Value Fund – June 2022

Fellow Unitholders,

It has been a volatile first half of the year that has seen significant drawdowns in equity markets as valuations have reset in anticipation of weaker economic growth in the coming quarters. Investors have focused on the macro headwinds of rising interest rates as policymakers are focused on curbing demand to slow inflation.

Small-cap and technology companies have been particularly affected against this backdrop with the Russell 2000 down 22.1%, the S&P/TSX Composite Information Technology sector down 39.7% and the tech-focused Nasdaq down 29.5%. The TSX Small Cap was down 13.9% and has benefited from its higher weighting in energy and materials, which has been a rare bright spot in 2022. The Pender Value Fund was not immune to this drawdown and was down 7.4% in June and closed the first half of 2022 down 28.6%[1].

Inflation has risen steadily this year, driven higher by strong consumption, supply chain bottlenecks and energy prices. With this uncertainty at the macro level, we have remained focused on our research process and in identifying fundamentally strong businesses. While these market episodes can be challenging to endure, it does create a significant breadth of opportunity for investors able to keep a long-term perspective and look past the murky macro environment. We have been adding to what we view as high quality small cap holdings that we believe can withstand a downturn in their industry and come out stronger.

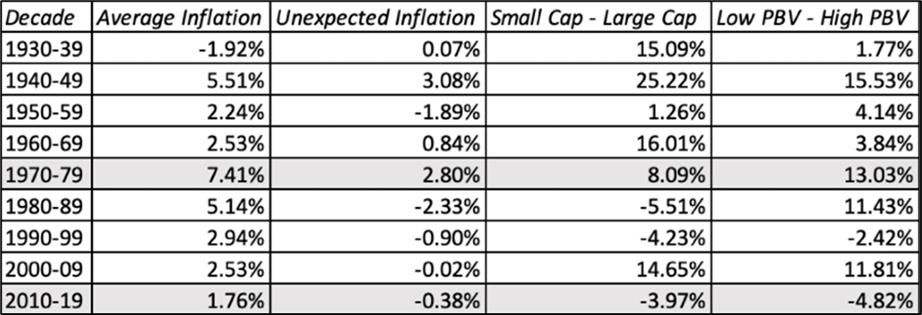

In a recent analysis of small cap company performance going back to the Great Depression, small caps were shown to outperform large caps by a healthy margin in periods where inflation was unexpectedly high. The chart below shows the performance of small cap companies in periods of inflation. This includes the 1960s and 1970s when small cap outperformance was over 16% and over 8% respectively.

Small Cap Performance in Inflationary Environments:[2]

There are advantages to being small. Smaller companies are nimbler and have cost structures that can adapt more quickly when the environment changes. They also have management teams who are closer to their customers and can act decisively to incorporate necessary changes into their strategic planning and growth plans. Pricing power is also an important attribute as small companies can pass cost increases onto their customers to keep their margins intact. While we aren’t yet at 1970s-levels of inflation, it’s an interesting history lesson that highlights small companies and the results of their ability to adapt quickly when inflation surprises.

At the end of June, about 60% of the portfolio was exposed to small and mid-sized companies. The top 3 sectors of Information Technology, Diversified Financials and Communications Services also made up about 60% of the Fund. The sector position is an outcome of our investment process where we’re focused on bottom-up company research. This becomes even more critical in periods of stress and in recent months, our portfolio activity was focused on adding high-quality companies with strong unit economics, a long growth runway, competitive advantages and a history of solid execution.

In this challenging market, Ebix, Inc. (Nasdaq: EBIX) and KKR & Co. Inc. (NYSE: KKR) were detractors from performance in June. Ebix posted weak performance after a short report was issued against the company. The report accused the company of faking revenues and focused on gift cards specifically, which became a significant revenue growth driver during the COVID-19 pandemic. The report negatively impacted positive sentiment towards the company as it was preparing the IPO of its EBIXCash division, which has been in focus as a positive catalyst for the company.

In the days following the short report, Ebix issued its own rebuttal, denouncing the report and refuting the claims of any misstatement in revenues. While the gift card business is low-margin and did not have much impact on cash generation, it has been a significant growth driver as customers shifted online during the pandemic.

KKR & Co also detracted from performance in June. The company has been a long-term compounder and has benefited from rising allocations to private assets. With the recent market turbulence and deterioration in risk appetite, the environment for raising capital has weakened for the company off record levels in 2021.

On the positive side, Burford Capital Limited and JD.com, Inc. were both contributors to the Fund in June. Burford Capital, a leading asset management firm focused on financing litigation, has continued to raise capital in this growing and developing asset class. There is pent-up realization of high IRR cases that the company is well-positioned to capitalize on over the next few years as courts open following pandemic-related shutdowns. These litigation finance assets are not correlated with overall markets and a strong pipeline of cases should underpin the fundamentals and cash flows of the business. We are also closely watching a large case that could be a near-term catalyst for the company.

JD.com was also a strong performer as the tech crackdown in China appeared to wind down in June, improving sentiment towards the company. In its most recent quarter, fundamentals remained robust with topline growth of 18% and over 10 million annual active customer additions. Although customer acquisition is slowing, the company has an active user base of over 580 million. The company is managing through the COVID-19 shutdowns in China and is seeing the situation improve in Shanghai. Both JD.com and Burford Capital. performed well in June and we continue to own them in the portfolio for their near-term catalysts and long-term compounding potential.

With the macro environment likely to remain murky in the back half of the year, growth has now been repriced and multiples have compressed. We are finding great opportunities in fundamentally attractive businesses that we can buy at multiples we have not seen in years. We believe small caps as a group look attractive and have a well-documented history of outperforming after coming out of bear markets. These opportunities do not present themselves often and we are busy, undertaking deep due diligence to identify those companies that have the brightest prospects for years to come.

Thank you for your continued support.

David Barr, CFA

July 20, 2022

[1] All Pender performance data points are for Class F of the Fund. Other classes are available. Fees and performance may differ in those other classes.

[2] https://aswathdamodaran.blogspot.com/2022/05/a-follow-up-on-inflation-disparate.html