It is phenomenal to think about the evolution of the Berkshire Hathaway (BRK) annual meeting over the years. Fifty three years ago the first Berkshire Hathaway annual meeting was held in a lunch room for friends and family. Today, more than forty thousand people descend on Omaha and fill an arena to capacity; not to mention a live stream that is viewed by many thousands more.

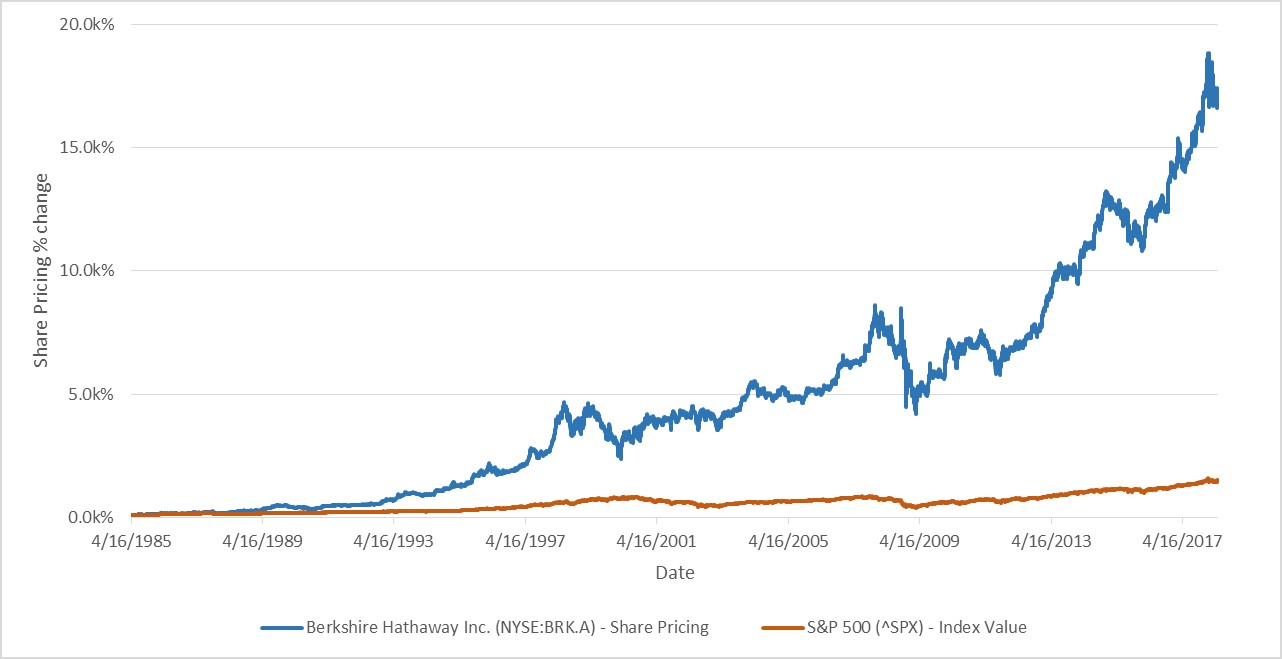

This simple chart makes it easy to see why BRK has been able to attract the masses:

Source: CapitalIQ

Keep it simple

Undoubtedly the track record of Berkshire Hathaway Inc. is extraordinary. But what may be even more incredible is the simple concepts and principles on which this wealth creation was built. Warren Buffett’s partner Charlie Munger puts it best, “Our approach has worked for us. Look at the fun we, our managers and our shareholders are having. More people should copy us. It’s not difficult, but it looks difficult because it’s unconventional — it isn’t the way things are normally done…. It’s simple and common sense.”

