Small Cap Equity – Manager’s Commentary – April 2022

Fellow unit holders,

The selloff in risk assets carried on in April and volatility continued to trend higher. This was driven by growing macro concerns that focused on the outlook for inflation, rising interest rates and the ongoing conflict in Ukraine. With higher interests potentially leading to a slowdown in economic growth, this led to the continued unwinding of risk and weak performance across equities.

So far this year, the S&P 500 Index (CAD) is down 12.9%, while the Russell 2000 index (CAD) fell 16.7%. In Canada, the S&P/TSX Composite Index has shed 1.3%, performing better on the strength in resource prices and its large weighting in energy companies. In this environment, the Pender Small Cap Opportunities Fund was down 6.2%[1] on the month and down 15.1%1 so far this year.

The broad weakness in equity markets impacted the performance of the Fund, with the drawdown most acute in smaller, growth-oriented technology firms. The disconnect between fundamentals and daily quoted prices continued to expand in April and grew ever wider as we began the month of May. While the portfolio of businesses we own continues to grow revenue and execute on strategic plans, the strong long-term fundamental outlook has been ignored as investors focused on the short-term macro related risks. The drawdown has been driven by multiple contractions on the concern that the fundamentals of these businesses may potentially slow along with a deterioration in economic growth. While these periods of volatility are challenging, the silver lining is the potential opportunity that it creates for future returns. For long-term investors, this is creating a good opportunity to own a portfolio of high-quality businesses that we believe have runway to compound for years.

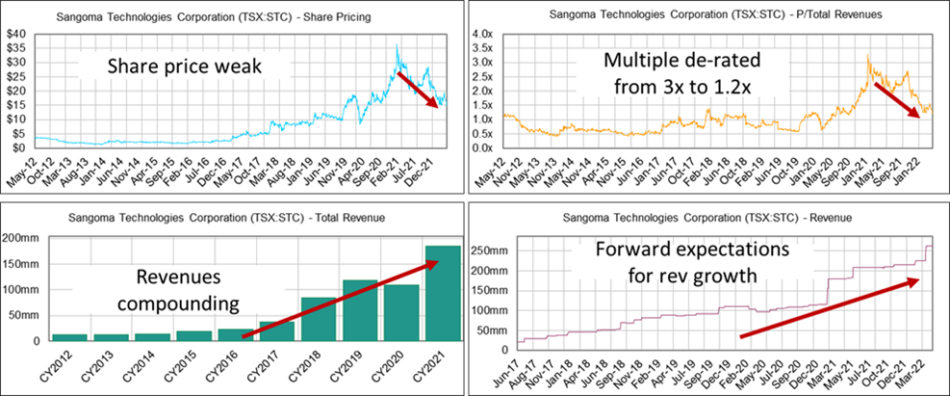

This phenomenon has played out in many companies in our portfolio, including in the top-10 holdings of Sangoma Technologies Corporation (TSX: STC), Sylogist Ltd. (TSX: SYZ), and Thinkific Labs Inc. (TSX: THNC). These technology firms have seen dramatic multiple compressions in recent months, while the underlying fundamentals continue to be strong. The charts below on Sangoma demonstrate this point. Its share price has been weak, driven by a compression in its price to revenue multiple from ~3x to ~1.2x. This has occurred as revenue continued to grow and the company’s forward expectations are that this growth will continue.

Despite the volatility, there were some bright spots in the portfolio during the month. Our resource exposed companies have benefited from rising commodity prices and continued to perform well. Spartan Delta Corp. (TSX: SDE) was the top contributor to the portfolio and continued to execute at a high level. In their last quarterly release, management guided the company to strong cash flow generation that implied a 20% free cash flow yield. We believe that this may even prove to be conservative with potential upside to this guidance if the current commodity price environment persists. While the stock has appreciated and grown within the portfolio, we have been trimming it back and adding to high conviction opportunities that have presented themselves in the sell-off.Sylogist is a profitable, growing company that has seen its multiple cut in half during the recent sell-off. Thinkific is a company we have followed for years, beginning when it was a private company. Although we ‘passed’ on participating in the IPO last year as we thought it was richly valued, this environment has given us the opportunity to own a business that is fundamentally strong, grew revenue by 80% last year and has a strong balance sheet to fund growth plans.

We have taken the opportunity to improve the quality of the businesses we own. During periods like this, higher quality businesses reach an attractive entry point which enable us to trade out of lower quality business models in favour of companies where we have the highest long-term conviction in the underlying intrinsic value of the company. We have been through many cycles in the past, and we believe this strategy will pay dividends for years to come. At some point the macro fears will recede and the focus will turn back to company-specific fundamentals. Until that occurs, these companies will continue to grow, execute their business plans and compound intrinsic value for shareholders.

It is also well documented[2] that small caps outperform over the long-term and lead recoveries coming out of bear markets. Going back over the last decade you can find periods when the Russell 2000 has corrected more than 25% following the market bottom, and the following year produced returns of 39% in 2011/2012, 48% in 2016/2017, 34% in 2019/2020 and 117% in the mid-COVID market recovery in 2020/2021. It is impossible to say when the market will bottom out this time around, but with the Russell 2000 and other markets falling into bear market territory, we believe return prospects looking forward are very compelling over both short- and long-term periods.

While we understand it is difficult to be optimistic when there are higher levels of uncertainty and weak market sentiment, we see a high probability of a positive outcome for long-term investors who can filter out some of the macro headlines and focus on company-specific fundamentals. Ultimately, our research shows us that the businesses we are investing in will drive performance and the opportunity to own the high-quality companies we are finding today does not come around very often.

Thank you for your continued support.

David Barr, CFA and Sharon Wang

May 18, 2022

[1] All Pender performance data points are for Class F of the Fund. Other classes are available. Fees and performance may differ in those other classes.

[2] Source: Ken French Data Library.