Global Focused Fund – Manager’s Commentary – Q2 2021

Fellow unitholders,

“The man who is in need of a new thinking tool, but hasn’t yet acquired it, is already paying for it.” – Charlie Munger

In this commentary we cover:

- New Fund name, similar idiosyncratic strategy

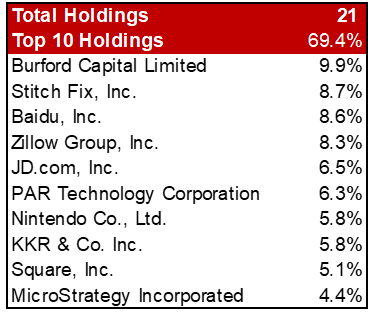

- Portfolio update: Burford Capital Limited (BUR), Stitch Fix, Inc. (SFIX), MicroStrategy Inc. (MSTR), Zillow Group, Inc. (ZG)

- New additions: Alibaba Group Holding Ltd (BABA), Discovery Communications Inc. (DISCK)

The Pender Global Focused Fund (PGFF or the Fund) was up 3.4%[1] for the quarter. On a year-to-date (YTD) basis, PGFF was up 15.8%[1]. The long-term performance of PGFF remains solid with 5-year annualized returns of 19.7%[1]. The primary objective for the Fund is to achieve capital growth over the long-term. More specifically, our goal for this mandate is to grow our capital at a healthy, double-digit pace over an extended period.

While stock price fluctuations come and go, what really matters to us is the underlying fundamentals of our portfolio companies. This is ultimately the most knowable and discernable evidence of intrinsic value creation. We believe it is also what drives stocks higher over time.

New name, similar idiosyncratic strategy

In late June, unitholders approved a Fund name change from the Pender US All Cap Equity Fund to Pender Global Focused Fund (PGFF). The name change was made to better reflect the global-centric nature of the holdings. Although most of the securities are listed in the US, the holdings are not necessarily US-centric and few were S&P500 members, which was a common misconception under the previous name.

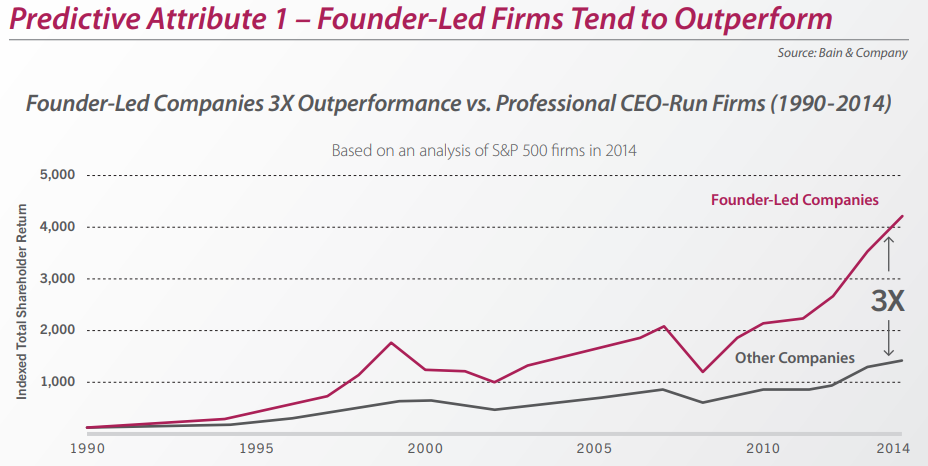

Although the Fund owns and has historically owned many large-cap American stocks, very few holdings have been sourced from the S&P500[2]. In part, this is because we believe the opportunity set is potentially more compelling in smaller-sized companies. In addition, we own several companies that are domiciled outside the US, which makes them ineligible for inclusion. But less frequently communicated is our preference to own many of the fastest-growing founder-led American companies, many of which have started to be systemically excluded from the S&P500. We are going to be covering this topic in more detail soon.