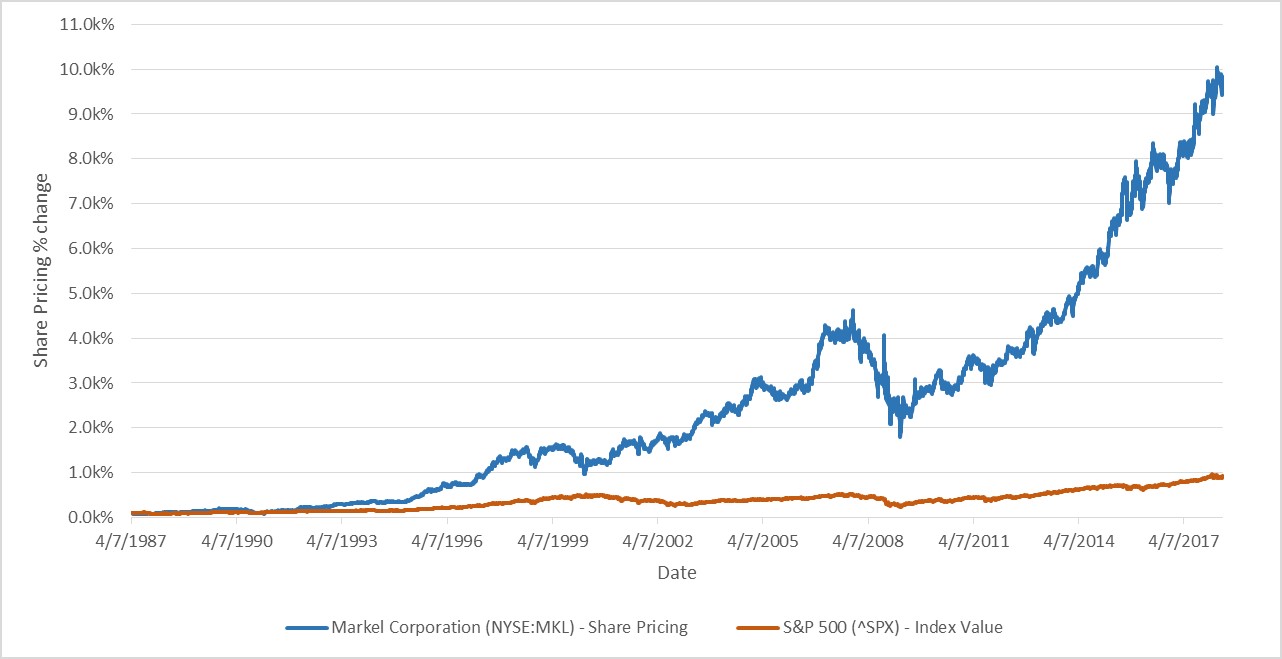

And even though the concepts that are reiterated in every letter, meeting and interview are simple, few have successfully replicated the formula. This is because “simple” does not translate into “easy”. Our brains are hardwired to act in certain illogical ways and it takes hard work, introspectiveness and forethought to overcome these tendencies. That being said, one firm that has unabashedly copied the Berkshire Hathaway model to their benefit is Markel Inc. (MKL), led by co-CEOs Tom Gayner and Richard Whitt.

Source: CapitalIQ

Given Markel’s phenomenal track record and resemblance to BRK, their annual meeting has also become a must-attend event for value investor proponents who find themselves in Omaha each May.

Below, we explore three key insights from our weekend that permeated both the BRK and MKL meetings:

- The value of brand and reputation

- The power of continuous learning

- The importance of understanding the human factor

The value of brand and reputation

Berkshire Hathaway may be best known for investing sizable amounts into North America’s most prominent brands. And if there is one investor who truly understands the value of this intangible asset, an asset which will never properly show up on a balance sheet, it’s Berkshire. And a brand is nothing but a reputation.

Berkshire has leveraged this asset to its fullest potential not only in its investments, such as Coca-Cola and GEICO, but also in the Berkshire brand itself.

As a testament to the importance Warren and Charlie place on their own reputation, they noted during the 2018 meeting that they intend for Berkshire’s reputation to remain long after they are gone, and that the only thing they could tell you in 50 years’ time is that Berkshire will still be “based on certain principles”.

