Pender Strategic Growth and Income Fund – Q3 2023

“It’s not whether you’re right or wrong that’s important, but how much money you make when you’re right and how much you lose when you’re wrong.” – George Soros

Highlights

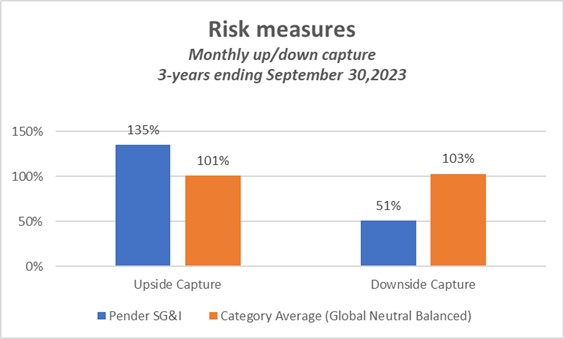

- The Fund recorded positive performance in a down quarter, extending our record of favourable up/downside capture.

- The Fund leveraged Pender’s specialized strategies for better balance in an uncertain world.

Dear fellow unitholders,

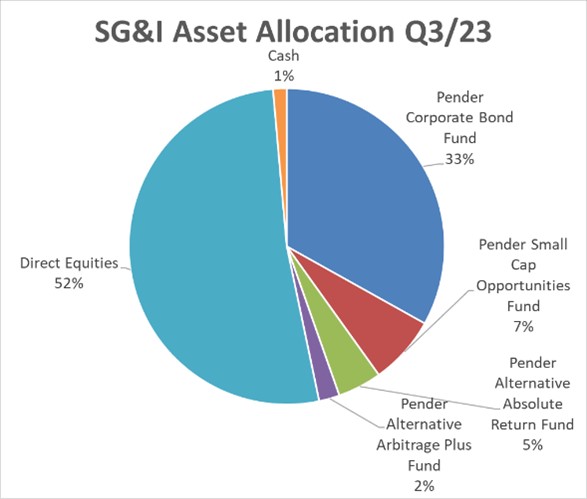

The Pender Strategic Growth & Income Fund (PSGIF) returned 0.3% in the third quarter of 2023, bringing year-to-date returns to 5.3% to the end of September[1]. Market sentiment was challenging in the quarter, with equities broadly lower over the period. It was another tough quarter for bond investors as yields surged and prices – which move inversely to yields – dropped. The positioning of Fund enabled it to generate a modest positive return despite the broad-based market drawdown during the third quarter. The Fund will not repeat such a favourable relative performance in every month or quarter. But we believe the Fund’s differentiated approach will continue to deliver good performance by leveraging Pender’s specialized strategies which focus on less efficient asset classes.

Source: Penderfund and Morningstar, September 30, 2023

PSGIF unitholders have benefited from a solid track-record over the last three years where it has excelled in both up and down markets. When the market surged, PSGIF has soared even higher, boasting a robust 135% upside capture ratio, compared to the category ratio of 101%. This means that for every 1% increase in the index, PSGIF has increased by 1.35%. But that is not all – when the market faced a decline, PSGIF remained more resilient. With a 51% downside capture ratio, far surpassing the category average of 103%, PSGIF has been able to limit losses to about half the decline of the index.

Death of 60/40? Not all equity and fixed income exposure is created equal

Investors often prefer ’balanced funds’ due to their simplicity and comprehensive nature, offering a one-stop solution for their investment needs. These funds appeal to unitholders seeking respectable returns while desiring a low-risk, worry-free investment that doesn’t require constant adjustments between different asset classes. The conventional wisdom dictated a 60%/ 40% mix of equity/fixed income, aiming to strike a balance between potential growth and downside protection – a ‘set it and forget it’ strategy that proved effective for a considerable period. However, we contend that the traditional 60/40 approach might be less balanced than widely believed. The asset mix of PSGIF’s 60/40 looks appreciably different than most balanced mandates. We believe this non-traditional positioning which leverages Pender’s specialized expertise will continue to outperform the benchmark by safeguarding your hard-earned money when markets falter and ensuring substantial gains during periods of growth.

High Yield Corporate Bonds & Alternatives as a Fixed Income Diversifiers

The fixed income allocation of a traditional balance fund is heavily tilted towards government and investment grade corporate bonds. Safe and easy returns seemed almost assured from such positioning until early 2022 when interest rates started to climb. This has left investors exposed to massive losses due to duration risk. There is an alternative. We believe investors should embrace more opportunistic credit risk within the high yield corporate bond market because it has generated favorable performance across various market cycles. Over the long term, high yield corporate bonds have outperformed almost every other major fixed income asset class.

