Alternative Absolute Return – February 2024

Highlights

- Cash and T-bill holdings have been reduced by about 20% of net asset value to improve portfolio yield.

- Additions to loan holdings, with current yields from mid-7% to mid-8%, include high quality businesses like Hilton Worldwide Holdings Inc. (NYSE: HLT) and Transdigm Group Inc. (NYSE: TDG).

The Pender Alternative Absolute Return Fund finished February with a return of 0.3% bringing the year-to-date return to 1.8%[1]. The Fund’s benchmark, the HFRI Credit Index (USD), returned 1.2% in February and 1.9% year-to-date.

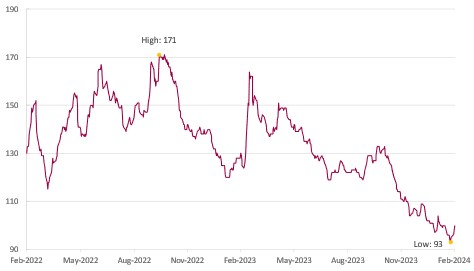

Credit spreads continued to perform in February, with both investment grade and high yield breaking new ground and establishing lower lows late in the month, both markets reached the lowest spread levels since early 2022. The total return for fixed income was constrained by higher government bond yields impacted by both supply and sticky “super core” inflation reports in the US. The ICE BofA US High Yield Index returned 0.3% in the month, bringing year to date returns to 0.3%. HY spreads were 30bp tighter on the month to finish at 329bp Option Adjusted Spread, less than 30bp away from the lowest spreads of the past 16 years.

“We believe it is more appropriate to focus on income and capital preservation than capital gains in the current market environment.”

Portfolio and Market Update

The Fund started the year with a defensive posture and a low net exposure. Over the past two months, we have looked for vehicles to improve portfolio yield without taking on much market exposure, the result is that our cash and T-bill holdings have been reduced by about 20% of our net asset value. The Fund added several short duration positions where we expect early calls as issuers look to term out 2025 and 2026 maturities in the current robust capital market environment. We also added to our loan holdings where we can earn current yields from mid-7% to mid-8% for high quality businesses like Hilton Worldwide Holdings Inc. (NYSE: HLT) and Transdigm Group Inc. (NYSE: TDG).

Hilton is now the Fund’s largest net exposure. We sold the last of our Hilton bond holdings while adding to Hilton’s B-4 term loan in February. The Hilton B4 loan resets monthly at a yield of the Secured Overnight Financing Rate (SOFR) plus a spread of 210bp. This loan has a BBB (investment grade) rating, we believe the closest comparable bond is Marriott International Inc (NASDAQ: MAR)’s 2030 maturity which trades at a spread of about 100bp over the US treasury curve. We believe it is more appropriate to focus on income and capital preservation than capital gains in the current market environment. If history is any guide there is negative asymmetry to where spreads can go from here.

ICE BofA US High Yield Index – Gov’t OAS bp

Source: Bloomberg/ICE BofA

ICE BofA US Corporate Index (IG) – Gov’t OAS bp

Source: Bloomberg/ICE BofA

Just because spreads are tight does not mean that they cannot continue to move tighter. Higher nominal bond yields than much of the past decade argues that it is possible that the market could hit lower spread levels than late 2021 which was the lowest level of the past 16 years.

You do not have to look far to see that speculation is alive and well today. Both Bitcoin and various other crypto assets have had a phenomenal run to start 2024, with Bitcoin hitting a new all time high in early March. Chipmakers with any exposure to Artificial Intelligence are another favored vehicle for speculation, with price movements vastly exceeding any upside surprises to revenue or earnings. Eventually prices will be dictated by fundamentals but it might be a while before that is the case.

In Late February, I attended the JP Morgan Global High Yield Conference. This annual event featured a keynote address from Jamie Dimon who shared his opinion on a variety of market and economic developments. He views economic pessimism as unfounded, as JP Morgan’s internal metrics all point to a booming US economy that is unlikely to be disrupted in the next six months. Despite strong current economic conditions, he believes that spreads are likely to widen from here, as they have behaved like an accordion over his career and are historically tight. Commercial real estate should be worth 30% less than it was based on the 3% move higher in long term interest rates. He expects to see a wide divergence between different banks’ experiences within the sector. JP Morgan’s exposure is in high quality muti-family which should be well positioned relative to peers, but they could still get hurt on it. He compared bank commercial real estate underwriting to private debt, where “everyone’s a genius” for now. Nevertheless, in the years ahead, it will likely become clear that some investors were more careful in their underwriting than others.

Further to that last point, we noticed some public Business Development Corps (“BDCs”), which are effectively private debt funds, have seen a spike in non-performing loans recently. For Example, FS KKR Capital Corp (NYSE: FSK) reported that their non-accrual (default) rate increased to 8.9% of investments at cost in Q4 2023, up from 4.8% at cost in the previous quarter. That seems like a big spike for one quarter to us. It remains to be seen if these developments are a blip or a trend, but leveraged businesses financed by private debt funds are likely to be the front edge of any economic weakness created by higher interest rates. Our main takeaway from the JPM conference was that our fellow investors seemed a lot more optimistic and risk seeking than the companies we invest in, some of which commented that they believed that consumers are tapped out.

Portfolio metrics

The Fund finished February with long positions (excluding cash) of 160.7%. 73.6% of these positions are in our Current Income strategy, 85.9% in Relative Value and 1.2% in Event Driven positions. The Fund had a -63.1% short exposure that included -7.2% in government bonds, -40.1% in credit and -15.8% in equities. The Option Adjusted Duration was 0.87 years.

Excluding positions that trade at spreads of more than 500bp and positions that trade to call or maturity dates that are 2025 and earlier, Option Adjusted Duration declined to 0.47 years. The duration figure include an Event Driven position where we believe duration does not accurately reflect the option value embedded in the security.

The fund’s current yield was 4.1% while yield to maturity was 6.7%.

Justin Jacobsen, CFA

March 12, 2024

[1] All Pender performance data points are for Class F of the Fund. Other classes are available. Fees and performance may differ in those other classes. Standard Performance Information for Pender’s Alternative Absolute Return Fund may be found here: https://www.penderfund.com/pender-alternative-absolute-return-fund/