Small Cap Equity – Manager’s Commentary – March 2020

Fellow Unitholders,

Before I start, I want to acknowledge the unsettling situation we are all facing. I look around and I see people playing their part to reduce the spread of COVID-19 and that fills me with hope. But we cannot say how long the situation will last, nor begin to assess the damage to lives and livelihoods as a result. I hope that you and your families are staying healthy and safe at this time.

From an investment perspective we cannot predict what markets will do during this time. We have our experience of prior downturns to lean on, but every time is different. For us, we continue to do two key things: sticking to our investment process that we have built through the years of knowledge and experience, and maintaining the great client relationships we have with our investors. During these challenging times we know we are asking a lot of investors to stay the course in the face of negative headlines and hype, but our goal has not changed. Everyday we are working first, to protect capital and second, to focus longer term on being positioned to grow capital when the tide turns again.

Turning to March, to say it was an ugly month would be an understatement. In periods like this its important to spend more time articulating our thought and investment process. In this commentary we’ll touch on:

- The current state of small cap investing;

- How small cap stocks perform coming out of periods like this;

- Our investment process in the current environment – getting through the next six months but focussed on generating returns when we enter the recovery;

- Highlighting some key holdings that demonstrate our approach; and

- Some portfolio updates

Small cap markets

We saw major indexes sell off massively mid-month before rallying towards month end. Small and microcap indexes that are better indicators of our universe sold off even more dramatically and didn’t enjoy the same bounce. As expected, our funds did not perform well in the month. The Pender Value Fund was down 28.4% and the Pender Small Cap Opportunities Fund was down 28.8%1. Please see the table below for market returns for the month and year to date.

Index | March Performance | Year to Date Performance |

Russell 2000 ($CAD) | -17.9% | -24.8% |

Russell MicroCap ($CAD) | -19.7% | -26.3% |

S&P/TSX Small Cap Index ($CAD) | -29.3% | -38.1% |

As of March 31, 2020. Source: Bloomberg

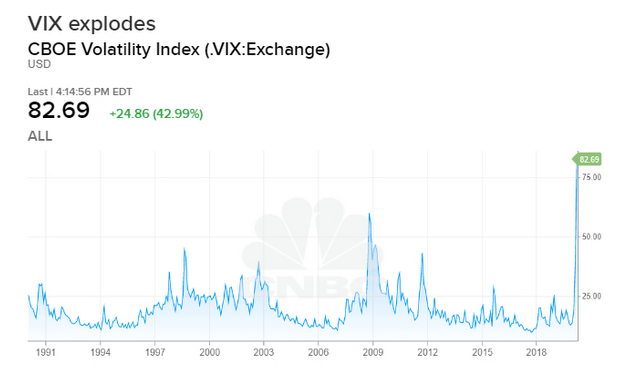

The volatility we saw in the month was gut wrenching and in fact, the volatility in the month peaked at a higher high than we saw during the financial crisis in 2008. VIX surged to 82.69 on March 16, surpassing the peak level of 80.74 back in 2008.

Source: CNBC

When markets are confronted with a high degree of uncertainty and a wide range of possible scenarios, volatility will be high as the bulls and bears battle it out day-to-day. Usually we watch this play out in equities that are battleground stocks. Today we are watching it play out across almost all markets.

Increasing our frustration level, and you’ve heard me talk about this before, is the dramatic underperformance of small cap stocks heading into this period.

Source: Optuma and Pender

This chart shows that small caps haven’t lagged large caps to this extent since 2003. Over the last couple of quarters, our general enthusiasm for the small cap universe was increasing dramatically as we saw valuations on companies that we believed would position the Fund very well for the next three to five years. Then things got cheaper. These are unprecedented times, globally and in markets. Small cap stocks were cheap going into this. The spring was coiled. Today the spring is coiled even more so, but as we know from our current experience, we believe it could coil some more.

What will tomorrow bring?

