Small/Mid Cap Dividend – Q2 2022

Fellow Unitholders,

It has been a volatile first half of the year that has seen significant drawdowns in equity markets as valuations have reset in anticipation of weaker economic growth in the coming quarters. Investors have focused on the macro headwinds of rising interest rates as policymakers are focused on curbing demand to slow inflation.

Small-cap companies were weak in this environment during the first half of the year with the TSX Small Cap Index down 13.9%, with the index down 20.8% during the second quarter. The Canadian small cap index has benefited from its higher weighting in Energy and Materials, which was a rare bright spot in 2022 until June. The Pender Small/Mid Cap Dividend Fund was down 12.2% in the second quarter and is down 11.9% so far this year.[1]

Inflation has risen steadily this year, driven higher by strong consumption, supply chain bottlenecks and energy prices. With this uncertainty at the macro level, we have remained focused on our research process and identifying fundamentally strong, cash-flowing businesses. While these market episodes can be challenging to endure, it does create a significant breadth of opportunity for investors able to keep a long-term perspective and look past the murky macro environment. We have been adding to what we view as those high-quality small-cap companies that can withstand a downturn in their industry and come out stronger.

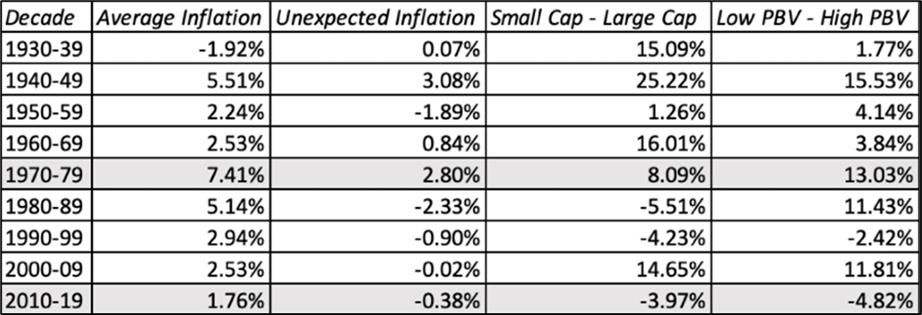

In a recent analysis of small-cap company performance going back to the Great Depression, small caps were shown to outperform large caps by a healthy margin in periods where inflation was unexpectedly high. The chart below shows the performance of small-cap companies in periods of inflation. The period of small-cap outperformance includes the environment of the 1960s and 1970s, when small-cap outperformance was over 16% in the decade of the 60s and over 8% in the 70s.

Small Cap Performance in Inflationary Environments:[2]

There are advantages to being small. Smaller companies are nimbler and have cost structures that can adapt more quickly when the environment changes. They also have management teams that are closer to their customers and can act decisively to incorporate changes into their strategic planning and growth plans. Companies with pricing power can pass cost increases onto their customers to keep their margins intact. While we aren’t yet at 1970s-level rates of inflation, it’s an interesting history lesson that highlights small companies and their ability to adapt quickly when inflation surprises.

At the end of June, over 80% of the portfolio was exposed to small and mid-sized companies, with the portfolio holding 11.4% in cash. The top 3 sectors of Industrials, Energy and Diversified Financials made up nearly 50% of the Fund, with broad diversification across 10 sector groups. The sector position is an outcome of our investment process, which is focused on bottom-up company research. Our process becomes even more critical in periods of stress, and in recent months, our portfolio activity was focused on adding what we believe are high-quality companies with strong unit economics, a long growth runway, competitive advantages and a history of solid execution.

In this challenging market, Hardwoods Distribution Inc. (TSX: HDI) and Dream Unlimited Corp. (TSX: DRM) were detractors from performance in the second quarter. While their stock prices have softened, the underlying fundamentals of the businesses have remained.

Hardwoods Distribution reported Q1 results in May, highlighted by 39% organic growth and 122% revenue growth when acquisitions are included. The company expects demand for its building products will maintain through 2022. While the company is facing supply bottlenecks and expects tight conditions will remain, Hardwoods Distribution is the largest customer for many of its suppliers, which gives it an advantage as its shipments should be prioritized and disruptions kept low.

While Dream Unlimited has come under recent pressure, we view the company’s underlying fundamentals as showing a different story. The company posted positive results in its last quarter and continued to remain active in pursuing its goal to create shareholder value. The company launched and completed an initial public offering of Dream Residential REIT and created a +$1bn industrial development fund focused on the Greater Toronto Area. The company also announced that recurring fees were up over the last year due to higher assets under management and fee-earning assets increased $0.9bn since the end of 2021 to sit at about $10bn.

On the positive side, Spartan Delta Corp. (TSX: SDE) has been a strong contributor in the second quarter. The company has benefited from high oil prices and is firing on all cylinders. This was demonstrated by its Q1 results that highlighted significant free cash flow and production levels above expectations. The ample free cash flow is allowing the company to quickly de-lever its balance sheet and should allow it to hit its 0.5x leverage target by the end of the second quarter. With strong cash flow in this robust operating environment, we believe capital allocation will be the company’s key focus going forward. We continue to see the company as attractively valued relative to peers but have been reducing our holdings as our position has grown within the portfolio.

We have continued to focus on what we view as high-quality businesses that are generating cash flow within the Fund. We believe these attributes position the Fund well to withstand a challenging market environment across a range of operating scenarios. Dividends are an important feature in the companies we own in the portfolio, with the current yield of the portfolio around 2.3% at the end of June.

While investing in periods of uncertainty can be challenging, small caps as a group look very attractive and have a well-documented history of outperforming after coming out of bear markets. We are optimistic about the opportunities we are finding today in this environment and believe this sets the Fund up well for the future. These opportunities don’t present themselves often and we are busy working through our research process to identify those companies that have the brightest prospects for years to come.

Thank you for your support.

David Barr, CFA

July 20, 2022

[1] All Pender performance data points are for Class F of the Fund. Other classes are available. Fees and performance may differ in those other classes.

[2] https://aswathdamodaran.blogspot.com/2022/05/a-follow-up-on-inflation-disparate.html