“We believe that our defensive-oriented strategies that are built for resilience will continue help buffer the downside while still being well-positioned to capture upside when market conditions normalized and animal spirits return.”

Since 1980, the high yield market has seen negative returns in only seven calendar years. Remarkably, there have been no consecutive years of negative returns in this asset class over the span of 40 years. Following periods of negative returns, the high yield market typically rebounds with either significant gains or several years of modest returns. This resilience in returns can be attributed to the principles of “bond math.” Although the high yield market may experience periods of weakness, leading to lower bond prices, it continues to yield high coupons. Eventually, as bonds approach maturity, they are pulled back to their face value, strengthening the recovery of returns.

Over the last decade, high yield bonds have had the second-highest risk-adjusted returns, trailing only below investment-grade bank loans. Investors have been fairly compensated for the additional performance risk when moving to below investment-grade credits. Importantly, although credit spreads are not unusually wide, today’s high yields on an absolute basis have rarely been observed over the last ten years, which we believe provides a favourable set up for investors.

Our fixed income investments are mostly reflected by our position in the Pender Corporate Bond Fund (PCBF), which contributed positively to performance in the quarter, despite challenges in the overall bond market. The overall approach is balanced across the fixed income opportunity set where it takes a counter-cyclical approach to duration and credit risk. In practice, this has generated favourable downside capture ratios for PCBF relative to its category and contributed to its long-term record. The PCBF ended the quarter with an average yield-to-maturity of approximately 8.5%, significantly higher than the start of last year, with a current yield of 5.5% and an average duration of maturity-based instruments of 3.4 years. For more details on the PCBF, see the September portfolio update here.

Liquid alternative mandates also provide good diversifiers to traditional fixed income. Such strategies are designed to provide stable, consistent returns with a low-risk profile. Importantly, there is low correlation to traditional fixed income with the ability to protect against rising interest rates and spread widening.

We added two of Pender’s liquid alternative strategies to the Fund in early 2022 in part to provide additional downside protection which turned out to be fortuitous timing. Both delivered positive returns in a market environment where most asset classes closed deep in the red. These alternative strategies are designed to be more market neutral through paired shorting and event-driven strategies, like merger arbitrage, to dampen volatility while still providing decent long-term returns. Once again, both Funds delivered on their promise by generating positive returns in a challenging third quarter.

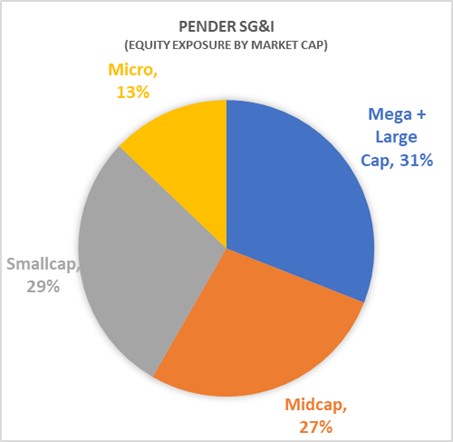

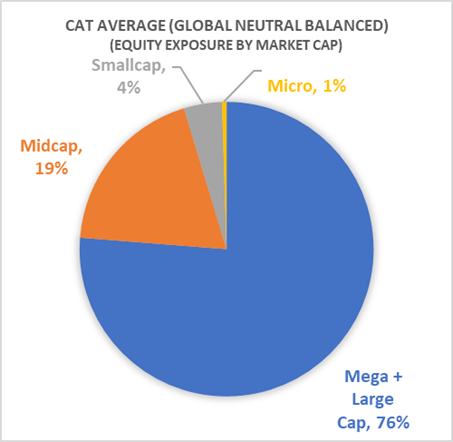

Higher exposure to small and midcap equities to improve potential upside capture

In the realm of balanced investment portfolios, a notable imbalance prevails: a significant exposure to large cap companies characterizes the typical equity component, leaving minimal room for the potentially higher long-term returns offered by smaller enterprises, as evidenced by empirical studies. For investors aiming to enhance their chances of capturing market upswings, a shift towards allocating more resources to these smaller, promising entities is advisable. This recommendation gains more urgency today given the near historical valuation disparities between large corporations and their small-to-mid-sized counterparts.

Got market cap (un)balance?

Source: Morningstar, September 30, 2023. Data is based on the long position of the equity holdings only.

