Small Cap Equity – Manager’s Commentary – December 2021

Fellow unit holders,

The Pender Small Cap Opportunities Fund was down 2.0%[1] in December, lagging large-cap indices such as the S&P/TSX Composite Index and the S&P 500 Index (CAD), which were up 3.1% and 3.5%, respectively. For the year 2021, the Pender Small Cap Opportunities Fund generated a positive return of 26.0%1 in line with large-cap indices, with the S&P/TSX Composite Index ending the year up 25.2% and the S&P 500 Index (CAD) being up 27.9%, and ahead of its small-cap peers, with the S&P/TSX SmallCap Index gaining 20.4% and the Russell 2000 Index gaining 14.1% during 2021. On a 10-year basis, the Pender Small Cap Opportunities Fund remains in the top one percentile in its category[2].

We have been fairly consistent in our messaging to unitholders over the second half of 2021: stock prices have diverged from the underlying intrinsic value of businesses. This has now become particularly acute in certain parts of the markets, such as small-cap, tech growth and emerging markets. For example, approximately 39% of Nasdaq stocks are down more than 50% from their 52-week highs, according to a recent Wall Street Journal report[3]. Stock prices appear to be broken and we believe this is primarily caused by the contraction of valuation multiples, but the businesses are not broken.

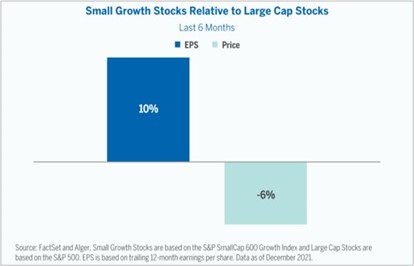

Meanwhile in the small-cap space, valuation is further disconnected from fundamentals. As shown in Chart 1, earnings per share of small growth stocks increased by 10% in the last six months, while stock prices decreased by 6%. As long-term investors, we believe this divergence creates wonderful opportunities for our funds.

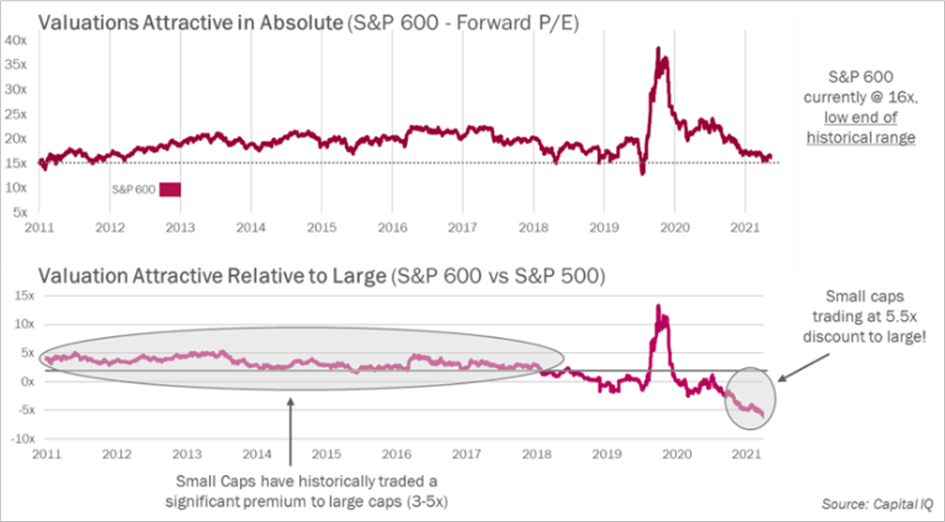

We believe small-cap valuations look attractive in both absolute and relative respects, as Chart 2 shows. The last time the valuation discount between small and large-cap stocks was this large (early 2001), the S&P SmallCap 600 Growth outperformed the S&P 500 by more than 50% during the subsequent five years.

Looking back at 2021, megacaps, cyclicals and traditional value performed well. However, the Pender Small Cap Opportunities Fund is generally underexposed to these themes. For the Fund, top contributors include crypto name BIGG Digital Assets Inc. (CNSX: BIGG), exactEarth Ltd. (now acquired by Spire Global, Inc.), and energy names like Spartan Delta Corp. (TSX: SDE) and Athabasca Oil Corp. 2022 (convertible debenture).

Aritzia Inc. (TSX: ATZ) was also among the key contributors for the year. Aritzia has accelerated sales growth despite COVID-related shutdowns and has expanded its presence in the US. Now, US sales account for almost half of total sales. We like this company’s consistent execution and clear strategy. We believe it is well-positioned to continue to compound growth in the next few years.

On the negative side, MAV Beauty Brands Inc. (TSX: MAV) was one of the key detractors. MAV had a rough year, experiencing sales decline and execution issues in launching new products. Earlier in 2021, the Board of Directors initiated a strategic review process, which concluded with the company choosing to continue pursuing organic growth opportunities. In the summer, a new management team was appointed to improve operational efficiency. We think this is a temporary setback for the company and recent insider buying has supported our view.

While stock markets have hit a rough patch since the start of 2022, we believe the Pender Small Cap Opportunities Fund is at a good place and the portfolio is set up well for the next three to five years. We believe the businesses in our portfolio remain fundamentally strong and the market price dislocation makes us feel optimistic about future portfolio returns.

David Barr, CFA and Sharon Wang

January 21, 2022

[1] All Pender performance data points are for Class F of the Fund. Other classes are available. Fees and performance may differ in those other classes.

[2] Morningstar.com