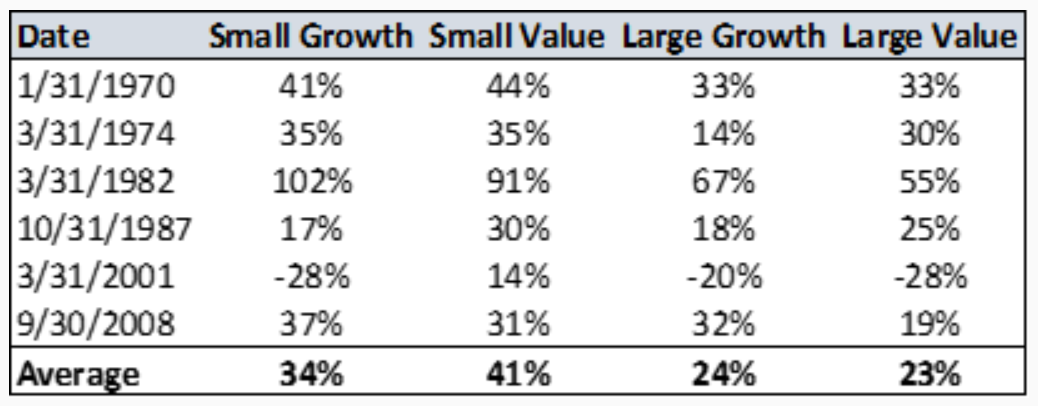

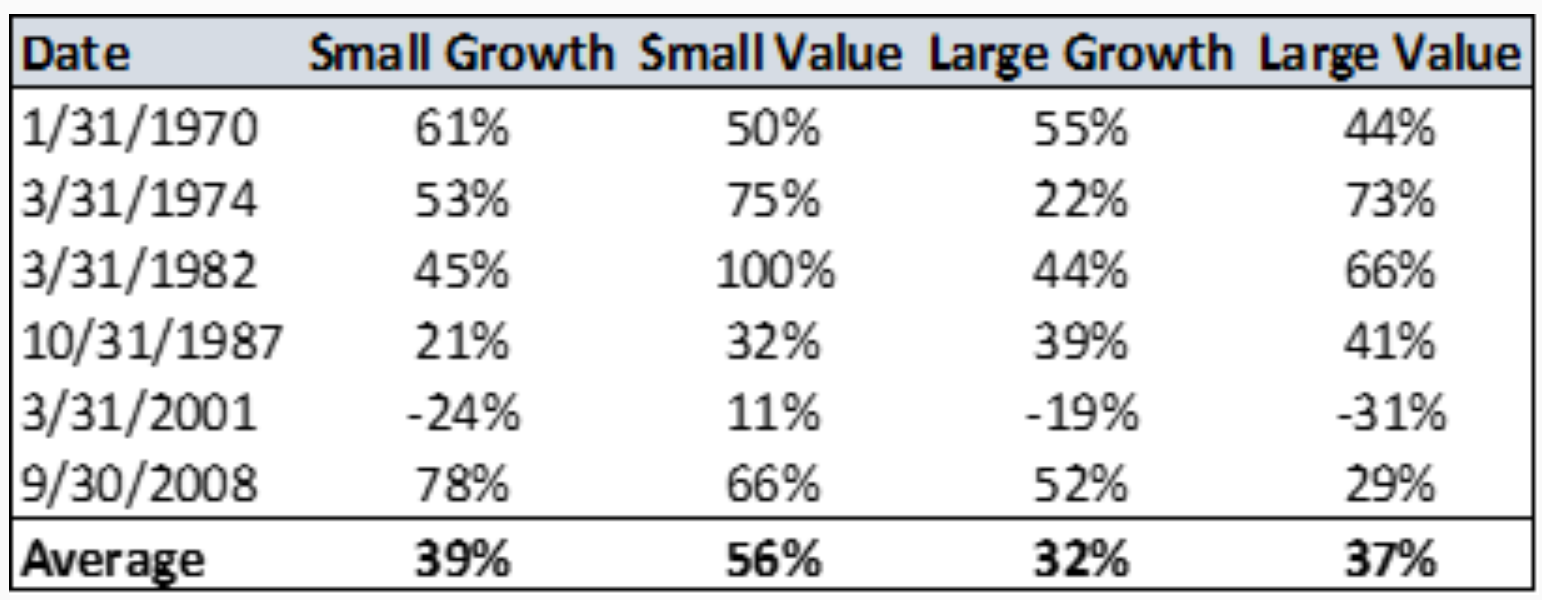

But alas, it is always darkest before the dawn. And some days it has been pretty dark. We believe that history points us to brighter days ahead, especially in small cap stocks. Below is a table showing the performance of small cap stocks compared to large cap stocks when we’ve experienced greater than 20% pullbacks in the S&P 500 historically. If history is any indication, we think in our view this is a good place to be when the tide turns.

