Small/Mid Cap Dividend – Manager’s Commentary – February 2022

Dear unitholders,

As investors continue to assess the financial risks related to the conflict between Russia and Ukraine, stock markets ended February on a mixed note. In Canada, the S&P/TSX Composite Index was up 0.3% in February, while the S&P/TSX Small Cap Index was up 5.8%, both supported by resource exposure. In the US, the S&P 500 Index (CAD) was down 3.3% but its small-cap peer, the Russell 2000 Index (CAD) was up 0.8%. The Pender Small/Mid Dividend Fund was up 1.2%1 in the month. We do not have any direct holdings in Russia or Ukraine and thus no direct impact to the portfolio.

Risk-off sentiment prevailed in stock markets, even before Russia invaded Ukraine. On a year-to-date basis, Canadian indices were mixed with the S&P/TSX down 0.1% and the S&P/TSX Small Cap up 4.7%. This is in stark contrast to major US indices with the S&P 500 Index (CAD) down 7.8% and the Russell 2000 Index (CAD) down 8.5%. The Fund was slightly lower, generating a YTD return of -0.8%1.

| Index | February | Year to Date |

|---|---|---|

| In our opinion, the key driver for the current drawdown is growth being repriced by the market. Headline news on inflation and rising interest rates translate into higher discount rates and a lower value of future cashflows. | ||

| S&P/TSX Composite Index | 0.3% | -0.1% |

| S&P/TSX Small Cap Index | 5.8% | 4.7% |

| S&P 500 Index (CAD) | -3.3% | -7.8% |

| Russell 2000 Index (CAD) | 0.8% | -8.5% |

| Pender Small/Mid Cap Dividend Fund[1] | 1.2% | -0.8% |

A year ago, investors paid a big premium for high growth rates. Spending in sales and marketing, and research and development for high paybacks was rewarded. Today, investors are not pleased by growth. We believe the market tends to overshoot in both directions: growth was probably overpriced a year ago but now markets have overreacted in some areas, creating opportunities in fundamentally attractive businesses. When this happens, repricing in the small/mid-cap space can be more dramatic.

Along this rotation theme, our higher growth holdings in the technology sector were the top detractors to the portfolio in February. Dye & Durham Limited (TSX: DND), Sylogist Ltd. (TSX: SYZ) and Enghouse System Limited (TSX: ENGH) ended lower during the month. We believe there is good opportunity for investors in these types of businesses today.

Enghouse remains one of the largest holdings in the Fund. Enghouse develops enterprise software solutions and has seen its growth profile slow after a pull forward in demand due to COVID. The company has been lapping this elevated growth period and should see a re-acceleration in growth over the next few quarters. In addition to organic growth, the company is seeing better opportunities to deploy capital via M&A. They paused their acquisition activities in late 2020 as they saw elevated valuation in the technology space. The recent pullback has improved their pipeline and they are seeing more opportunities that meet their criteria. We see the shares as attractive given this combination of accelerating organic growth and increased opportunities to deploy capital into M&A.

On the positive side, Spartan Delta Corp. (TSX: SDE) and Altius Renewable Royalties Corp. (TSX: ARR) were top contributors during the month. Both benefited from renewed interest in the energy sector as oil and gas prices rose in response to Russia’s invasion of Ukraine. Altius Renewable Royalties Corp. saw its stock price hit fresh record highs in February when its first mover advantage in the renewable royalty industry started paying off. As a result, the company is on more radars as an alternative to dilutive equity or limited debt capacity. The current inflationary environment is also a positive for Altius’ royalty model and we see the shares as attractively valued.

In these times of uncertainty, we reiterate our view that the setup for small-cap companies remains attractive on a three to-five-year outlook. In our view, there are several factors in place creating tailwinds.

First, small-cap stocks are significantly undervalued on a relative and absolute basis. Small-cap companies are trading at a large discount to large caps (see previous commentary), which is a disconnect from historical data that suggests small-cap companies should trade at a premium to large caps. Mean reversion and multiple rerating could lead to a powerful bounce back of small-cap names, in our view. Secondly, we own fundamentally strong businesses that we believe will compound value at a healthy clip for many years. With intrinsic value increasing, stock prices should eventually catch up. Finally, the M&A environment remains strong with no signs of slowing down. When a company is good quality and trading at a discount, we believe someone will take notice and buy the business sooner or later.

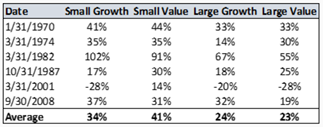

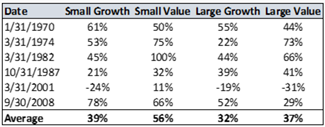

Back in March 2020 when markets sold off massively due to the COVID breakout, we wrote in our Pender Small Cap Opportunities commentary that small-cap stocks historically lead coming out of periods like this and we showed the data below: the performance of small-cap stocks compared to large-cap stocks when we have experienced greater than 20% pullbacks in the S&P 500 historically.

Fig 1. 12M Returns Starting 3 Months from a 20% Drop in the S&P 500

Fig 2. 24M Returns Starting 3 Months from a 20% Drop in the S&P 500

Source: Ken French Data Library

We don’t know how many brave souls listened to us and invested in small-cap at that time, but by December 2020, we definitely heard many investors expressing regret. The current environment is full of uncertainty with a wide range of potential outcomes. Investors may feel it emotionally difficult to make decisions. But by the time certainty returns, the opportunity may be gone. We are convinced that now is a compelling time to get exposure to small-cap stocks or to stay invested to achieve promising long-term returns.

Thank you for your support.

Dave Barr, CFA

March 17, 2022

[1] All Pender performance data points are for Class F of the Fund. Other classes are available. Fees and performance may differ in those other classes.