Value Fund – Manager’s Commentary – November 2021

Fellow unit holders,

The Pender Value Fund was down 5.2%[1] in November, while the S&P/TSX Composite Index dropped 1.6% and the S&P/TSX Small Cap Index dropped 3.6%. In the US, major indices also lost ground in the month, with the S&P 500 Index (USD) down 0.7% and the Russell 2000 Index (USD) down 4.2%. In terms of Canadian dollars, the S&P 500 Index (CAD) gained 2.5% and the Russell 2000 Index remained in negative territory with a 1.1% loss.

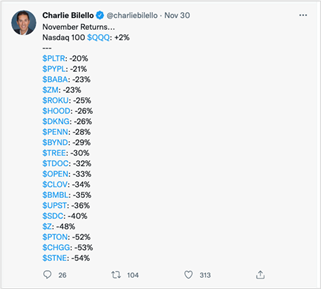

While index performance was weak in November, individual stocks suffered significant losses. Take a look at this incredible chart published by Charlie Bilello on his Twitter account as proof.

We own a few of the names that made this list and several others that dragged down the Fund performance in November. The top four detractors in the Fund, Zillow Group, Inc. (NASDAQ: ZG), Peloton Interactive, Inc. (NASDAQ: PTON), Sangoma Technologies Corporation (TSX: STC), and Stitch Fix, Inc. (NASDAQ: SFIX), each contributed about 1% or more to the losses in the Fund during the month. While experiencing some volatility, they remain core holdings and we continue to like them for the long term. We believe over the next three to five years, they will continue to ride the tailwinds of digitization, addressing large markets that will provide a significant growth runway.

In early November, Zillow announced a surprise decision to shut down Zillow Offers and shift its focus back to its core IMT business, which is highly profitable and growing. While this caused a pullback in share prices, we believe that strategically this makes sense, as it allows Zillow to continue to focus on leveraging its dominant traffic to reduce friction in the home buying and selling process, but with a more asset-light and scalable approach to monetization. We expect the core IMT business to compound at a very attractive pace. On December 2, Zillow announced better-than-expected progress winding down Zillow Offers and started a massive repurchase plan. Share prices have rebounded since and we believe Zillow remains a compelling investment opportunity.

Peloton was another detractor during the month. The company significantly reduced its annual outlook for FY22 when it released earnings on November 4 as management underestimated the impact of reopening. This negatively impacted the shares but did not change our thesis on Peloton. From a long-term perspective, home connected fitness offers a superior customer experience compared to existing solutions (gyms and traditional exercise equipment). We believe Peloton is one of the winners in this industry, given that they are incredibly customer-centric, as evidenced by their consistently high NPS score. The customer value proposition is excellent and keeps getting better with more fitness offerings. Peloton is led by an impressive founding team, has a large total addressable market, strong unit economics (long customer lifetime value and minimal customer acquisition costs covered by hardware margins) and is still in the early innings. We believe the recent price pullback presents an attractive buying opportunity and we have subsequently increased our weight in Peloton.

Sangoma was also negatively impacted in the month following its withdrawal from its US IPO after management found that pricing was not attractive. Not surprisingly, share prices declined on the announcement. Despite the seemingly undesirable optics of the withdrawal from a US listing, we believe Sangoma remains fundamentally strong. For the most recent quarter (ended September 30, 2021), Sangoma reported record revenue, over 70% of it being recurring revenue and a 72% gross margin. Integration with Star2Star is on track in terms of products and channels, and we believe the company is in a position to accelerate organic growth. Now that the company has been on the radar screen of US investors, there is the potential for a valuation multiple rerating which would put it more in line with US peers.

It is interesting to observe a tale of two markets during the tax loss season. On one hand, investors are shy of selling their winners because no one want to incur more capital gains. On the other hand, investors are aggressively harvesting capital losses to offset capital gains. As we mentioned above, some of our names have been impacted by this phenomenon. We do not like to see our stocks under pressure, but we remain confident that these are fundamentally great businesses with long runways and capable management teams. We hold strong in our belief that sooner or later the gap between share price and intrinsic value will close. All we need is patience.

With the holiday season quickly approaching, we would like to extend warm wishes to our clients and hope you enjoy a safe, healthy and happy holiday season.

David Barr, CFA

December 14, 2021

[1] All Pender performance data points are for Class F of the Fund. Other classes are available. Fees and performance may differ in those other classes.