CIO’s Q3 Commentary – Felix Narhi

“The biggest factor affecting market returns over a short period of time are changes in investor moods. And moods don’t care about spreadsheets, reasoning, formulas, or metrics. They make fools out of those who try to predict them.” – Morgan Housel

In this commentary we cover:

- Volatility strikes back: A second market correction in 2018

- “Needle in the haystack” vs. “tide goes out” investing

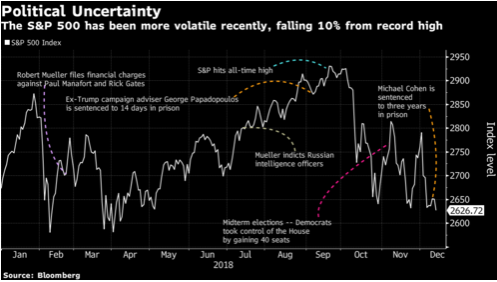

What a difference a quarter makes. We published our last commentary on September 20, which coincided with an intermediate market peak of the S&P500 and the beginning of another +10% market correction. This year has been unusually volatile, with two separate +10% drawdowns in 2018. The last time this happened was in 1990. The index has also seen the most +2% down days since 2011. Although the S&P500 in aggregate is not yet in bear market territory, almost half of the stocks in the S&P500 had fallen 20% or more from their 52-week highs. This includes all the FAANG stocks which have long led the market. Small caps are already in bear market territory, as seen by the more than 20% decline in the Russell 2000. Closer to home, the TSX index is also in the midst of a +10% correction since peaking in July. Now that we are in the late innings of the longest bull market in S&P500 history, investors are increasingly fearful that this may finally be the beginning of a long overdue bear market. The ongoing pessimistic drumbeat about trade wars, global growth slowdown and political uncertainty is starting to weigh on the market. It’s hard to remember the relative tranquility of 2017 when the tides goes out. At Pender, we are following similar strategies that we outlined during the last big market correction in early 2016.

The opportunity set depends on the market cycle

When it comes to uncovering potentially mispriced securities, the opportunity set narrows and widens depending on the market cycle. Although the lines are sometimes blurred, we believe there are generally two kinds of investing:

1) “Needle in the haystack” investing, and;

2) “The tide goes out” investing.

Finding “needles in the haystack”

We believe there will always be individual securities in any cycle of the market that will be either unloved, underfollowed or misunderstood, and therefore potentially mispriced. To find compelling ideas or continue to hold onto existing positions, we believe you need either an analytical or behavioural investment edge. Sometimes you need both. In normal times, when the markets are relatively tranquil, we spend most of our time trying to find idiosyncratic “needle in the haystack” opportunities in the market, primarily leveraging our analytical edge. We largely access the same information available to other institutions, but attempt to filter and think about it a differentiated way so that we can gain a variant view to the long-term intrinsic value of a security. Some of the ways we do this include a) conducting “scuttlebutt” research, especially among smaller stocks; b) seeking out firms with predictive attributes (e.g. founder-run firms tend to outperform); and c) being more patient than the average market participant.

A recent successful example of “needle in the haystack” investing has been TripAdvisor (TRIP) which we accumulated in mid-to-late 2017. In the past year, the stock has gone from unloved and misunderstood to somewhat better loved, and one of the best performing stocks in the S&P500 in 2018. We have been trimming the position on strength, but it remains a top 10 holding in a few mandates, including the Pender Value Fund. Such mispriced opportunities will always be available, even when overall markets are hitting all-time highs, like they were in 2017. (Note: TripAdvisor was an unusually quick win, no doubt making up for some other mispriced securities we also own that have been more stubborn to run up as quickly).

Stocks often make big price moves, seemingly out of tune with a company’s long-term fundamentals. When stock prices go down there is often the nagging question in the back of one’s mind, “Does someone know something I don’t?” Of course, the answer is often “Yes”. For instance, insiders will almost always know more about the prospects and nuances of their firm than any outside investor. The actions of insiders, particularly the open market purchases of stock by insiders with a good long-term track record in capital allocation, can be useful signals for potential mispricing. Occasionally, all hell breaks loose. Stock price moves associated with corrections or bear markets have little to do with “someone knowing something”, or with the fundamentals.