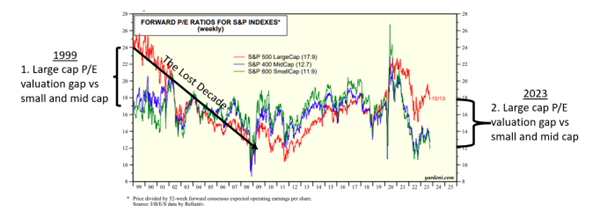

Comparing the current market landscape to the turn of the millennium, it’s hard not to worry about a potentially ominous parallel. On the eve of the stock market bubble bust, large caps were the market darlings and were trading at relatively high valuations. The subsequent decade became a “lost decade” for investors as this valuation imbalance corrected itself. The forward P/E valuation gap between large and small caps today is at eerily similar levels. While history does not guarantee future outcomes, one enduring truth is the cyclical nature of markets and the reliability of mean-reversion. Recognizing this, we advocate for a more balanced approach across market capitalizations, a strategy that remains sensible even in the face of uncertainties.

This time is different: Is today’s premium S&P500 valuation gap warranted?

Source: Yardini.com, Pender

We believe valuation mean-reversion will eventually provide a long overdue tailwind for small cap equities. But the third quarter was not a “risk-on” market environment favouring small caps. Our small and microcap equity exposure through the Pender Small Cap Opportunities Fund (PSCOF) was a slight detractor from performance during the quarter. The narrative is a familiar one: small caps lagged their large cap counterparts this year in a market that has been driven by only a handful of mega-cap technology companies.

The top seven contributors to the S&P 500 delivered nearly 85% of the total returns so far this year, with the share price appreciation pushing valuations in these companies to elevated levels. Although we recognize it has been a challenging period for smaller companies outside this group, we believe that their attractive relative valuations plus potentially improving company fundamentals will provide a favourable set up in future periods. For more details on the PSCOF, see the September update here.

Within our direct equity holdings, we had strong positive contributions from ARC Resources Ltd. (TSX: ARX) and Texas Pacific Land Trust (NYSE: TPL). This outperformance was supported by gains in the Energy sector, with energy related companies taking their cue from oil prices that surged 29% during the quarter to close above $90 per barrel at the end of September. We trimmed some of our energy holdings into this cyclical strength during the quarter. These rising crude prices also contributed to a recalibration of inflation expectations and comments from US Federal Reserve officials indicating higher for longer interest rates in the of declining, but still elevated inflation rates. We also saw a positive contribution from Burford Capital Ltd. (NYSE: BUR) which continued to benefit from the re-rating momentum of the litigation funder’s stock.

Our top detractors in the quarter included Trisura Group Ltd. (TSX: TSU) and Microchip Technology Inc. (Nasdaq: MCHP). Trisura reported earnings near the top end of their guided range and came in 7% ahead of consensus. Recent market concerns around the quality of letters of credit provided by a particular reinsurance provider in the US did not impact financials in the quarter as no provisions needed to be made for the recoverability of those assets. We believe the weakness in Trisura’s stock is out of step with its strong fundamentals.

Despite posting a record quarter on most metrics, Microchip’s management said it expects a challenging near‐term demand environment due to weakness in China, a slowdown in Europe and early signs of weakness in the automotive sector. They are also accommodating some push‐out requests from customers which will result in some weakness in the coming months. We consider Microchip one of the best managed semiconductor companies in the industry with its proven ability to generate robust free cash flow through the recurring inventory correction cycles. Coupled with its undemanding valuation, we remain bullish on the stock at recent price levels.

Outlook

We are finding opportunities across each asset class and remain diversified in our overall positioning. With the peak in inflation nearing or behind us and central banks slowing and, in some cases, pausing, their interest rate raising campaigns, the focus has turned to expected future economic growth and the lag effect of tighter financial monetary conditions brought about by higher interest rates. We think this will remain in focus with concern from investors that tighter financial conditions will impact spending habits and that a recession is on the horizon. We will continue to monitor these macro events and assess their impacts on our positioning to help ensure the businesses we own have the durability and balance sheet strength to withstand a challenging economic environment. We believe that our defensive-oriented strategies that are built for resilience will continue help buffer the downside while still being well-positioned to capture upside when market conditions normalized and animal spirits return.

Felix Narhi, CFA & Geoff Castle

October 27, 2023

[1] All Pender performance data points are for Class F of the Fund. Other classes are available. Fees and performance may differ in those other classes. Standard Performance Information for the Pender Strategic Growth & Income Fund Performance may be found here: https://www.penderfund.com/pender-strategic-growth-income-fund/.