Why the next big tech name could come from the healthcare sector

Important Information: Pender Technology Inflection Fund I Limited Partnership managed by PenderFund Capital Management Ltd. (“Pender”) holds an investment in Clarius Mobile Health, Inc. (“Clarius”) and the author of this article, Maria Pacella, CFA, is Senior VP, Private Equity and Portfolio Manager with Pender and is also a member of the board of directors of Clarius.

The world’s biggest tech companies have driven equity markets forward for much of the past decade. The seemingly endless “world’s richest company” title fight amongst the “FAANG”s has pushed valuations to record-breaking levels; and while equity markets have slowed down somewhat, these companies are still well clear at the top of global market cap rankings.

Investor capital – from venture capital to large scale institutional investment – has propelled these companies to stock market supremacy. Not surprisingly, new enterprises continue to attract venture capital, as investors hope to get in on the ground floor of “the next Google”.

According to the CVCA’s VC & PE Canadian Market Overview for 2018, “Canadian venture capital investment continued its momentum in 2018 following years of steady investment growth across the entire spectrum of stages in the ecosystem.” The report talks about seed, early stage and later stage companies; however we believe there is another stage.

Private companies that have a commercialized product generating sales revenue, but may not yet be profitable and therefore still require capital to accelerate growth are, we believe, at an “inflection stage” between early and later stage companies.

A deeper dive into these smaller tech companies at this inflection point reveals a whole new world of strong businesses, that have achieved market validation, which could very well be future market movers.

Taking the healthcare sector, rising costs, among other factors, have driven the industry to turn to technology to develop new solutions to old problems.

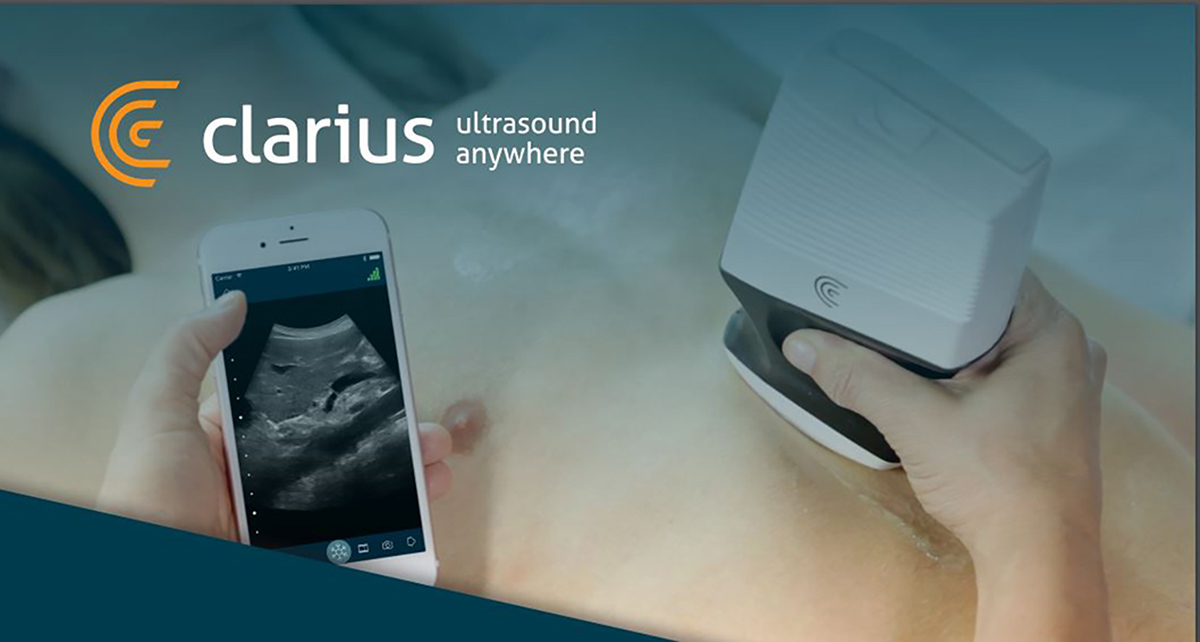

One such example is Clarius Mobile Health, a Vancouver, Canada-based medical imaging company that makes handheld ultrasound imaging scanners, capable of connecting with iOS and Android devices. The devices are completely portable, and capable of producing high-resolution ultrasound images from virtually anywhere, sending data instantly to the cloud for analysis at hospitals and other medical institutions. Suddenly the patient no longer has to travel to the hospital. Doctors – including veterinarians – can travel to remote areas and provide care to communities that would not otherwise have access to ultrasound technology. The current global ultrasound market is valued at around CDN$6 billion[1] and a high performance, ultra-portable scanning unit has the potential to move the market beyond patient care towards early diagnosis and preventative medicine.

In developing this technology, Clarius, like many of its peers in the health-tech and biotech space, is responding directly to calls from medical professionals looking for easy-to-use and more cost-effective scanning solutions. “Long term there is a strong indication that every doctor will be using these small devices as AI-driven visual stethoscopes”, said Laurent Pelissier, Chairman and CEO, Clarius Mobile Health.

The convergence of health and tech has become one of the fastest growing subsets of the technology sector more broadly, with early and inflection stage companies engineering products specifically to meet the shifting needs of healthcare professionals. This cooperation is resulting directly in innovations that will help drive forward advances, not only in the quality of patient care, but also in earlier diagnosis and preventative medicine. These solutions represent some of the highest potential for disruptive technologies going forward.

On top of the potential for these products to be life-changing and life-saving, the market for these innovations in the North American healthcare sector is massive, let alone globally. In truth, it’s exactly the long-term potential for growth in this sector that makes it so attractive as an investment opportunity.

Like many consumer-facing technologies, health-tech advances that make everyday tasks more effective and less expensive for medical practitioners and hospitals will likely continue to draw interest. Change may accelerate as both the potential of current technology becomes known and the pace of technological change makes more things possible.

But it’s not just innovation in medical equipment driving this growth either. Evolution in artificial intelligence and “big data” driven technologies are also helping transform everything from patient record management to faster, more accurate cancer diagnosis and treatment options.

Yet many of these companies are relatively small and, more often than not, have yet to go public. While it remains entirely likely that “the next Google” is still a private company, outside of traditional venture capital (which continues to be geared more towards start-ups than inflection stage companies), in our view this subset of the technology sector remains relatively underserved by investors.

By Maria Pacella, CFA

April 25, 2019

Catalysts: Investing in “take-outs”

At the time of writing, David Barr’s track record for picking small cap take-out1 targets stands at 40 portfolio holdings taken out since the Pender Small Cap Opportunities Fund was launched (June 2009). In just […]

Circle of Competence

Warren Buffett and Charlie Munger said it best when they recommended that investors stay within their “Circle of Competence”. Your circle of competence is the knowledge base you have developed, over and above the average […]

The Pender Edge: What factors give us an advantage?

Download PDF We take a private equity approach to public markets We research potential holdings as if we were buying an ownership stake in the business, not just the stock. We take a deep look […]