Balanced Funds – Q3 2022

Highlights

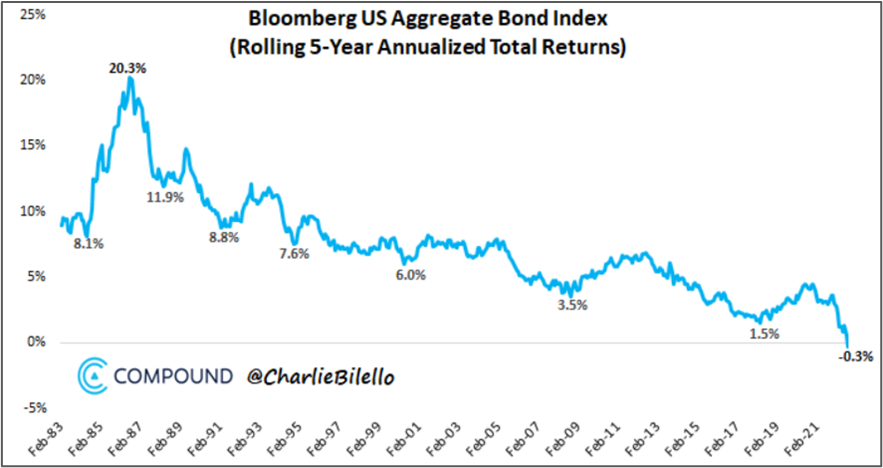

- Policymakers in most parts of the world have raised rates this year with the count and pace continuing to mount. The US Bond Market has had a -0.3% annualized return over the last five years, the first negative five-year return in US bond market history. Global bond markets have been even worse.

- Against this market backdrop, the equity holdings within the Fund detracted, while we saw positive contributions from our fixed income exposure and holdings in alternative strategies.

- While forward-looking growth and earnings estimates have remained steady, fears of an economic slowdown and a recession on the horizon have grown, leading investors to discount a more challenging outlook for equities, including small cap companies.

- Alternative strategies have performed well and provided the portfolio with positive and uncorrelated returns in this environment, as we had hoped they would. Over the long term, these strategies should dampen overall portfolio volatility while delivering returns with a low correlation to the overall portfolio.

The third quarter of 2022 saw a continuation of many of the trends we saw in the first half of the year. Volatility in equity markets, rising bond yields and continued hawkishness from central banks to tame inflation have created difficulties for investors so far this year.

The S&P 500 finished the quarter at year-to-date lows, down 23.9% so far in 2022. This is the third worst start since the index was founded in 1957. It is also the longest correction since the March 2009 low. Other US indexes were similarly weak, including the tech-heavy Nasdaq, which ended the quarter down 32.0% and the small/mid benchmark of the Russell 2000 Index that ended down 25.1%. It is not a rosy picture in fixed income either. US Treasury yields continued their march higher in the quarter, with the 10-year yield ending September at 3.8% and up 85 bps on the quarter. Continuing a major theme of this year, tighter monetary policy from central banks in response to elevated inflation has fueled the selloff in credit markets. Policymakers in most parts of the world have raised rates this year with the count and pace continuing to mount. The count of rate hikes reached 277 across 80 central banks worldwide, which compares to 123 rate hikes from 41 central banks in all of 2021[1].

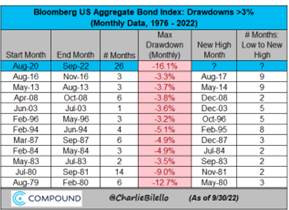

The 16.1% decline in the US Aggregate Bond Index over the last 26 months is now the longest and largest drawdown in history for the US bond market (see the charts below). The US Bond Market has had a -0.3% annualized return over the last five years, the first negative five-year return in bond market history. Global bond markets have been even worse. A theoretical 60/40 portfolio[2] is down 21% so far in 2022, on pace to become the second worst year in history. Only the depression-era 1931 was worse.

Against this market backdrop, the Pender Strategic Growth & Income Fund was down 1.9% in the quarter, bringing year-to-date returns to -11.8%[3]. With mixed market performance in the third quarter, the equity holdings within the Fund detracted, while we saw positive contributions from our fixed income exposure and holdings in alternative strategies.

Equities

Within our direct equity holdings, we saw positive contributions from Texas Pacific Land Corporation (NYSE: TPL) and CCL Industries Inc. (TSX: CCL.B), while our holding in Burford Capital Limited (NYSE: BUR) detracted in the period.

Texas Pacific Land Corporation engages in land and resource management, operating a royalty business primarily leasing land rights to oil and gas companies for exploration and development. We see this royalty business model as attractive given its historical returns in a capital-intensive commodity industry. The company has benefitted recently from a strong oil and gas market that in turn has led to increased drilling on its properties. Management has been focused on diversifying the business and finding new ways to monetize its land position.

CCL Industries was also a positive contributor to performance during the quarter. The company posted strong Q2 results that were announced in August, highlighted by impressive organic growth of 11%. Management also provided an encouraging outlook for the second half of the year. In addition to organic growth, the company has executed well on identifying and integrating acquisitions, which we expect to continue. With ample capacity on its balance sheet and approximately $1.5 billion of liquidity available, the market dislocation has created an attractive opportunity for CCL to deploy capital and make tuck-in acquisitions.

Our holding in Burford Capital detracted in the quarter, giving up the gains of strong performance in the second quarter. The company is a leading asset management firm focused on the new asset class of financing litigation. Burford has been successful in raising capital in this growing field and is poised to capitalize on pent-up realizations as courts reopen and work through the backlog of cases following pandemic-related shutdowns. These litigation finance cases are uncorrelated to overall markets and a strong pipeline should continue to underpin the fundamentals and cash flows of the business. Despite the weakness in the quarter, our investment thesis remains intact. We are also closely watching a large case that could be a near-term catalyst for the company.

