Small Cap Equity – Manager’s Commentary – February 2022

Fellow unit holders,

As investors continue to assess the financial risks related to the conflict between Russia and Ukraine, stock markets ended February on a mixed note. In the US, the S&P 500 Index (CAD) was down 3.3% but its small-cap peer, the Russell 2000 Index (CAD) was up 0.8%. In Canada, the S&P/TSX Composite Index was up 0.3% in February, supported by rising energy prices. The Pender Small Cap Opportunities Fund was down 0.2%[1] in the month. We do not have any direct holdings in Russia or Ukraine and thus no direct impact to the portfolio.

Risk-off sentiment prevailed in stock markets, even before Russia invaded Ukraine. On a year-to-date basis, major US indices and our portfolio were in negative territory. The S&P 500 Index (CAD) was down 7.8%, the Russell 2000 Index (CAD) was down 8.5%, while the Pender Small Cap Opportunities Fund was down 8.0%1.

In our opinion, the key driver for the current drawdown is growth being repriced by the market. Headline news on inflation and rising interest rates translate into higher discount rates and a lower value of future cashflows. A year ago, investors paid a big premium for high growth rates. Spending in sales and marketing, and research and development for high paybacks was rewarded. Today, investors are not pleased by growth. In addition, a lack of profitability on a GAAP basis is being further penalized as investors question the viability of some of these business models. We believe the market tends to overshoot in both directions: growth was probably overpriced a year ago but now markets have overreacted in some areas, creating opportunities in fundamentally attractive businesses. When this happens, repricing in the small/mid-cap space can be more dramatic. We are seeing software companies that have grown recurring revenue by over 50% year-over-year priced at less than 1.5x EV/Revenue, which seems like great value. We believe there is good opportunity for investors in these types of businesses today.

For example, in February, we increased our weighting in Thinkific Labs Inc. (TSX: THNC), a leading SaaS platform enabling course creators to build, manage and monetize online courses. Thinkific went public at $13 per share last April, went up to a high of $19.47, and then dropped below $3.00 recently. The total addressable market for Thinkific is massive, in the billions of dollars, as the creator economy is huge and growing quickly, especially during COVID. Thinkific has grown its recurring revenues organically at a rate of over 60%, even before COVID accelerated the adoption of online courses, and it was profitable pre-IPO. We believe that there is a good product-market fit here and the underlying unit economics are strong.

Thinkific could be profitable if they scaled back spending in the short term, but in our view, they should be reinvesting heavily and scaling up as long as unit economics remain robust, and the runway is there. Growth is the best value driver over the long term. Proceeds from the IPO provided the company with a war chest to invest in growth. Thinkific is led by its co-founding CEO and insiders own a significant share of the company. While it is trading below 1.5x EV/revenue, we believe there is a substantial disconnect between price and value.

Thinkific was one of the detractors of fund performance in February, together with Sylogist Ltd. (TSX: SYZ), Sangoma Technologies Corp. (TSX: STC) and WeCommerce Holdings Ltd. (TSXV: WE). These holdings are some of our highest conviction ideas and they were negatively impacted by the market sell off. When they went on sale, we took the opportunity to buy more.

On the positive side, Altius Renewable Royalties Corp. (TSX: ARR) was a top contributor during the month. Its stock price hit fresh record highs in February when its first mover advantage in the renewable royalty industry started paying off. As a result, the company is on more radars as an alternative to dilutive equity or limited debt capacity. The current inflationary environment is also a positive for Altius’ royalty model and we see the shares as attractively valued.

In these times of uncertainty, we reiterate our view that the setup for small-cap companies remains attractive on a three to-five-year outlook. In our view, there are several factors in place creating tailwinds.

First, small-cap stocks are significantly undervalued on a relative and absolute basis. Small-cap companies are trading at a large discount to large caps (see previous commentary), which is a disconnect from historical data that suggests small-cap companies should trade at a premium to large caps. Mean reversion and multiple rerating could lead to a powerful bounce back of small-cap names, in our view. Secondly, we own fundamentally strong businesses that we believe will compound value at a healthy clip for many years. With intrinsic value increasing, stock prices should eventually catch up. Finally, the M&A environment remains strong with no signs of slowing down. When a company is good quality and trading at a discount, we believe someone will take notice and buy the business sooner or later.

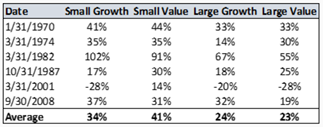

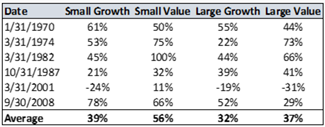

Back in March 2020 when markets sold off massively due to the COVID breakout, we wrote in our commentary that small-cap stocks historically lead coming out of periods like this and we showed the data below: the performance of small-cap stocks compared to large-cap stocks when we have experienced greater than 20% pullbacks in the S&P 500 historically.

Fig 1. 12M Returns Starting 3 Months from a 20% Drop in the S&P 500

Fig 2. 24M Returns Starting 3 Months from a 20% Drop in the S&P 500

Source: Ken French Data Library

We don’t know how many brave souls listened to us and invested in small-cap at that time, but by December 2020, we definitely heard many investors expressing regret. The current environment is full of uncertainty with a wide range of potential outcomes. Investors may feel it emotionally difficult to make decisions. But by the time certainty returns, the opportunity may be gone. We are convinced that now is a compelling time to get exposure to small-cap stocks or to stay invested to achieve promising long-term returns. Thank you for your support.

David Barr, CFA and Sharon Wang

March 14, 2022

[1] All Pender performance data points are for Class F of the Fund. Other classes are available. Fees and performance may differ in those other classes.