Small Cap Equity – July 2022

Fellow unit holders,

In a reversal of the weak equity market performance in the first half of the year, markets posted a strong rebound in July. The macro environment was again in focus with a slightly dovish turn in central bank policy, the potential for a soft economic landing and investors anticipating a peak in inflation all acting as catalysts for the improving sentiment.

This translated into the positive performance across equities with the S&P/TSX Composite Index up 4.7% and the S&P 500 Index (CAD) up 8.7% in the month. Small-cap benchmarks and technology companies also performed well, with the Russell 2000 Index (CAD) up 9.9%, the S&P/TSX Small Cap Index up 7.7% and the S&P/TSX Capped Information Technology Index up 9.8%. The Pender Small Cap Opportunities Fund lagged the sharp rebound in the overall market and was up 2.6%[1] in July.

During rebounds, micro-caps, being less liquid, can be slower to react to market trends. We also saw this in the sharp post-COVID rebound in equity markets in 2020 when investors were slower to come back into micro-cap stocks. In that recovery, micro-caps were delayed by about a quarter, with the market bottoming in March and micro-caps bouncing back in earnest from June. The recovery in micro-cap stocks may be slightly delayed relative to their more liquid large-cap peers, but the fundamentals at the company-specific level give us confidence that it is on the way once capital starts flowing more freely.

The portfolio remains focused largely on technology, consumer products, health care and financial services, with these sectors making up about 64% of the portfolio.

Within the tech sector, we have been adding to Kinaxis Inc. (TSX: KXS) and Copperleaf Technologies Inc. (TSX: CPLF) this year and see them both as very high-quality software companies. Both have sticky customer bases that lead to a high percentage of recurring revenues, which in turn gives us increased visibility of their financial models. In particular, CopperLeaf has a customer base (predominantly within the utility sector) that is not as sensitive to the macro backdrop, adding an additional layer of stability that we believe is important, given the higher degree of uncertainty at the macro level looking ahead over the next few quarters.

Magnet Forensics Inc. (TSX: MAGT) and Aritzia Inc. (TSX: ATZ) are also portfolio holdings that have performed well recently. In early August, Magnet posted impressive quarterly results with revenue growth of 41% and 15% EBITDA margins. The company is led by its founder and is continuing to demonstrate robust, profitable growth despite the uncertain macro environment. It has a high-quality business model with strong retention and expansion within its customer base supporting its durability.

Aritzia also posted a strong quarter, beating estimates and raising its expectations for the year. The company grew revenues by 70% and bottom-line earnings by 85%, led by its expanding store network and further momentum in e-commerce in the US. The company was upbeat in its assessment of consumer sentiment and has not yet seen any deterioration in spending. With the stock price reflecting a slowdown that has not materialized in the boots-on-the-ground fundamentals, it has been active in buying back its stock at these levels. We see this as a prudent deployment of capital and believe it is supported by ample current and future free cash flows as Aritzia continues to scale.

Some of the Fund’s micro-cap holdings that lagged in the month included companies like mdf commerce inc. (TSX: MDF) and Blackline Safety Corp. (TSX: BLN), as well as long-time holding Sangoma Technologies Corporation (TSX: STC). These companies are examples of where we see parallels to the 2020 recovery, with capital coming back to the more liquid companies in the market first, and smaller companies being slower to recover. The underlying fundamentals of these businesses continue to perform well relative to their depressed valuations.

History has shown time and again that fundamentals eventually win out over a reasonable period of time and we are confident that these companies are well positioned for when a sustainable recovery takes place.

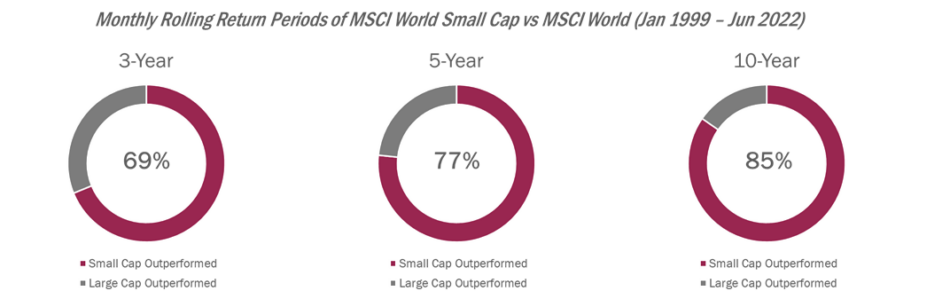

Small caps in particular have proven to be long-term winners. The charts below show what percentage of the time small companies outperform their larger peers. In the analysis we looked at rolling three, five and 10-year returns for the MSCI Small Cap World Index and the large cap MSCI World Index dating back to 1999[2]. Small caps were the clear winners, outperforming their large-cap peers 69% of the time over three years, 77% of the time over five years and 85% of the time over 10 years.

For investors with a similar long-term investment horizon, this is an excellent time to be investing where you can find high-quality companies at very good prices.

Thank you for your continued support.

David Barr, CFA and Sharon Wang

August 25, 2022

[1] All Pender performance data points are for Class F of the Fund. Other classes are available. Fees and performance may differ in those other classes.

[2] Morningstar Direct