“The tide goes out” again in late 2018

When investors get spooked and stampede for the exits en masse, the broad opportunity set widens. But it sure doesn’t feel like an opportunity. This is the time for “the tide goes out” investing. Suddenly the “haystack” is full of “needles” in plain sight, but very few are willing to take advantage of these opportunities. These are the times when many companies that are both well followed and well understood become unloved. These are the times when the “spreadsheets, reasoning, formulas, or metrics” that backed up an investor’s conviction in tranquil times seem like a quaint mirage from a bygone era. These are the times where analytical rigor provides little comfort, but where a behavioural edge makes all the difference. This is what Buffett was referring to when he said, “Once you have ordinary intelligence, what you need is the temperament to control the urges that get other people into trouble in investing”.

In a bear market, if you want to benefit from the part ownership of a profitable enterprise over time, behave like a landlord. You don’t have sell a great asset for money you don’t need, just because you receive a string of idiotic offers. On the other hand, you should consider buying when you find sellers who are willing to accept low ball offers for great assets. This is the buy low part of the maddeningly obvious “buy low, sell high” strategy. Unfortunately, the wisdom of this strategy seems to be least obvious, or foolhardy advice, during the gloomy part of the market cycle when you need it most. Periodic corrections provide opportunities for investors to either upgrade their portfolios or put money to work in better valued long-term opportunities. As in 2016, we are once again deploying cash as a strategic asset class into securities as prices fall into our buy zones.

Indiscriminate selling during corrections often takes down both great and mediocre companies alike. This provides a good opportunity to upgrade a portfolio. When valuations converge, we are happy to sell our mediocre, but still very cheap companies, to accumulate positions in long-term wealth-creating businesses, when they are also attractively priced. For example, Compounders, as a percentage of the Pender Value Fund, are near an all-time high. In some cases, we are buying back into the very same names we sold in the past year or two, but at a big discount. This is one of our favourite sources for “new” ideas. We find recycling previous ideas can be a relatively low risk, but lucrative strategy for us over time. After all, we have already done our homework on those companies, so we know the issues and key drivers much better than some new stock that just popped up on our radar screen.

In some cases, investors don’t need to do anything to still get a potential boost from savvy market cycle transactions, thanks to the actions of the management teams of their holdings. Consider the Liberty Group of companies, which represent the investment vehicles of one of the best modern-day investors, John Malone. Over time, he has played the stock market cycle like a maestro. His companies habitually buy back their own shares when the cycle goes south and the stock gets cheap (buy low). Then they occasionally issue back some of that stock when the market gets enthusiastic again (sell high). Patient shareholders have been the big winners over time. According to a recent Barron’s article, John Malone’s Liberty Media returned 24% annually from May 2006, when it took its current form, through to November 8 2018 whereas the S&P500 had gained 8.5%, including dividends. It is hard to calculate exactly how much Liberty’s 24% annualized return is driven by the management’s capital markets activity, but it’s safe to say that it’s probably material!

Below is a chart of CNN’s Fear & Greed index over the last three years. The index is a composite of seven indicators for gauging the stock market’s emotions. At the time of writing we are at a “6”, near to the very extreme end of the fear range and one of the lowest levels historically. We have overlaid our market cycle view onto this index. From our vantage point, the tide is clearly out. Markets do not usually stay in a state of extreme fear for long, but emotional decisions during such times often sabotages the long-term plans made many investors in calmer times.

Source: CNN Fear & Greed Index and PenderFund

When extreme fear overtakes the market, no amount of reasoning, data, fancy charts or talk about the “long-term” provides much comfort or makes much of a difference. Stock prices spiral downward and pessimistic market narratives suddenly appear credible. A feedback loop often takes over, where selling begets more selling, as humans and algorithms compete to see who can hit the lower bid quicker. It is no fun to watch your portfolio tick down every week. And we emphasize that we have no idea what the market will do in the short term. To paraphrase our opening quote, market moods make fools out of those who try to predict them. However, on a stock by stock basis, we estimate the Pender Value Fund, in aggregate, is at one its cheapest relative valuation levels since inception. Similar to the experience in 2016, we believe it has the potential to rebound like a coiled spring, once the market’s mood calms down from its current state of extreme fear. This is when you need to remain disciplined, because your lifetime results as an investor will be mostly determined by what you do during turbulent times. Like the timeless adage says, “this too, shall pass.”

Please do not hesitate to contact me, should you have questions or comments you wish to share with us.

Felix Narhi

December 19, 2018

For full standard performance information, please visit: http://www.penderfund.com/funds