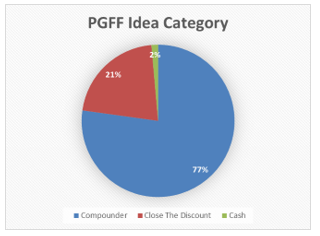

We categorize most of the portfolio as core compounder holdings (77.2%), or companies that are growing their business value at a mid-teens annualized pace, or better. Although we typically build our initial core positions during a periodic hiccup (market-related or company-specific), compounders are seldom available at classically cheap valuations. Nevertheless, they account for most of the market’s long-term returns. In our view, this implies there were some significant qualitative drivers that investors missed which led to persistent mispricing during most of their wealth-building journey. In other words, one could say such stocks were “cheap” from a qualitative perspective even though they were not statistically “cheap”[3].

We aim to own most of our promising core compounders for an extended period, as long as the growth runway remains long, the unit economics remain compelling, management continues to execute on their mission, and valuations do not reach extreme levels. This is a relatively rare combination[4]. We will occasionally trade around core positions for risk management purposes which can be value additive, but for the most part, we will be patient, with a “buy low and let grow” philosophy.

Portfolio Updates

On the positive side, we saw notable performance contributions from Burford Capital Limited (BUR) and Stitch Fix, Inc. (SFIX).

Burford (9.9% weight in the Fund) is a pioneer and the market leader in global litigation finance. Burford’s track record has been exemplary with IRRs in the range of 30% since inception. These high returns are also uncorrelated to financial markets because litigation is inherently idiosyncratic. Courts make their decisions and cases can be settled irrespective of what happens in the broader economy. Uncorrelated high returns are seen as financial nirvana for many investors, which has helped attract capital to a very lucrative and growing asset management business.

Recent financial results have been strong and Burford has been a beneficiary of the rotation trade during the quarter. Most courts were not doing in-person jury trials during the pandemic and the backlog of cases being tried now will help the monetization efforts of delayed claims. Investors are also anticipating a surge in business over the next few years due to the pandemic, which we believe will continue to produce disputes with an anticipated multi-year tailwind of legal proceedings which will require funding by litigation financiers.

During the quarter, there were also a few positive developments in the company’s long-running financing of a case against Argentina’s 2012 nationalization of its state-run oil producer (YPF SA). We view this largely as optionality as it is not priced into the stock. We view Burford as a compounder that is temporarily trading like a depressed close-the-discount idea. The Fund has held a core Burford position since February 2020.

Stitch Fix (8.7% weight in the Fund) is an innovative online apparel retailer with attractive unit economics supported by durable competitive advantages. The company combines data science and proprietary data with human judgment to deliver hyper-personalization at scale, transcending traditional brick-and-mortar and most undifferentiated e-commerce retail experiences. As online shopping continues to take share from the “high street/shopping mall”, Stitch Fix should continue to outpace the market through increasing share of wallet, acquiring new clients, and expanding its addressable market.

Stitch Fix shares increased significantly during the quarter, after third-quarter sales topped estimates and it raised its full-year outlook. The company is in the early stages of a business model transition which, if executed to plan, will significantly increase its addressable market and improve the economics of the business.

Stitch Fix is another good example of adding value through trading during wild price swings. We initially picked up our core position at ~$17 in May 2020. Since then, we have generally been accumulating while trading around our core position. We have almost doubled our initial position and lowered our average cost after considering lifetime trading activity with the holding. However, the trading is only a small part of the value add. For the stocks that drive markets higher, the main driver of compounding wealth is not in the buying and selling, but in the holding.

Notable second quarter detractors from our performance came from our investments in MicroStrategy Inc. (MSTR) and Zillow Group, Inc. (ZG).

Zillow (8.3% weight in the Fund) had a torrid run following the pandemic market bottom as investors piled into hot growth stocks. More recently, Zillow is going through a sizable drawdown as investors shifted their attention away from tech growth and rotated into cyclicals. However, the company’s potential in the nascent iBuyer industry, its profitable and growing legacy ad business, and newly launched product which bundles multiple home transaction services, all make Zillow a high-conviction investment.