These are principles that the firms’ reputation was built on. And acting in a reputable manner year after year has garnered Berkshire a steadfast reputation that has attracted two key groups of people: a long-term oriented shareholder base and willing sellers that knock on their door. And although unquantifiable, these two groups have had an immensely important role in Berkshire’s wealth creation. It is not only in the interests of others to act in an ethical and respectful manner, but in the interests of oneself. We at Pender strive never to underestimate the power of a brand or reputation in either our investments or our own dealings.

The power of continuous learning

One cannot go to the BRK annual meeting today and not be struck by Charlie Munger, 94 years young, walking out from behind the blue curtain to hold an eight hour meeting before tens of thousands of people. And if walking unaided isn’t an impressive enough feat, Charlie holds court, gathering laugh after laugh with well-timed and pointed comments throughout the day. After factoring in luck and good genes, it’s hard not to attribute this remarkable display to Charlie’s unrelenting mind. He is the exemplar of continuous knowledge gathering, or in his own words continuous “ignorance removal”.

Berkshire has set a foundation of principles that they hope will stand the test of time, but in implementing those principles Warren and Charlie remain flexible. Their surprising agility is routed in a curiosity about the world, an acknowledgment of their own ignorance and a receptiveness to change. Berkshire’s recent technology and airline investments, two industries that were previously denounced by the pair, are examples of their flexibility.

Munger: “You have to have the habit of re-examining your old ideas all the time…. You just can’t get through life successfully without it. The world changes.”

One of our key values at Pender is to nurture an entrepreneurial environment. The word “entrepreneur” is a powerful one, as it represents passion, innovation, and ambition. An entrepreneur does not rest on their laurels, but instead embraces change and seeks opportunity in the world of tomorrow. And for us, Charlie is a poignant example of how continuous curiosity enables this spirit.

The importance of understanding the human factor

Often forgotten in investing is a true understanding, or a desire to understand, the strength of human relationships. All businesses have key relationships with consumers, employees and shareholders. We signify these as key relationships because a major strain in only one of these relationships can bring down even the most formidable companies. By the same token mediocre companies can be made great by properly strengthening these relationships.

Warren, Charlie and Tom very much appreciate the importance of these relationships.

When Tom was asked at the Markel meeting to outline the perfect hypothetical business, he didn’t rifle off profitability metrics or balance sheet strength. He simply said, a world class business is one which truly serves its customers, employees and shareholders. That is a powerfully simple statement from the CEO of a US$15 Billion conglomerate. But all too often, the importance of this foundational concept is lost in the short-termism of Wall Street.

Another example of the human factor is the power of incentives. Charlie Munger tried to hammer home the importance of incentives in his 1995 Harvard University speech titled The Psychology of Human Misjudgement, where he stated: “I think I’ve been in the top 5% of my age cohort all my life in understanding the power of incentives, and all my life I’ve underestimated it. Never a year passes that I don’t get some surprise that pushes my limit a little farther.”

It’s even fair to say that some of Berkshire’s secret sauce is in their deep understanding of incentives. This was evidenced by Charlie’s response when Warren was asked to detail Berkshire’s managerial incentive structures, “He (Warren) really doesn’t want to answer… he’s got every formula in the book, and he keeps them all private. That’s our system.”

As evidenced by Markel and Berkshire, stakeholder relationships and incentive structures are immensely important. And although it will always be imprecise, we at Pender heavily weigh these qualitative factors in all of our investing decisions.

In conclusion

Our Omaha weekend was well worth the trip and recommended for all those who are as passionate about investing as we are. And although we write about these insights in relation to investing, there may be truth to these concepts in everyday life. It’s hard to imagine someone going astray in life while properly valuing human relationships, continuously learning and upholding a good reputation. And come to think of it, the permeation of Warren and Charlie’s wisdom into everyday life may have as much to do with the gathering of the masses as the track record above.

June 08, 2018