Small/Mid Cap Dividend – Q4 2023

Highlights

- Top contributors to the Fund were Computer Modeling Group Ltd. (TSX: CMG), a technology company in the oil and gas industry and Aecon Group Inc. (TSX: ARE), which provides construction and infrastructure development services to private and public sector clients globally.

- Detractors included Canacol Energy Ltd. (TSX: CNE), Colombia’s largest independent natural gas producer, and several energy holdings impacted by the decline in oil price.

- The Fund added three new positions: Ag Growth International Inc. (TSX: AFN), Aritzia Inc. (TSX: ATZ), and Jamieson Wellness Inc. (TSX: JWEL).

The fourth quarter was marked by the reversal of several trends witnessed in the third quarter. The price of oil dropped 16% to end the year at $71.7 per barrel (WTI), giving up most of the gains from the third quarter and closing at levels similar to the end of June ($70 per barrel). The US 10-year yield dropped 67bps in the fourth quarter to end the year at 3.88%, giving up the increase in rates seen in the third quarter and well below the peak of almost 5.0% seen during October.

Reflecting easing in inflationary pressures, the Federal Reserve’s latest dot plot, updated in December 2023, projects three rate cuts in 2024. Similarly, notes from the Bank of Canada’s governing council meeting in early December indicate interest rates are “sufficiently restrictive” to get inflation under control.

Q4 2023

The Pender Small Mid Cap Dividend Fund ended the quarter ended December 2023 with total returns of 3.0%[1], lagging the S&P TSX SmallCap Index total return of 6.1%.

Top Contributors / Detractors

The top contributor during the quarter was Computer Modeling Group Ltd. (TSX: CMG), a technology company in the oil and gas industry engaged in the development and licensing of reservoir simulation software. They reported strong results for the September quarter, continuing a trend of improving top line growth over the last several quarters driven by healthier end markets and growing exposure to the energy transition theme.

Another significant contributor for the quarter was Aecon Group Inc. (TSX: ARE), a recent addition to the portfolio. Aecon provides construction and infrastructure development services to private and public sector clients globally. They announced a strategic investment by Oaktree Capital Management into a subsidiary, Aecon Utilities Group, valuing the utilities business which is just 19% of Aecon’s construction segment revenue at $750 million (vs. Aecon Group’s enterprise value of $781 million). We see further upside in the stock as Aecon completes construction on four legacy projects that have impacted financials due to cost overruns. One of the four projects reached mechanical completion in September 2023, two more are expected to be completed in 2024 and the last one in 2025.

Amongst top detractors during the quarter was Canacol Energy Ltd. (TSX: CNE), Colombia’s largest independent natural gas producer. In October, Canacol disclosed the termination of a long term take or pay gas sales contract that was scheduled to commence deliveries on December 1, 2024. This project was long awaited and would have significantly increased contracted sales volume for the company. Management is planning to use the resulting capex savings to pay down debt and accelerate investments into Bolivia. We have reduced our position in the stock as we evaluate prospects for the business.

“We believe small/mid cap stocks are well positioned in 2024. They stand to benefit from declining interest rates and better availability of credit.”

Other energy names in the portfolio also were detractors to performance in the quarter, impacted by the decline in oil price.

Portfolio Changes

We added three new names to the portfolio during the quarter.

- Ag Growth International Inc. (TSX: AFN) provides equipment and solutions required to support the efficient storage, transport, and processing of food globally, serving as the connection between the farm and the plate. Demand for its products is driven by, on the one hand, growing crop volumes and production and on the other hand, urgency to reduce grain spoilage (developing regions store only 10-15% of annual crop yield vs 60-70% in US and Canada).

- Jamieson Wellness Inc. (TSX: JWEL) is a growing global health and wellness company with a leadership position in the Canadian vitamin, mineral and supplement (VMS) marketplace. Its growth is being driven by an aging population and younger new consumers, an increasing focus on self-care and preventative health, and rising disposable incomes in emerging markets. It is expanding in China, the world’s fastest growing VMS market, and a recent acquisition in the US has given it the opportunity to grow in the world’s largest VMS market, 20x the Canadian market size.

