Small Cap Equity – March 2023

HIGHLIGHTS

Small-cap stocks have historically traded at a premium to large caps given their higher growth potential. However, we are now in a market when small caps trade at a significant discount to large caps.

We are continuing to rotate our portfolio into higher quality companies where we see the best risk/reward profiles such as Sylogist Ltd. (TSX:SYZ) and CopperLeaf Technologies Ltd. (TSX:CPLF).

Magnet Forensics Inc. (TSX:MAGT) was acquired by Thomas Bravo, a private equity firm specializing in software investments. While we rarely buy a company expecting it to be acquired, it is a by-product of our investment process and our public market approach to private equity.

The M&A market continues to percolate as small-cap share prices continue to languish, there is a growing acceptance of the current valuation by sellers in the market. This will facilitate an increase in M&A as both strategic and private equity investors look for opportunities.

—

Fellow Unitholders,

The Pender Small Cap Opportunities Fund returned 2.9% in the first quarter of 20231. The year began in a similar fashion to where we left off in 2022, with uncertainty continuing to dominate the markets. The small-cap market certainly was not immune to the macro-driven vacillations. Small-cap stocks started the year by rebounding from depressed valuations created by the aggressive tax loss selling we saw to end 2022. Once the buying subsided, macro factors took over and March was a negative month for both small-cap indices and the Fund.

The dramatic fall of Silicon Valley Bank in March not only shook the technology ecosystem, but also reverberated into other financial institutions. Quick government intervention calmed the storm before contagion was able to spread. Markets always react immediately to events such as these, and the interesting debate is whether or not they tend to overreact. Our team has been looking for the second and third-order effects that could potentially change the fortunes of our portfolio companies.

With macro concerns leading the charge in the quarter, everyone’s favourite safe haven trade is back on: US mega-cap stocks. In fact, the trade is so popular that it is propping up what would otherwise be an anemic year for large caps. To illustrate this point, the top eight companies in the S&P500 have contributed over 80% of the year-to-date returns!

“Unloved and out-of-favour stocks create wonderful opportunities… we are now in a market when small caps trade at a significant discount to large caps.”

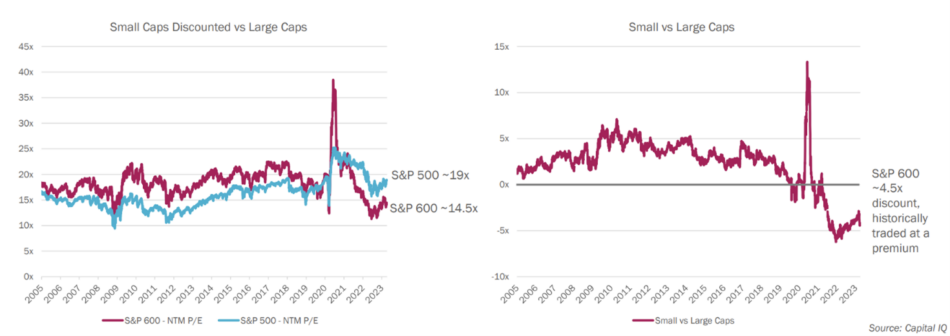

We are now back on the theme we have been riding for more than five years, a divergence in valuations between small–cap and large cap stocks. Small–cap stocks have historically traded at a premium to large caps given their higher growth potential. However, we are now in a market when small caps trade at a significant discount to large caps. Comparing the S&P 600 and the S&P 500 in the US, small caps are trading at 14.5x next twelve months earnings (NTM P/E), while large caps are trading at approximately 19x. This translates into a discount of approximately 4.5x. The following charts show how the premium has gone away recently and where the discount is today[2].

Unloved and out of favour stocks create wonderful opportunities, and with the overlay of economic uncertainty, we are continuing to rotate our portfolio into higher quality companies where we see the best risk/reward profiles. In macro-driven markets like this, business fundamentals don’t count. When we look through our portfolio, we continue to see very positive business developments. Examples from our top holdings include Sylogist Ltd. (TSX:SYZ) which has increased its organic growth rate after a couple of years of reinvestment , while CopperLeaf Technologies Ltd. (TSX:CPLF) announced in its most recently reported quarter that recurring revenue increased and its cash burn decreased, signalling a potential inflection to profitability. With business fundamentals like these, we continue to be very constructive on the portfolio positioning.

We officially said goodbye to Magnet Forensics Inc. (TSX:MAGT). The company, a developer of digital investigation solutions, was acquired by Thomas Bravo, a private equity firm specializing in software investments. While we rarely buy a company expecting it to be acquired, it is a by-product of our investment process and our public market approach to private equity. Given Magnet’s private equity ownership, I am sure we will have the ability to own this company again sometime in the future.

And finally, the M&A market continues to percolate. As small-cap share prices continue to languish, there is a growing acceptance of the current valuation by sellers in the market. This will facilitate an increase in M&A as both strategic and private equity investors continue to look for opportunities to deploy their cash in hand. In some cases, we will be more than happy to oblige!

David Barr, CFA and Sharon Wang

April 19, 2023

[1] Class F of the Fund. Other classes are available. Fees and performance may differ in those other classes.

[2] Source Capital IQ.