Alternative Absolute Return – November 2023

Highlights

- In November we significantly added to our US Treasury Bill holdings as well as high-quality term loans. Our purchases included loans backed by Hilton Worldwide Holdings Inc. (NYSE: HLT), TransDigm Group Inc. (NYSE: TDG) and Four Seasons Holdings Inc. (private).

- We also topped up long positions in the Canadian dollar high yield market that offered an attractive spread premium to US dollar bonds in the same capital structure.

The Pender Alternative Absolute Return Fund finished November with a return of 0.9% bringing year to date returns to 7.8%[1].

Financial markets enjoyed a near euphoric rally in November driven mostly by lower government bond yields but further helped by narrowing risk premiums. The US high yield market generated its best return since July 2022, quite a remarkable event when the starting point for spreads was below the 10-year average, whereas spreads were about 150bp higher than average at the outset of July 2022.

Portfolio and Market Update

Market dynamics shifted quickly in November, with fixed income and equities enthusiastically responding to economic data which showed a slowing economy. Core US CPI coming in 9bp lower than expected in October was sufficiently good news for the Russell 2000 to have its best day in over a year gaining 5.4% on November 14. The market appears convinced that a major pivot from the Federal Reserve is coming. Even if macro data points are moving in the right direction, we expect data to be noisy going forward, with the market priced for good outcomes on multiple fronts it will not take much to disappoint elevated expectations.

“The combination of tight spreads and significant easing of monetary policy which is priced into interest rates is difficult to reconcile.”

As of December 3, more than five cuts of 25bp are priced into the Fed Funds Futures curve for 2024. At the same time, credit spreads for high quality high yield are at their lowest level in over 18-months. The combination of tight spreads and significant easing of monetary policy which is priced into interest rates is difficult to reconcile. For rates to prove accurate, we would expect significant economic weakness which would argue for higher risk premiums. For spreads to be sustained at current levels, robust economic growth is required, which would make it difficult for dramatic rate cuts to occur. The market appears primed for a 2019 type Fed pivot, but the reality is that core CPI is still running at 4% year over year and has now had three years of solidly above target inflation. While risk assets give no indication that financial conditions need to be eased, there is rampant speculation in vehicles like cryptocurrencies which is indicative of excessive capital remaining in the financial system.

For much of the past two years, the rates market has done a terrible job of accurately projecting the forward path of monetary policy, with a strong bias to cuts being about six months away. Additionally, the market has been eager to over extrapolate recent developments. Just as we saw some outlandish projections for higher rates earlier in the fall, the narrative has flipped, and some commentators have called for even more cuts than are already priced for 2024. The market tends to overshoot, and the process creates trading opportunities. While we may prove to have been early, we believe that November presented an opportunity to de-risk as valuations became increasingly stretched. There is inherent negative asymmetry in spreads most of the time in credit markets, which becomes particularly pronounced when spreads move significantly inside of historical averages.

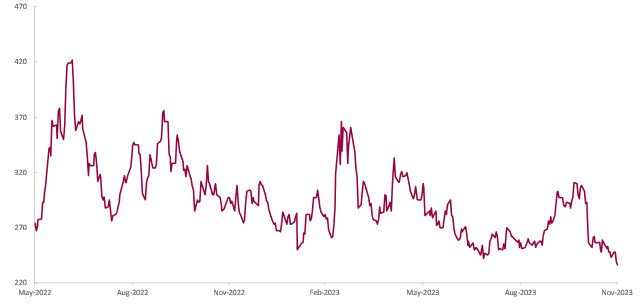

ICE BofA BB US High Yield Index – Gov’t OAS, bp

Source: Bloomberg

One of our biggest challenges was finding outlets for cash generated from sales. We added significantly to our US Treasury Bill holdings as well as high-quality term loans. Our purchases included loans backed by Hilton Worldwide Holdings Inc. (NYSE: HLT), TransDigm Group Inc. (NYSE: TDG) and Four Seasons Hotels Holdings Inc. (private). In each case, the credit spread available on the loan was at least 50bp greater than what we believe is the closest comparable bond, providing a margin of safety if spreads widen from current levels.

We saw some value in the Canadian dollar high yield market as well, topping up long positions that offered an attractive spread premium to US dollar bonds in the same capital structure.

We will be patiently waiting for better entry points into risk assets. Credit markets exhibit strong mean reverting characteristics over time. Since 2008 there have only been two calendar years where high yield spreads did not hit 500bp: 2017 and 2021. With the 10-year average spread of about 450bp, we think the starting point of 384bp for December is clearly arguing for defensive positioning. We also see risks to taking on excessive duration at current levels as the market has come a long way in a short period of time.

Portfolio metrics:

The Fund finished November with long positions of 153.2%. 68.3% of these positions are in our Current Income strategy, 82.8% in Relative Value and 2.1% in Event Driven positions. The Fund had a -65.9% short exposure that included -11.1% in government bonds, -39.9% in credit and -14.9% in equities. The Option Adjusted Duration was 0.66 years.

Excluding positions that trade at spreads of more than 500bp and positions that trade to call or maturity dates that are 2025 and earlier, Option Adjusted Duration declined to 0.21 years. The duration figure include an Event Driven position where we believe duration does not accurately reflect the option value embedded in the security.

The fund’s current yield was 3.3% while yield to maturity was 6.6%.

Justin Jacobsen, CFA

December 7, 2023

[1] All Pender performance data points are for Class F of the Fund. Other classes are available. Fees and performance may differ in those other classes. Standard Performance Information for Pender’s Alternative Absolute Return Fund may be found here: https://www.penderfund.com/pender-alternative-absolute-return-fund/