special situations which generated positive returns for investors.

Smaller companies are also able to pivot rapidly to changing economic and business conditions and find creative solutions to generate growth. A meaningful number of smaller companies continue to compound growth at a steady clip providing a long runway of positive returns for early investors. Investing in small caps represents leaning into the higher growth part of the market cycle.

Companies with smaller capitalizations are followed less closely or completely ignored by the “Street” and sell-side analysts. This situation frequently generates market inefficiencies in the prices of small and micro-cap stocks. Savvy investors with a deep understanding of the business fundamentals can exploit these inefficiencies to generate alpha.

The Pender Ecosystem: Leveraging our small-cap expertise into alternative investment strategies

Increasingly, investors are looking for ways to diversify their portfolios with alternative assets and investment strategies that have a low correlation to traditional assets such as stocks and bonds, are tax advantaged, and can provide a predictable flow of income.

There are 3 major reasons for the growing popularity of alternative assets:

- Traditionally, alternative assets such as hedge funds, private equity, commodities, even art and collectibles have only been accessible to large institutional investors or high-net-worth individuals. These strategies typically required locking up capital for long periods which is not always feasible for all investors.

- Increasingly volatile and uncertain markets, against a macro backdrop of inflation and rising interest rates, necessitate some exposure to investment strategies which can mitigate risk while at the same time aim to generate positive returns.

- As the correlation among various asset classes, such as equities and bonds, for example converge, investors seek out strategies that can provide true diversification in addition to risk-adjusted returns.

To address these challenges, Pender launched the Pender Alternative Arbitrage Fund in 2021 to achieve 6 key benefits for investors:

- Market neutral: goal of consistent and predictable absolute returns

- Low risk/low volatility/low drawdowns

- Low correlation to traditional assets such as equities and bonds

- Tax efficient: returns taxed as capital gains, not income or dividends

- Interest rate hedge: return potential increases with rising interest rates since spreads are widened by an increase in the risk-free rate

- Low duration: deals are completed within three to five months

The Pender Alternative Arbitrage Fund (“PAAF”) and its leveraged version PAAP seek to generate profits during a merger and acquisition event or takeover deal. Typically, it involves purchasing the shares of the target firm during the interval between the announcement of a takeover and its completion. The difference or “spread” between the offer price and the market price represents the market’s faith in the consummation of the deal.

By focusing on smaller deals, PAAF gains a tremendous advantage from Pender’s existing small- cap ecosystem. Our team of analysts already has a deep understanding of the small-cap universe where many of these businesses are often underfollowed, unloved and/or misunderstood. To us, this represents a compelling opportunity.

By working closely with our investee companies, we are in a unique position to discern management’s goals which, at times, may include a liquidity event such as a merger or acquisition. In some cases, we are one of the major shareholders of the investee company and may become actively involved. Our activities may include appointing directors to the board or implementing management changes that better fit the evolving business. This may lead to such positive outcomes as a liquidity event that generates positive returns for our investors.

As an example of how the Pender ecosystem typically operates, usually when a takeout is announced, Pender will sell the holding in our Pender Small Cap Opportunities Fund at slightly below the takeout offer price to take advantage of other opportunities. At this time, the Pender Alternative Arbitrage Fund is typically employed to capture the lower-risk spread return between the takeout price and the current market price. In doing so, the Fund generates tax-advantaged returns for Unitholders because capital gains are taxed at a lower rate than income.

We have a competitive advantage in evaluating the viability of merger arbitrage deals as we have owned many of the companies involved in these transactions. Evidence of our expertise is shown in the high percentage of successful deals in which we participate.

This insight is even more important today as a prevailing risk-off sentiment has caused multiple price compressions, particularly among the small/mid caps. This has created positive tailwinds for those who deeply understand a business through regular meetings with management, the competitive landscape and product market fit.

Unlike large and mega-cap takeovers which face an increasingly hostile regulatory environment, small-to-mid cap mergers and acquisitions have a higher probability of success and the duration from offer to completion is typically shorter, approximately three to five months. This allows the portfolio manager to redeploy capital much sooner.

In today’s increasingly uncertain market environment, the average investor is seeking a solution to the drawbacks of a traditional balanced portfolio. Arbitrage strategies provide low correlation, tax advantages, and income replacement and thus may be a suitable addition to a well-diversified, balanced portfolio.

Sign Up To Our Newsletter

Stay Connected

Join our online community and receive a monthly round up of new blog posts, commentaries, podcasts, media coverage and more.