Alternative Absolute Return – April 2024

Highlights

- The Fund added to some higher quality, high yield positions in April.

- Following a market rebound, we raised cash in the later part of the month.

- We closed our short position in Charter Communication’s unsecured bonds, and our capital structure trade in CSC Holdings LLC, a subsidiary of Altice USA.

The Pender Alternative Absolute Return Fund finished April with a return of 1.6% bringing year to date return to 4.1%[1].

April saw an uptick in volatility as economic data continued to push back market expectations for rate cuts from the US Federal Reserve, with just one rate cut now priced in for 2024 down from over six at the start of the year. While risk assets sold off at the start of the month, the buy-the-dip impulse was strong with high yield spreads close to unchanged on the month at 318bp Government OAS on the ICE/BofA US High Yield Index. The market return of -1% was the first negative month since October and entirely driven by higher government bond yields.

Portfolio and Market Update

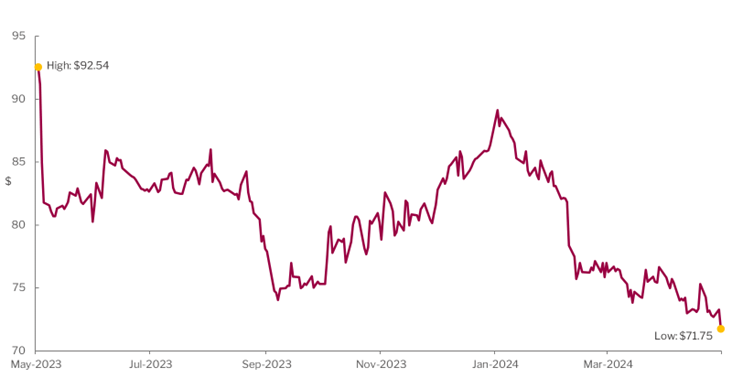

The Fund added to some higher quality high yield positions in April as interest rate volatility impacted some issues more than others, creating pockets of opportunities. Following a market rebound we raised cash in the later part of the month. Risk premiums remain compressed especially for BB rated bonds. As recently as April 29, the ICE BofA BB US High Yield Index closed at a spread of 184bp Govt OAS, which is lower than any point over the sixteen year period from 2008 through 2023, and only 3bp above the 2024 low reached in March. This illustrates a very strong risk taking impulse in a segment of the market that is perceived to be safe.

ICE BofA BB US High Yield Index – Gov’t OAS bp

Source: Bloomberg/ICE BofA

For much of the past six months, the Fund has been able to add loans at significantly wider spreads than what was available in equivalent bond issues. In our view, one of the reasons why loans were attractive was because the market was convinced that rate cuts were imminent and therefore preferred fixed coupon issues and duration rather than floating rate instruments like loans. The tone appears to have shifted, with market participants now embracing “higher for longer” resulting in a material compression of spreads for broadly syndicated loans.

“We believe that the market is not focusing on risk to the extent that it should. We continue to maintain a defensive posture and believe it is likely that spreads will widen materially from current levels at some point in 2024.”

In recent months, we accumulated a position in Cedar Fair LP’s 5.5% 2025 bond which we believed would likely be refinanced with a loan which could look attractive relative to opportunities in the bond market. We were wrong. Cedar Fair’s new term loan priced at a spread of 200bp over the Secured Overnight Financing Rate (SOFR) which was almost the exact same spread that Six Flags Entertainment Corp priced a secured bond offering in April. Cedar Fair and Six Flags are expecting to complete their merger in the coming months, meaning these two issues are effectively the same underlying credit risk. At the same spread and at a price of par we’d pick a high yield bond over a loan unless we believed higher policy rates were imminent, because loans can typically be called away after 6 months at a price of par which caps upside. Falling government bond yields often coincide with wider credit spreads, which is the worst of both worlds for loans, whereas corporate bonds benefit from falling underlying yields to partially offset wider credit spreads.

We believe that the market is not focusing on risk to the extent that it should. A great example of this is a bond issued by Ingles Markets Inc. which operates grocery stores highly competitive markets in the southeastern United States. Their business has been under some significant pressure lately. According to their most recent report for the quarter ending December 2023, operating income was down 38% year over year driven by lower sales, lower gross margins and higher administrative expenses[2]. The company’s Class A shares closed April at a 52-week low. Despite fundamental headwinds and equity market performance the company’s bond trades at very close to the tightest spread over the past year, suggesting that bondholders are effectively asleep at the wheel as risks are building.

Ingles Markets Inc 4% 2031 Unsecured Bond Spread, bp

Source: Bloomberg

Ingles Markets Inc – Class A

Source: Bloomberg

The Fund closed our short position in Charter Communication’s unsecured bonds in April. While we believe that US cable business will be more challenging going forward than it has been in the recent past, the bonds had repriced to yields close to where the market bottomed in October. We believe that the company’s commitment to investment grade ratings at the secured level of their capital structure will effectively force them to reduce leverage in future which should offset a weakened competitive position going forward.

The Fund closed our capital structure trade in CSC Holdings LLC which is a subsidiary of Altice USA. While our position had mostly been market neutral and stood to benefit from a rapid deterioration of business fundamentals, with rumors of a bondholder group forming we believed that it was prudent to exit. There have been several recent instances of “non-pro rata up-tiering” in large, stressed capital structures where a select group of bondholders improved their standing in the capital structure at the expense of bondholders who were not in the group. While we believed it would be difficult for a priming transaction to occur in this case, we thought it was appropriate to remove the tail risk.

We continue to maintain a defensive posture in the Fund and believe it is likely that spreads will widen materially from current levels at some point in 2024. While we wait for a better opportunity set, we are focused on adding value through trading and uncovering attractive carry trades in the interim.

Portfolio metrics:

The Fund finished April with long positions (excluding cash) of 147.9%. 64.4% of these positions are in our Current Income strategy, 79.7% in Relative Value and 3.8% in Event Driven positions. The Fund had a -48.0% short exposure that included -5.5% in government bonds, -28.4% in credit and -14.1% in equities. The Option Adjusted Duration was 1.34 years.

Excluding positions that trade at spreads of more than 500bp and positions that trade to call or maturity dates that are 2026 and earlier, Option Adjusted Duration declined to 1.10 years.

The fund’s current yield was 4.5% while yield to maturity was 6.5%.

Justin Jacobsen, CFA

May 2, 2024

[1] All Pender performance data points are for Class F of the Fund. Other classes are available. Fees and performance may differ in those other classes. Standard Performance Information for Pender’s Alternative Absolute Return Fund may be found here: https://www.penderfund.com/pender-alternative-absolute-return-fund/

[2] Source: Ingles Markets Inc. company filing, 10-Q quarterly report.