How investors can benefit from merger arbitrage strategies

February 28, 2023

Print PDF

Merger arbitrage strategies are finally available to individual investors—and that’s a good thing because they can offer consistent positive returns, lower volatility and add diversification to an investment portfolio. Yet until recently these investment strategies could only be accessed by accredited investors such as pension funds, family offices, and high-net-worth individuals. In 2019 regulatory changes allowed investors to access “alternative” mutual funds that employ merger arbitrage strategies.

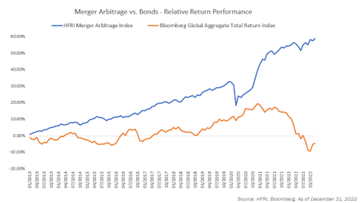

You could say this is a “good news/bad news” story. First the good news: alternative strategies, such as merger arbitrage, can be an excellent portfolio diversifier, and potentially superior to the traditional 60/40 equity/bond portfolio which suffered big losses in 2022 and could do so again. But many investors don’t fully understand merger arbitrage and its benefits.

What is arbitrage?

Arbitrage is an investment strategy that takes advantage of the difference in prices for the same asset in different markets. Here is a simple analogy:

You decide to buy a vintage Mötley Crüe concert t-shirt on Kijiji currently priced at $25. You have a high degree of confidence that, thanks to the success of the Netflix documentary on Pamela Anderson who was once married to Tommy Lee Bass, the band’s co-founder, you believe you could re-sell it on eBay where similar shirts are selling for a slightly higher price, say $27.50 because, you know, Mötley Crüe. The difference, or spread, of $2.50 is your profit.

This is an event-driven strategy: you buy the t-shirt in a small local market on Kijiji with limited buyers and then immediately sell it on eBay a large global market with lots of buyers willing to pony up thanks to the renewed public interest in Mötley Crüe.

What is merger arbitrage?

In the world of finance, merger arbitrage is also an event-driven strategy. It seeks to capture the difference between the share price of a company from when a merger is announced until its successful completion.

When a merger & acquisition is announced, the notice will provide an expected closing date and indicate the offer price. As the offer price is generally higher than the share price of the day, we call this the takeover premium. The reason for the takeover being priced at a premium is to incentivize current shareholders to accept the offer, sometimes the offer is rejected by shareholders and occasionally a higher offer is made. The share price of the target company typically rises near to but still below the offer price. That remaining gap between the new share price and the offer price is called the arbitrage spread. When the deal goes through, shareholders are paid the offer price and this spread will close.

An investor who believes there’s a strong probability in a successful deal close, can purchase the target company’s shares at the slightly discounted price and later sell the fully valued shares upon completion of the deal to generate a profit. When this process is repeated in a series of mergers & acquisitions, even smaller profits compound to generate a healthy total return.

Why invest in merger arbitrage?

Why invest in merger arbitrage?

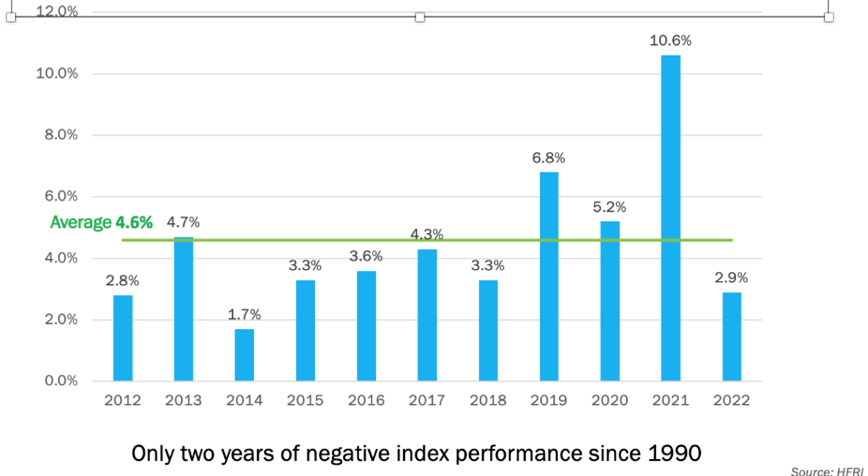

Merger arbitrage is not a new strategy, and it has proven its mettle in different market conditions and economic cycles. This makes it suitable for investors who seek the benefits of true diversification in their portfolios.

Unlike index-tracking mutual funds and ETFs, a merger arbitrage strategy is market neutral. The goal is to generate consistent and positive returns under all market conditions. This is an appealing attribute given our increasingly uncertain times due to rising interest rates, spiking inflation, geopolitical tensions, climate change, and disruptive technological advances. The strategy not only has a low correlation to equity and bond cycles, but individual merger deals also have low correlation amongst one another.

Unlike other investment strategies, merger arbitrage strategies are lower risk with less volatility and lower drawdowns giving portfolio protection in turbulent markets. By only investing in deals with legal agreements in place, and not speculating on the potential for an acquisition, together with relatively short deal duration of 3-to-5 months, capital is not tied up for long periods and capital from closed deals can be quickly redeployed into new ones. As arbitrage investors demand a premium over the risk-free rate, the strategy has historically proven to be an effective interest rate hedge, with return potential increasing with rising rates. Lastly, because returns are taxed as capital gains, not income, it is tax efficient relative to bonds.

M&A Tailwinds

The appeal of merger & arbitrage strategies is they have a low correlation to market direction making them an excellent diversifier in a portfolio. However, there are periods, such as today, which provide attractive tailwinds for M&A strategies. These positive trends include:

- Public market valuations remain below those of the private markets which make them attractive acquisition targets for private equity firms and corporations which have a stockpile of cash ready to deploy.

- This is strong environment for companies which are serial acquirers, and which are well positioned to acquire small-to-mid-size companies that may have reached a growth inflection point and require large capital investments, or those that are experiencing debt servicing challenges during this period of rising interest rates and may be more receptive to a buyout offer.

- The rise of activist investors targeting undervalued businesses seeking to influence shareholders and a company’s board to try and sell the business.

- While the deal risks for M&A deals is in line with historical levels, the potential yields and relative arbitrage spreads are currently higher than historical levels.

M&A: The Pender Advantage

Our M&A strategy is an organic extension of our established equity investment process where we evaluate businesses based on a private market value with the expectation of a catalyst such as a M&A event. Because of Pender’s expertise in the small and mid-cap universe of companies, we already have the knowledge and expertise, as well as the relationships with management. When an acquisition is announced, we draw from our core equity circle of competency and existing research coverage and due diligence to gain an edge in our M&A investment strategies. By focusing on the part of the investing universe where we already have an advantage, investors benefit, not only from the M&A strategies themselves through potential downside protection and consistent and absolute returns, but also from our differentiated expertise in trading and liquidity management in smaller mergers. For example, at the time of writing, Pender has been successfully involved in 84 deals since 2010 (Pender’s History of Identifying Catalysts).

To learn more, visit: https://www.penderfund.com/pender-alternative-arbitrage-fund/

Sign Up To Our Newsletter

Stay Connected

Join our online community and receive a monthly round up of new blog posts, commentaries, podcasts, media coverage and more.