How the portfolio is positioned to capture potential gains

We believe the world will be a very different place on the other side of the global health crisis and associated financial crisis. We know that markets are cyclical, and history can be a useful guide. But this crisis is unprecedented. The intellectual horsepower being diverted into solving this crisis is immense and we are turning our attention to focus more on the impact on healthcare and consumer behaviours and identifying the potential winners that will emerge.

One Asset Class that has Historically Outperformed

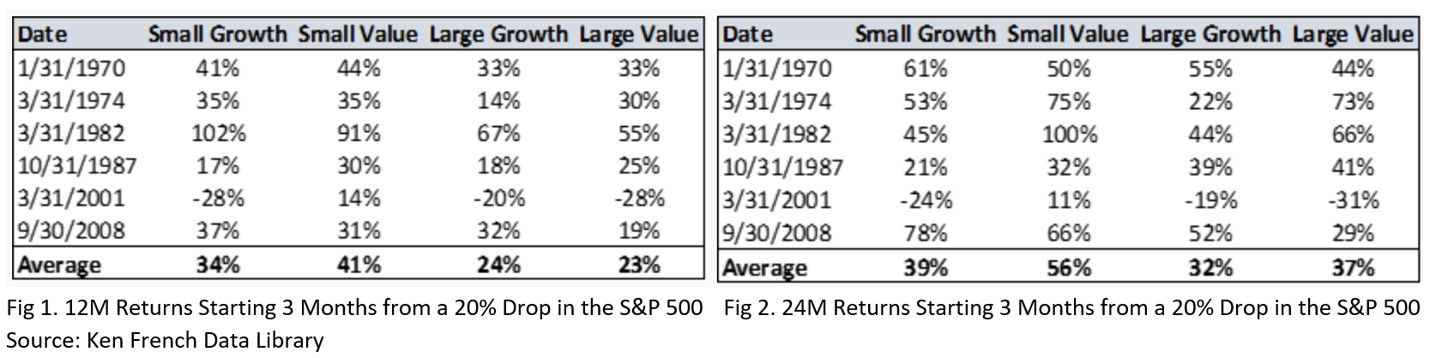

Micro to mid cap stocks have been underperforming large cap for a long time. We thought they offered incredible value going into this crisis, and we are now seeing an even greater irrational disconnect. While our priority is to protect on the downside, we also want to position portfolios for the recovery.

In the past, small caps have driven really strong returns in a recovery. We believe the spring is coiled to do the same this time around and that it is a good time to be allocating to small cap, in part because they have been hit harder, but also because it is an investment universe where we have spent more time and where we understand the important value drivers.

The Resilience of Small Cap Stocks

Mentally fit founders: Until they achieve scale, small cap companies are battlegrounds. Management teams are adapted to heading off challenges. Mentally they are prepared for the struggle to survive and thrive. In addition, being younger companies, they are still often operated by the founder who is both unlikely to make decisions that put the company in jeopardy while at the same time being an intrinsic risk taker who can spot potential opportunities in challenging times.

Nimble: Small cap companies can be a lot more responsive to changes than large caps. Turning the tanker around is challenging but spinning on a dime means nimble, small cap companies can have a big advantage coming out of times like this.

Adding value: It is important to seek small companies that are prepared for harder times, often with robust balance sheets. Keep in mind that capital light businesses are also more likely to add value over time. When the harder times inevitably hit, these companies can find themselves with the resources to take advantage of the opportunities of the moment: buying back shares, grabbing market share, or acquiring an ill prepared competitor at a bargain price. Owner-operated small cap companies can add a lot of value at times like these, and exit the recovery better positioned than when they entered.

Technology: Technology companies are often well positioned to capture new opportunities coming out of periods like this. We are already seeing significant changes to human behaviour. The stay-at-home economy and new consumer spending habits are accelerating the adoption of new technology.

M&A

When we talk about M&A we always ask ourselves two questions: are there willing buyers and are there willing sellers? As we have seen during previous downturns, the answer to both is “yes”, particularly once credit markets stabilize. Sound businesses that are trading below liquidation value and survive may emerge spooked and decide that they are ready to sell. The flip side to the coin are the disciplined capital allocators who have been largely dormant during the final, over-valued innings of the recent bull market and are now ready to deploy their capital reserves to grow through smart acquisitions. We are not interested in catching the falling knife by investing in distressed companies just hoping to survive. Hope is a bad investment strategy. We are looking for the strong, target companies. See Catalysts: Investing in Take-Outs for some of the signs we look for.

We agree with Howard Marks who recently wrote, “Given price drops and selling we’ve seen so far, I believe this is a good time to invest, although of course it may not prove to have been the best time.” Of course, buying at the “best time” would mean buying on that one single day that a stock or market hits the absolute bottom. A “good time” to buy is when the valuations of good companies are extremely low, which is widespread during bear markets like today. With correction periods that can often last for months, it is better to buy during that “good enough” period than wait for the “best time”. That was certainly the case during the great financial crisis where the sale for S&P500 lasted for about nine months from the fall of 2008 to the summer of 2009, while the best time was on March 9, 2009 (see chart). We have no idea where the bottom might be, but given the significant market declines already seen, we believe we are in a similar “good time to invest” zone today. As such we are working hard to build value into the portfolio and be ready for the upturn.

We agree with Howard Marks who recently wrote, “Given price drops and selling we’ve seen so far, I believe this is a good time to invest, although of course it may not prove to have been the best time.” Of course, buying at the “best time” would mean buying on that one single day that a stock or market hits the absolute bottom. A “good time” to buy is when the valuations of good companies are extremely low, which is widespread during bear markets like today. With correction periods that can often last for months, it is better to buy during that “good enough” period than wait for the “best time”. That was certainly the case during the great financial crisis where the sale for S&P500 lasted for about nine months from the fall of 2008 to the summer of 2009, while the best time was on March 9, 2009 (see chart). We have no idea where the bottom might be, but given the significant market declines already seen, we believe we are in a similar “good time to invest” zone today. As such we are working hard to build value into the portfolio and be ready for the upturn.

PenderFund and Felix Narhi

April 2, 2020

Investing During Uncertain Times: What is Pender Doing?

When the facts change, we change our minds The nature of most human activity is that the facts involved tend to change, but often not as abruptly, and rarely on such a wide scale as […]

Four Potential Investment Strategies in a Stock Market Correction

Investors had largely ignored COVID-19 for over a month, but now emotions have started to get the better of cooler heads, and markets have reacted. Extreme fear has taken over. Unfortunately, emotional trading can quickly […]