The current climate for M&A

Despite the choppy macro backdrop, global M&A activity remains elevated with US$2-trillion in the first half of the year.

That’s thanks to a small group of megadeals—25 deals worth more than US$10-billion. Big US companies still have large piles of cash on hand after boosting liquidity two years ago to navigate the pandemic. In addition, record levels of dry powder puts private equity in a good place to weather a downturn and be opportunistic.

While the big deals grab the headlines, activity has also been reasonably strong for smaller deals. At the current pace, and considering dislocated valuations in small caps, 2022 is shaping up to be a near record year for “take outs” of equity holdings held in Pender’s mandates. Valuations of smaller companies have taken a much bigger hit relative to large caps in 2022, thus making them attractive to disciplined strategic and financial buyers.

Nevertheless, while cash may be available, the appetite for deals has declined. Rising inflation, the war in Ukraine, a possible economic slowdown, a risk-off approach to bank lending, and regulatory headwinds in the US are all casting clouds over M&A activity. The uncertainty around such megadeals involving Musk/Twitter, Broadcom/VMware, in addition to the collapse of deals between Arm and Nvidia, and Walgreens and Boots, have cast a chill. This is a different environment than the boom times of 2021 when, fueled by abundant sources of low-cost financing, corporate boards were eager to deploy capital to grow and scale businesses in non-organic ways.

Today, many corporate boards are increasingly looking inward. Amid increased uncertainty and volatility, they are putting their own houses in order before going out to market to deploy capital in what is perceived as a much riskier environment and more pessimistic mood. And, yet it’s worthwhile to look beyond the current situation of the past few quarters for the bright spots of opportunity and potential catalysts driving future M&A activity.

Counter-cyclical & contrarian winners

“…when most of the world is pulling back, we’ll look for areas to push forward, into our existing businesses or beyond.” Joey Levin, CEO, IAC

M&A activity is pro-cyclical. In boom times, overly enthusiastic acquirers frequently shoot first and aim later, with mind boggling acquisition premiums reducing the odds of merger success. In such times you usually want to be the recipient of such largesse, and not a shareholder of the buyer. Studies have shown most of the added value created from M&A activity ends up in the pockets of the shareholders of the targets, rather than acquirers.

On the other hand, pessimistic times also coincide with lower prices because competition for deals is much lower and heroic financial assumptions get a reality check. This is the time when disciplined acquirers step up to fill some of the void.

Bruce Flatt, CEO of Brookfield Asset Management, noted in his recent letter to shareholders, “We are therefore investing capital at excellent returns—much higher than we would have otherwise achieved under conditions like those experienced in late 2020 and 2021. With our investable capital at a record level, we should be able to make meaningful strides with our franchise over the next few years.” Likewise, this is a terrific opportunity for other disciplined management teams of Pender holdings like CCL, Premium Brands, Enghouse, IAC, Onex, and Exor. These companies have long records of contrarian capital allocation which have paid off over time.

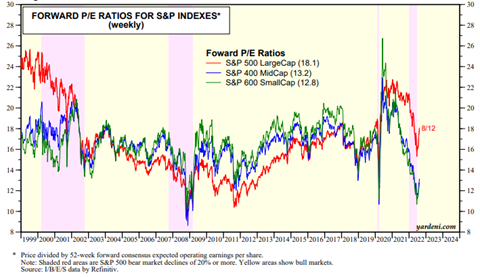

With equity markets recently down 20-30% from the peak globally, some issues losing as much as 80% of their peak quoted value, and credit markets turning sideways for many corporate borrowers, the investing environment for cash-rich buyers is once again ripe with opportunities. Markets don’t sell off this dramatically very often; individual stocks selling off more than 50% is even less common. Today, many stocks are downright cheap, especially in small and mid-cap land.

Forward P/E Ratios for S&P Indexes

On Onex’s latest earnings call, management noted, “For many of our companies, we continue to see private market transactions at values materially higher than that implied by the day-to-day trading of comparable public companies.” [emphasis ours]. In many cases public market prices have become disconnected from fundamental value. This means that potential future returns for many stocks and acquisitions targets are meaningfully higher today than they were just a few months ago. No wonder contrarian management teams are stepping up.