MicroStrategy (4.4% weight in the Fund), an analytics and business intelligence company, currently derives most of its market value from Bitcoin holdings that it accumulated over the past year. As a result, MicroStrategy’s stock moves in sympathy with the price of Bitcoin, which can be very volatile, because it is still an emerging frontier asset. But we are happy to report that the value added through opportunistic trading around our core position has been a net positive for the Fund. We believe some exposure to Bitcoin through MicroStrategy makes sense as a portfolio diversifier and potential inflation hedge, and because we believe the eventual payoff could still be sizable.

“It’s not whether you’re right or wrong, but how much money you make when you’re right and how much you lose when you’re wrong.” – George Soros

Changes to the portfolio

During the quarter, we added Alibaba Group Holding Ltd (BABA) and Discovery Communications, Inc. (DISCK). We also received shares in Vimeo, Inc. (VMEO) following its spinoff from IAC/InterActiveCorp (IAC). We also sold SharpSpring, Inc. (SHSP) during the quarter after Constant Contact, backed by Clearlake Capital Group, L.P. and Siris Capital, announced it would acquire the company, which provided us with a quick win over a relatively short holding period.

Alibaba (3.2% weight in the Fund) is a growing economic powerhouse. It operates the world’s largest ecommerce platform with more than twice the reach of Amazon when measured by gross merchandise value (GMV). It owns the most consumer data in China, a highly scaled logistics platform, a massive third-party ad network, and is China’s #1 cloud provider. It has a highly entrenched user base with spending increasing every year. Its vast ecosystem is supported by one of China’s largest digital payment platforms, Alipay. BABA holds a 30% equity stake in Ant Group, a financial services company which owns Alipay and other leading consumer and small business lending, insurance, and asset management businesses. In many respects, we believe BABA is akin to an economic toll booth for a growing share of Chinese economic activity.

However, recent headlines of increased regulatory scrutiny have hit investor sentiment in China in a big way. We can think of few sectors that are as out of favour and unloved as Chinese tech right now. The gloomy headlines have pushed BABA’s valuation to near all-time lows, which we believe provides an ample margin-of-safety to our estimated fair value ranges.

“High quality assets can be risky, and low quality assets can be safe. It’s just a matter of the price paid for them.” – Howard Marks

It is important to acknowledge that there is risk today, but there was also potential risk when this stock was hitting all-time highs not too long ago. Investor perception of business risk has increased, but valuation risk has decreased. One could make the case that with many Chinese stocks being 30-60% off recent highs, investors are more than adequately compensated for this perceived change in business risk. Alibaba is already making the necessary changes to align with new policies and should continue compounding intrinsic value for a long time, in our view.

Discovery (4.0% weight in the Fund) is a global leader in real life entertainment, serving a passionate audience of superfans around the world. In May 2021, the company announced a transformational merger with WarnerMedia (part of AT&T). Once completed in mid- 2022 the combined company will have the second-best brands in media (behind Disney) and will hold a top-three position with the massive scale necessary to compete on a global basis. We find the industrial logic of this investment grade, synergistic combination under the leadership of David Zaslav very appealing. This is not our first bite at the Discovery apple. It is a recycled idea which we profitably traded in the past. Based on recent prices, we believe the combined company could provide us a low-teens annualized potential return, even if Warner Bros Discover stops growing and nothing happens after the merger. But that is not the plan. The company has articulated a thoughtful strategy to cut costs and expand their strong IP into new streaming marketplaces which we believe could deliver substantial upside to patient investors over the next three years. Looking to 2025 and beyond, we expect the company will become a clear leader in the global streaming marketplace.

Please do not hesitate to contact us, should you have questions or comments you wish to share with us.

Felix Narhi, CFA

August 31, 2021

[1] All Pender performance data points are for Class F of the Fund. Other classes are available. Fees and performance may differ in those other classes.

[2] Only one current portfolio holding, Discovery Communications Inc. (DISCK), is a member of the S&P500.

[3] We believe statistically cheap stocks that are also not qualitatively cheap are frequently “value traps”.

[4] Recently there have been a lot of stocks that have gone up multifold, but we believe in many cases their underlying businesses are unlikely to justify those stock runs over the long run and that many will ultimately round trip if the businesses themselves are not creating per share intrinsic value at a decent pace.