The advantages of an all-weather investment strategy

Looks can be deceiving. On a recent holiday, to a place where the sun was blazing, the sky was pure azure, and the sea shone like polished glass, I found the perfect spot to take a sea kayak for a spin. But within 20 minutes the winds picked up and the sea began to churn. I paddled like mad back to shore and to safety. Investors know this feeling all too well when a strategy that works well in one environment becomes hazardous when the winds change. Hence, owning investments that are agnostic to the macro environment can be beneficial over the long term. Stressed and distressed debt investing is one of these ‘all-weather’ investment strategies.

Why distressed debt investing is all-weather?

In every economic cycle, there will be companies that are facing some type of credit stress. The reasons are manifold. The company may have made an acquisition—or several–that did not go as smoothly as expected. Perhaps the company took on too much debt to fund acquisitions, R&D, business expansion, or simply for share buybacks. They may have lost a lawsuit and raised debt to settle it. It could also be that management’s expectations for revenues and profits missed the mark making loans harder to service and raising the probability of a default. Or as was the case during the era of ultra-low interest rates, the company simply borrowed heavily at rock-bottom rates and now the loans have come due and must be rolled over at much higher rates. Any one of these scenarios could create credit stress.

This is why the opportunity set in stressed and distressed credit is generally consistent and is not cycle dependent. Although there are periods, and we are in one today, when the opportunity set is potentially larger than it has been during the past 15 years.

Currently, we are in a sea change period where the interest rate regime from 2008-2021 has given way to a less benign credit environment of tighter liquidity and less avidity among lenders.

The impact of this regime change in the interest rate backdrop has been wide ranging. Led by the US Federal Reserve, central banks around the world transitioned from quantitative easing to quantitative tightening in 2022. In response to the COVID-19 pandemic, the Fed’s balance sheet exploded, growing from about $4.2T in assets in the first quarter of 2020 and peaked at nearly $9T in assets in April 2022. This tidal wave of capital that supported the US and Global financial system through pandemic shock began to unwind in 2022, moving from a tailwind to a headwind.

This rising cost of capital has unseated the relatively calm environment in credit markets. It’s been a wake-up call and has led to a buildup in stresses across credit markets as borrowers will have to face this new market reality. Distressed exchanges—when a company is unable to meet its financial obligations and renegotiates the terms of its debt—rose 6x in 2022 to $21.4 billion. This is the highest level of distressed debt exchanges since 2009. Companies look to restructure their debt through this process as an alternative to an outright default and entering bankruptcy.

As Howard Marks, co-founder of Oaktree Capital, a leader in distressed credit, said in a recent podcast, “Easy money sets the stage for bad outcomes.” And a bad outcome is where a distressed credit investment strategy takes centre stage because, if you think opportunistically, it’s possible to take advantage of the situation to earn an interesting return.

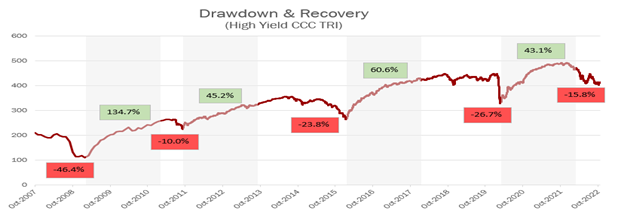

Over longer time periods, the stressed and distressed segments of the market have historically offered attractive returns to investors. These segments of high yield bonds performed as you would expect–the wider spread credits outperformed over a cycle and provided investors a return enhancement element to an overall portfolio mix. (B- and CCC-rated bonds are used as a proxy for stressed and distressed issuers.) If we focus on CCC rated bonds, the returns have varied through different periods in the credit cycle. The chart below shows this phenomenon in more detail – the peak to trough drawdown in CCC high yield credits, as well as the subsequent recovery over the ensuing two years off the lows.

In the two years following the troughs in CCC high yield credits, this segment of the high yield market has delivered an outsized return of over 70% to investors. This is where investors have the opportunity to deploy capital in credit investments that offer an attractive risk to reward return potential.

Source: Bloomberg

One of the key advantages a credit investor has over an equity investor is capital priority. In the event of a default, there is still value available to investors at the higher tiers of the capital structure. Most investors pay attention to the equity portion of a company’s capital structure— let’s call it the top of the iceberg. What they neglect to recognize is the potentially significant value embedded in the bottom of the iceberg, which for a good company in a distressed situation represents a good margin of safety.

For investors with a longer-term horizon, including a distressed credit strategy into the investment portfolio can add meaningful diversification and potentially generate attractive risk-adjusted returns through all economic and market cycles.

A Better Way in Fixed Income

There is no longer an “easy button” in fixed income whereby investors can earn relatively high real returns from invested instruments guaranteed by the government. While most investors still construct their portfolio with a mix […]