While valuation sensitivity is important, so is deal type. No one bats a thousand, but good acquirers have robust and repeatable processes that increase their odds of success.

Smaller deals could pick up

Peter Clark and Roger Mills, finance experts who study M&A, found that deals they call “opportunistic,” where a weak competitor sells out, created value for the acquirer at a rate of around 90 percent. “Operational” including bolt-ons and line extension equivalents also had high rates of success. At the other end of the spectrum are the mega deals that grab the headlines but are the trickiest to pull off and often come with a low probability of success. The worst are so-called “transformational” deals, which are big leaps into different industries which often peak late in the cycle; these succeed less than 20 percent of the time. Next time a company you own announces a “transformational” acquisition, run for the hills!

As you might imagine, smaller companies are often good candidates as bolt-ons and opportunistic deals for buyers who are more active in gloomy environments like today. Smaller companies are far more numerous targets for buyers and are typically easier to integrate. While the recent drawdown has been painful, the good news is most of our small cap portfolio is trading at what we believe to be sizable discounts to private market value, which makes them prime candidates to be privatized, or acquired by strategic or financial buyers. We are already seeing interest from buyers for many of our holdings, mitigating downside risk and providing optionality.

In early August, California chip maker Semtech Corporation agreed to buy Vancouver-area communications technology vendor, Sierra Wireless Inc. for US$31 per share, a deal valuing Sierra at US$1.2-billion. Pender has owned Sierra on and off over the past decade. There were periods when it was struggling and losing money. As a perennial “round tripping” stock, it has provided decent trading opportunities over time when it would periodically fall below our estimated range of private market value as a “close the discount” holding. Looks like this discount is now closed for good!

The company was founded in Richmond, B.C. It makes cellular hardware and software used to connect sensors on vehicles, computers and other devices that are part of the Internet-of-Things (IoT). The combined capabilities of the two companies in cloud computing positions Semtech as a key player in the next era of technological innovation including the full digitization of the industrial world.

During the past year, Sierra has had a dramatic reversal of fortune. Management changes spurred by activist investors had returned the business to profitability. They cleaned up the operational performance, diversified the manufacturing footprint and resized the portfolio. Management made the savvy decision to ramp up inventory because they anticipated supply chain issues, hence the past few quarters have been very profitable. The sale to Semtech is a wonderful outcome for our unitholders.

If stock price dislocations from private market value persist, expect more deals in the future.

New Pender fund launch: The benefits of using leverage in arbitrage strategies

A year ago, we launched the Pender Alternative Arbitrage Fund which achieved a 4.3% since inception. Given investors’ needs to generate higher real returns during these challenging times, the newly launched Pender Alternative Arbitrage Plus Fund will target 1.5x to 2.0x the exposure of the Pender Alternative Arbitrage Fund and maintain the same holdings, investment process and risk management practices. Merger arbitrage has historically been a low-risk, low-volatility asset class that has delivered consistent, absolute returns with low-correlation to traditional assets such as fixed income and traditional equity. This makes it well suited for leverage with the potential to enhance total returns. The Fund is well-suited to investors concerned about rising interest rates, inflation, and widening credit spreads who seek to protect their portfolios in a tax-efficient manner.

To read the latest Pender Alternative Arbitrage Fund commentary, click here.

To learn more about Pender’s Liquid Alternative Strategies, contact your Financial Advisor.

Financial Advisors: Please reach out to your local Pender contact.

Range Anxiety: Inflation and a recession risk…but also a silver lining

In this article, I’ll attempt to unpack where we are today and what’s ahead. And, spoiler alert, there are reasons for optimism despite the current headlines

Stephen Poloz talks to Pender about his new book, The Next Age of Uncertainty – Part 1

In part one of two, Stephen Poloz, Special Advisor to Osler and former Governor of the Bank of Canada, talks about future economic volatility and the five tectonic forces driving it. Why title your book […]