Fig 1. 12M Returns Starting 3 Months from a 20% Drop in the S&P 500

Fig 2. 24M Returns Starting 3 Months from a 20% Drop in the S&P 500

Source: Ken French Data Library

Getting from here to there

While no two market downturns are the same, there are lessons you can learn from each one and apply at times like this. We are taking a two-pronged approach to our analysis of companies right now. Step one is to ask – will they survive six months with no revenue? This is very similar to the approach I took in my venture days coming out of the dotcom meltdown. Finding the survivors and subsequent winners turned out to be very rewarding. The second step is to assess how they are positioned coming out of this. The world will change, new trends will emerge, and our team is focused on identifying these opportunities, either in existing or new positions. How does this impact our portfolio management? We are selling companies that don’t meet the first test, reweighting the portfolio based on the second and identifying new opportunities for companies that will capitalize on trends emerging from this.

As you know, investing is a probabilistic endeavor. In the current environment, there is a broad swath of scenarios that could come out of this pandemic. When we have such a wide range of potential outcomes, volatility will be high amidst the uncertainty. But by the time certainty returns, the opportunity will be gone.

We are optimistic that we may see some “positive black swans” such as a vaccine or effective treatment emerging before the 18-month outer limit and based on the amount of capital and intellectual horsepower addressing this right now, that probability is higher than zero. However, we are not attributing any value to this possibility in our business analysis. We look at this as a free option.

When the facts change, it’s all about the businesses!

With the market gyrations and the headline news flow capturing everyone’s attention, it’s important not to lose sight of what we are doing. We are identifying businesses that we believe have the characteristics to compound our capital at an attractive rate of return over the long term. Given how much the macro environment has changed, I thought it would be useful to highlight several key holdings, some we held prior and some are new positions, that are attractive in the current business environment. Here are five portfolio holdings that we would like to highlight as examples of the kinds of businesses you own through our funds.

Sylogist

Sylogist is a company we have followed for over a decade and made a previous appearance in the Pender Small Cap Opportunities Fund about a decade ago. Sylogist designs and sells solutions that help organisations to improve their operations, processes and system controls. Its customers include government, schools and not-for-profit organizations and it is a stable, predictable business, which is key at times like this. Around the time of our first investment it was a small, highly profitable software company, growing through acquisition with an aligned management team. Back then we had concerns as we believed management was becoming less aligned with shareholders (ESG alert!). We sold our position but we continued to monitor the business. Recent events have helped to alleviate our concerns about management’s alignment and the recent downturn has provided us with an attractive entry point. Today the company has $40 million of cash in the bank, revenue of $37 million, has EBITDA margins greater than 40% and trades at 8 times EBITDA. In addition, the company has announced a strategic review and, if sold, we could win short term. Alternatively, the company may deploy capital and buy troubled software companies. Another potential win win.

Macro Industries

Here’s another name from the past. One area we have been looking at more intently is infrastructure. We believe North American governments will ramp up the economy and jobs coming out of this downturn through large scale infrastructure projects. Macro is a pipeline and facility construction and maintenance company. Having previously invested and continued to follow Macro, today it trades at .5X book value, or at effectively the value of the cash in the bank. We have other investments in our funds that are trading below cash value and we are confident in their long-term prospects. The last time we saw as many opportunities of this nature was in the 2009-2010 time frame. In this case you are getting the infrastructure business for free. They have two major contracts that remain on schedule, and a recurring book of maintenance business that was very stable through other downturns.

