Alternative Absolute Return – June 2023

HIGHLIGHTS

- The Fund added to event-driven holdings, most notably the 5.75% 2026 notes issued by PDC Energy Inc. (Nasdaq: PDCE) which is in the process of being acquired by Chevron Corp. (NYSE:CVX).

- New issue activity picked up and we participated in several transactions, most notably Northland Power Inc.’s (TSX: NPI) inaugural hybrid issue which priced at a discount to par to yield 9.5% for the first five-year term.

- We exited several higher beta positions in the broad market rally in the first half of June, including Hudson Pacific Properties LP (NYSE: HPP) 2030 bonds and equity.

- The Fund’s macro hedges hurt performance, but we believe that patience will be rewarded as certain areas of the market have run further than is justified by fundamentals.

—

Dear Unitholders,

The Pender Alternative Absolute Return Fund finished June with a return of 0.01%, bringing year-to-date returns to 3.31%[1].

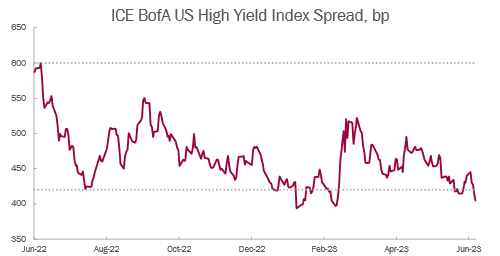

Markets were generally buoyant in June as participants focused on positives while events with negative implications for asset prices, like higher risk-free rates, were largely ignored. The ICE BofA US High Yield Index faced resistance in the low 400bp OAS range, which is consistent with where resistance has been for much of the past year.

Portfolio Update

The Fund added to event-driven holdings in June, most notably the 5.75% 2026 notes issued by PDC Energy Inc. (Nasdaq: PDCE). The company is in the process of being acquired by Chevron Corp. (NYSE: CVX), with the transaction expected to close by the end of the year. Our investment thesis is that Chevron will not want to maintain separate financial reporting for PDC post-closing of the transaction and will likely call our bonds at the current call price of $101.4, which combined with the coupon, would generate an IRR of approximately 9% for a six-month hold using our month-end mark. There were positive indications in early July that this transaction could close much sooner than year-end, in which case the IRR would improve substantially. We believe this is an attractive return for a high-quality, low-risk transaction.

One of our positions in Commercial Mortgage-Backed Securities (CMBS) received positive news in June as The Real Deal reported that the private equity owners of the Austin Fairmont have put the property up for sale. While there is no certainty that a transaction will be consummated, with a mortgage coming due in September 2024, we believe that the sponsors are acting in a thoughtful and proactive manner to get in front of what could be a lot of assets coming up for sale in the coming months. This CMBS transaction was issued as a two-year mortgage in fall 2019 with three one-year extensions. We now believe that there is a good chance of the mortgage being paid out at par in 2023, which would improve our IRR significantly relative to our base case that this holding would be paid out at final maturity in 2024. Our cost base for this position was $96.4 last December, with a current coupon of 7% (LIBOR +180bp).

New issue activity picked up in June and we participated in several transactions, most notably Northland Power Inc.’s (TSX: NPI) inaugural hybrid issue which priced at a discount to par to yield 9.5% for the first five-year term. We expect that patiently waiting for issuers who require capital in the coming months will pay off. There are a lot of CFOs who have put off refinancing near-term liabilities in the hopes that higher rates will prove to be temporary. Both the Federal Reserve and Bank of Canada delivered hawkish messaging in June. Ultimately, we expect that many corporate issuers will need to come to market over the next 12 months in order to avoid 2025 bond and loan maturities becoming current liabilities.

We exited several higher beta positions in the broad market rally in the first half of June. Notably, we sold our position in Hudson Pacific Properties LP (NYSE: HPP) 2030 bonds that we had acquired in late April. As an American west coast focused office REIT, we are expecting a long cycle ahead, which argues for selling into rallies. We also closed out a modest short position in HPP equity at a profit in June.

The Fund’s macro hedges hurt performance in June, but we believe that patience will be rewarded as certain areas of the market have run further than is justified by fundamentals. Momentum and FOMO appeared to be driving price movements in June. An expensive market that becomes more expensive is one of the more difficult setups for our fundamental- and valuation-driven approach to positioning. Despite a market that is fully priced overall, we are seeing some attractive individual opportunities.

“We expect that many corporate issuers will need to come to market over the next 12 months in order to avoid 2025 bond and loan maturities becoming current liabilities.”

Portfolio metrics:

The Fund finished June with long positions of 129.6%. 21.5% of these positions are in our Current Income strategy, 92% in Relative Value and 16.1% in Event Driven positions. The Fund had a –68.9% short exposure that included -14.6% in government bonds, -37.8% in credit and -16.5% in equities. The Option Adjusted Duration was 1.49 years.

Excluding positions that trade at spreads of more than 500bp and positions that trade to call or maturity dates that are 2025 and earlier, Option Adjusted Duration declined to 0.84 years. The duration figure includes an Event Driven position where we believe duration does not accurately reflect the option value embedded in the security.

The Fund’s current yield was 5.22% while yield to maturity was 6.18%.

Market Outlook

Six months ago, we argued that the US high yield market was likely to be range bound over the near term, and it would be challenging for the market to rally beyond the low 400bp range in spread. Even though the market broke through 420bp several times over the past six months, including at the end of June, we view this as a sign that the market is overextended, rather than the market transitioning to a new tighter-spread reality.

Source: ICE/Bloomberg

There are plenty of signs of late-cycle dynamics, with the increased cost of capital of the past 18 months yet to be felt by much of the market. Some have pointed to price action in response to the AI craze and have drawn a comparison to the late ‘90s tech bubble, arguing that there are years left to go until the peak. We believe that the current market environment is likely an echo of the speculation-driven bubble of 2021 that was characterized by cryptocurrencies, NFTs, meme stocks and SPACs. There were some spectacular short-term run ups in stocks like AMC and Bed Bath & Beyond well into 2022. It is probably a bad sign if the main market driver can be characterized as a craze and the argument for being invested in the craze is to point to the ‘dotcom’ bubble, which was so detached from reality that the Nasdaq index fell by 80% following its peak, during which time the Federal Reserve cut its policy rate by 4.25% on a net basis.

While hawkish messaging from central banks hurt fixed income markets generally in June, a higher-for-longer regime benefits our floating rate securities, including leveraged loans and rate re-set preferred shares, which bounced off what we viewed as depressed levels in late May. The market has been pricing in higher long-term rates than the Fed dot plot for months now, but June’s updated forecasts showed relatively significant movement amongst FOMC voters, with seven of 17 respondents now projecting a long-term policy rate of over 2.5% In March there were only four such projections and for comparison, a year ago only two. In our view, these projections are still well behind the curve, but slowly acknowledging that the facts have changed.

There are cracks and structural problems in several areas of credit markets, probably no more so than in commercial real estate, with a lot of mortgage maturities coming due in the next couple of years. While this is not news to the market, we believe that the impact has not been fully appreciated. In leveraged finance, the lack of CLO issuance could push more issuers to the high yield market, increasing the pricing power for investors and the cost of capital for issuers. We believe that now is a great time to have excess capital to tactically deploy in the coming months, as we expect the opportunity set to improve.

Justin Jacobsen, CFA

July 11, 2023

[1] This Pender performance data point is for Class F of the Fund. Other classes are available. Fees and performance may differ in those other classes.