- Aritzia (TSX: ATZ) is a multi-channel retailer with an innovative global platform offering everyday luxury in aspirational environments with engaging service. Its track record of profitable, organic growth and free cash flow generation underpin its strong financial foundation. Capitalizing on the availability of premium real estate, it is growing its boutique network across North America with a focus on the US.

FY 2023

The Pender Small Mid Cap Dividend Fund (PSMDF) ended the year 2023 with total returns of 5.0%, underperforming the S&P TSX SmallCap Index total return of 5.8%.

The year 2023 saw market leadership from mega caps as news flow around artificial intelligence took Wall Street by storm. The rally in the so called “Magnificent Seven” (Apple, Alphabet, Microsoft, Amazon, Meta Platforms, Tesla and Nvidia) was nothing less than spectacular, with the group advancing 111% in 2023 vs a 24% return for the broader S&P 500. With their combined market cap exceeding US$10 trillion, they now make up 28% of the index. This rally more than made up for losses in 2022 when the group finished down 40%, losing $4.7 trillion in combined market value, whereas the remaining stocks in the S&P 500 dropped 12%.

Performance of the small caps lagged in comparison to the rally in large cap stocks during 2023. In Canada, the S&P TSX SmallCap Index was up 5.8% vs the 11.8% price return for the S&P TSX Composite Index, and in the US, S&P 600 Index was up 15.9% vs the 26.3% price return for the S&P 500 Index. As a result of this divergence in large vs small cap performance that has persisted over the last several years, a very attractive relative valuation opportunity has opened up with the S&P 600 trading at a 4.3x discount to the S&P 500 whereas historically small caps have traded at a premium.

During the year, we added 17 new holdings to the portfolio, an unusually high portfolio turnover rate. In terms of major sector changes, we reduced exposure to energy and utilities while increasing exposure to the consumer, financial, and material sectors. We are benchmark agnostic and have positioned the portfolio to benefit from what we believe are the best long-term opportunities to compound value.

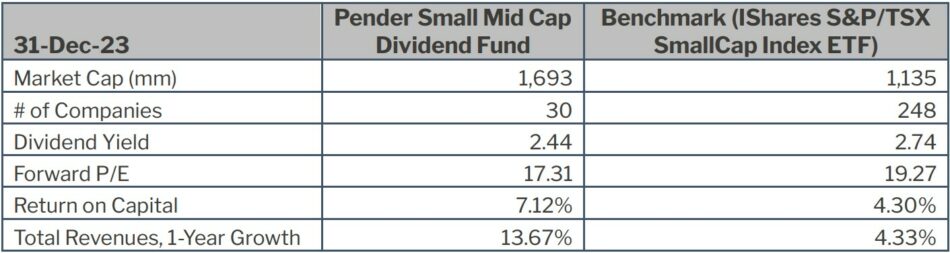

As a result of these changes, when we compare the fund to the passive investment option (iShares S&P/TSX SmallCap Index ETF, Ticker: XCS), we feel confident we are investing in quality companies with strong growth prospects at better valuations than the broad Canadian small cap market (XCS). This should be a recipe for outperformance over the long term.

Source: Pender, Capital IQ, as of December 31, 2023.

Outlook

We believe small/mid cap stocks are well positioned in 2024 as they stand to benefit from declining interest rates and better availability of credit as they are relatively highly levered when compared to their larger peers.

Also, as mentioned earlier, the valuation set up for small caps is highly attractive and the last time they were this beaten down, it proved to be the starting point for a great revival in small-cap stocks. In the aftermath of the dot-com bubble bursting, the S&P TSX Composite Index gained just 6% in the six years after peaking while the S&P TSX SmallCap Index rose by 40%.

Aman Budhwar, CFA

January 12, 2024

[1] All Pender performance data points are for Class F of the Fund. Other classes are available. Fees and performance may differ in those other classes.