EBIX

We talk a lot about founder-led companies and this is such a company. Technically speaking, Robin Raina is not the founder of EBIX but he has been the CEO for over 20 years and practically built EBIX to where it is today. He is taking his salary in shares of the company. Now that’s alignment! EBIX is a data interchange platform for the insurance industry. A fairly predictable sector in this environment. The other aspect of their business is in foreign exchange in India. While that will be subject to a slowdown, we don’t believe it will be to the level that the market has priced in. The company has historically grown at greater than 10% revenue both organically and through disciplined acquisitions. This is another historical holding of ours. We originally bought the stock when the company was in the midst of a short attack (before they were popular north of the border). The stock got down to the $6 range at that time and recovered to over $80 per share. We took part in a lot of the ride but not all. Its stock chart today is indicative of a lot of the companies in our universe. It is down around 80% from the peak in the past 12 months and down around 65% YTD. On its journey to these lower levels we revisited our thesis and now it’s a full position size in the Pender Value Fund. The company has over $100 million of cash in the bank. Today it trades with a market cap of $375 million on revenue of $580 million and EBITDA of $170 million.

Sangoma

Sangoma is a company we spoke about in the fall of 2019 as we made it a major holding in our funds. The company builds unified communications systems and software for businesses. Heading into this period, the company had grown profitably at double digits for multiple years. We have a lot of confidence in the managements team and their ability to operate. As everyone is adjusting to remote working, it’s easy to see this trend gaining more momentum. While it has been prevalent in the technology industry for years, other industries after now being forced into working from home and are likely to more readily adapt to it. Sangoma is positioned very well to continue to capitalize on this trend. Again, here’s a business that has seen its share price cut in half in the past weeks.

Winpak

The final company is Winpak, a vertically integrated producer of specialty packaging materials and machines primarily for perishable foods, beverages and healthcare customers in North America. Winpak focuses on niche segments of the perishable goods packaging industry where the company’s focus on innovation drives sustainably higher margins and returns as they can charge their customers higher prices which are more than offset by lower spoilage costs. Winpak was originally founded as a subsidiary of the Finnish based Wihuri Group and, after going public, still remains majority owned and controlled by the founding family. This unique relationship allows Winpak to leverage the considerably larger R&D spending of their sister company as though it was a subsidiary, but to the benefit of Winpak shareholders as the innovations from that R&D drive higher returns. As you can imagine, food and pharmaceutical packaging is an essential business in these challenging times and all of Winpak’s production facilities remain fully operational. The company has ample free cash flow generation, a net-cash balance sheet of more than 20% of its market cap in cash and a long-term oriented, disciplined approach to capital allocation. Winpak should remain a resilient business and is well positioned to accretively deploy cash into selective acquisitions to drive future returns.

Portfolio Updates

This is usually the part of the discussion where we talk about what worked and what didn’t work in the month. The reality is, almost everything went down, so our largest positions were our largest detractors. On the trading side, we sold or trimmed companies with substantial business risk or balance sheet risk. An example would be JetBlue which we bought based on a similar thesis to our successful Air Transat purchase in 2019. With airlines running near full capacity and the Boeing Max8 grounding, airplane fleets were more attractive. That opportunity has done an abrupt about turn during the health crisis and so we’ve moved on. On the buy side, we focused on companies that had been on our watchlist and that had lower business and balance sheet risk but were positioned well to come out of this downturn. Macro, mentioned above, was one of these companies. Along this theme, Fluor Corporation which is one of the largest engineering and construction firms by revenue was also added to some of our equity funds.

Our cash weightings increased by approximately 7% for both funds with the Pender Value Fund ending the month with 9.6% cash and the Pender Small Cap Opportunities Fund ending the month with 15.9% cash. In a situation like this, when there could be a lot of different scenarios at play, we believe keeping some powder dry for more negative scenarios and waiting to deploy at better price points is prudent. That said, if things improve from here, given how deep the discount is to intrinsic value in the portfolios, we believe having a bit of cash drag in a positive scenario still positions us for a promising result.

While it is generally easier to say and harder to do in periods of high uncertainty and large drawdowns, it is our strong conviction that owning businesses that will do well emerging from this period of time and staying invested is critical to achieving strong, long-term results. We are fortunate to have other long-term investors invested in the funds alongside us. Thank you.

David Barr, CFA

April 7, 2020