Value Fund – January 2022

Fellow unit holders,

It was a tough start to 2022, with January being one of the worst months ever for broad indices and our fund. The Pender Value Fund was down 7.0%[1] in January, while large and small-cap indices were also down: the S&P 500 Index (CAD) was down 4.7% and the Russell 2000 Index (CAD) was down 9.2%. In Canada, the S&P/TSX Composite Index only had a mild loss of 0.4% in January, mostly buoyed up by strong energy prices. In general, we are underexposed to the energy sector.

We view the current drawdown to be mainly liquidity driven and a result of multiple contractions, as opposed to company-specific fundamental deterioration. At this point in time, over 70% of companies in the S&P 500 Index have reported earnings and 77% of those have beaten analyst estimates. The S&P 500 Index is reporting earnings growth of more than 30% for the fourth straight quarter and earnings growth of more than 45% for the full year[2]. If you were to just look at the earnings growth of the S&P 500 Index, you’d find it hard to believe that it had such a big drawdown.

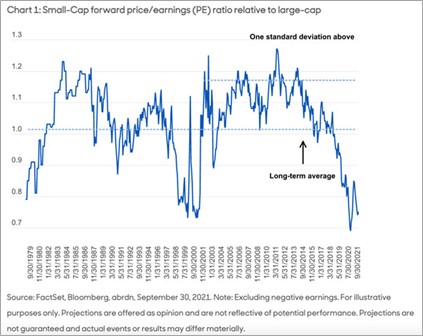

The small-cap universe was hit even harder, and many companies have not reported earnings yet! The tide has been out for small-cap for most of 2021 and now rushing water starts to accelerate. When will the tide come back in? Short term, we do not know, but we are confident that rising tides will drive small-cap stocks for the next three to five years. We believe the current setup is extremely favourable for small-cap stocks. We talked in our last commentary about how valuations are disconnected from fundamentals for small-cap stocks and valuations for small-cap stocks remain highly attractive in both relative and absolute aspects. The chart below shows how small-cap stocks are trading near their largest discount to large cap stocks in the last twenty years.

Technology stocks also sold off in January. The Nasdaq Index (CAD) was down 8.6% and the TSX/S&P Capped Info Tech Index was down 12.0%. Many of our favourite ideas were negatively impacted in January including Peloton Interactive, Inc. (NASDAQ: PTON), Zillow Group, Inc. (NASDAQ: ZG), Sangoma

Technologies Corporation (TSX: STC), and Dye and Durham Limited (TSX: DND). These are high-conviction core holdings in the Pender Value Fund and we still believe these businesses are fundamentally strong.

In early February, Peloton announced management changes and cost cutting plans. There is also a rumour that Peloton might be acquired, which has supported its recent stock price appreciation. In general, the Nasdaq meltdown could lead to more takeout rumours and transactions.

Also in early February, Zillow issued positive guidance together with its year end results and the stock price has responded positively. Zillow also announced a significant share buyback program which reinforces our belief that the underlying business is doing well.

It is evident that in January our China tech holdings Baidu, Inc. (NASDAQ: BIDU) and JD.Com Inc. (NASDAQ: JD) were top contributors to the Pender Value Fund, as the government regulatory environment seems to have stabilized (no news is good news).

We are never happy so see drawdowns in the Fund, but the flip side is that we become more opportunistic as our best ideas go on sale. We believe the current market environment has set up a very attractive long-term environment for our high-conviction holdings. Our view that stock performance is eventually determined by underlying business progress has not changed and, as investors, we just need to be patient.

David Barr, CFA

February 22, 2022

[1] All Pender performance data points are for Class F of the Fund. Other classes are available. Fees and performance may differ in those other classes.

[2] https://insight.factset.com/sp-500-earnings-season-update-february-11-2022