During the third quarter we added two new holdings, Microchip Technology Incorporated (NASD: MCHP) and Liberty Broadband Corporation (NASD: LBRDK) and exited Information Services Corporation (TSX: ISV). Both additions were successful investments that we have made in the past and which have fallen to compelling levels due to the bear market. Information Services proved to be a solid investment that delivered double-digit annualized returns over our holding period, which began in early 2020. Given its modest growth profile, it is now a fully valued holding in our view. We therefore decided to sell it to fund better opportunities. As always, we might revisit the idea again in the future when the opportunity set changes.

Microchip is a diversified leading supplier of microcontrollers, mixed signal, and analog semiconductors. More than half of its revenue comes from high margin and proprietary microcontrollers, which are chips that act as the brains within a wide variety of common electronic devices, including garage door openers, electric toothbrushes and communication infrastructure, among many other products.

We consider Microchip as one of the best-run firms within the chip space. Founder Steve Sanghi is aligned and has been an exemplary capital allocator while running a lean operation. Management is at the early stage of executing its new strategic plans, which include materially increasing its dividend payout in the coming years. Due to fears of a cycle slowdown and market gloominess, the stock is trading at the low end of its historical valuation range. However, this cycle, too, will eventually end and current valuation levels have historically served as an excellent entry point into this dependable compounder.

Liberty Broadband’s primary asset is its 26% ownership of Charter Communications, itself the second largest cable company in the US, which has stable, utility-like characteristics. Both stocks trade at a wide discount to our respective estimates of their fair value. Investors are worried about slowing growth at Charter and its debt load in a higher interest rate environment. True, Charter is not a fast-growing business anymore. However, due to the management team’s capital allocation strategy, we anticipate the stock will continue to be a free cash flow “compounder” on a per-share basis over the near term.

Both Charter and Liberty Broadband use most of their free cash flow to shrink their equity bases through stock buybacks. Charter can now buy back its stock at a double-digit free cash flow yield. Liberty Broadband is the largest owner of Charter stock. It proportionately sells back its stock to Charter and uses the cash to retire its own stock, which happens to be trading at a material discount to its net asset value. The valuation disconnect on both stocks makes additional share buybacks very accretive to remaining shareholders, but particularly for LBRDK owners who effectively benefit from the dual discount. Down the road, we expect Liberty Broadband to merge with Charter at a narrower discount. The potential setup appears compelling at recent valuations.

Within the portfolio, our small cap exposure through the Pender Small Cap Opportunities Fund (PSCOF) detracted from overall performance in the quarter. With the volatility in equities, small caps have also been under pressure as we have seen multiple compression, despite relatively solid underlying fundamentals. While forward-looking growth and earnings estimates have remained steady, fears of an economic slowdown and a recession on the horizon have grown, leading investors to discount a more challenging outlook for equities, including small cap companies. For more details on the PSCOF, see the September update here.

“The inclusion of alternative strategies provides the Fund with the potential to deliver positive performance even in challenging environments, like the one we face today, relative to traditional balanced strategies.”

Fixed Income

The Pender Corporate Bond Fund contributed positively to performance in the quarter, within the context of difficult market conditions in credit markets. With fixed income yields rising and spreads widening throughout the year, the forward-looking returns in credit markets have improved considerably during 2022.

The relative outperformance in Fixed Income included our position in Exterran Corporation 8 1/8% notes, which rallied in September on signs that the company’s acquisition by Enerflex Ltd. may proceed as planned. A resilient performance from high-quality short-term notes such as McDonald’s Corporation 2025 maple bonds was also a source of strength.

Weaker holdings included longer duration positions that fell in sympathy with the move in the yield curve. Specific weak spots included a position in National CineMedia, LLC 1st lien notes, which suffered from uncertainty created by the bankruptcy filing of theatre operator Cineworld Group, plc. The Cineworld filing, which we believe to be related primarily to the necessity to effectuate lease restructurings, may create credit opportunities across the theatre sector, including the notes we hold, which now are priced to yield 18% to a 2028 maturity.

Fund Positioning and Outlook

The portfolio ended the quarter with approximately 51% invested in direct equities, 6% allocated to PSCOF, 36% invested in the Pender Corporate Bond Fund and limited cash. In absence of holding cash or significantly overweighting the energy sector, it has been challenging to find “balance” in an environment where most asset classes have been selling off.

Fortunately, the Fund added the Pender Alternative Absolute Return Fund and the Pender Alternative Arbitrage Fund to the portfolio earlier this spring, and these additions have helped dampen some of the recent drawdown. At quarter end, these Funds were approximately 4% and 3% weights in the Fund, respectively. These alternative strategies have performed well and provided the portfolio with positive and uncorrelated returns in this environment, as we had hoped they would. Over the long term, these strategies should dampen overall portfolio volatility while delivering returns with a low correlation to the overall portfolio. This provides the Fund with bespoke Pender strategies that have the potential to deliver positive performance even in challenging environments, like the one we face today, relative to traditional balanced strategies.

The economic slowdown and tightening monetary policy in nearly every country around the world appears to be breaking the back of inflation. Although timing is impossible to predict, we suspect that we will soon hear moderation of today’s hawkish rhetoric. For further commentary on the potential end of the rate hike cycle, please see this recent Morningstar interview with Geoff Castle.

Felix Narhi & Geoff Castle

October 28, 2022

[1] Topdown Charts, Market Cycle Guidebook, September 2022

[2] 60/40 = S&P500/US 10-year treasuries

[3] This Pender performance data point is for Class F of the Fund. Other classes are available. Fees and performance may differ in those other classes.